The back-and-forth nature of the attorney-insurer relationship, along with massive amounts of marketing, misconceptions, and perhaps antiquated perceptions, can mislead people regarding car insurance claims, car accident injuries, and what an injured person could or should do.

These auto insurance myths can often be found right alongside car insurance tips. Let me see if I can unpack it for you in a way that makes sense.

Myths and Facts – Literally Everywhere You Search

If you type any combination of “car insurance myths and facts” into your search engine of choice, you’ll see that the subject is covered. Insurers have the myths they want to set straight. Attorneys do the same.

You’re also going to notice a lot of repetition in those lists, articles, blogs, and so on. Everyone seems to have some magical car insurance claim tips they want to share and myths they want to set straight. How can something be a myth if everyone and his brother is debunking it?

The simple fact is that a lot of people still buy into the myths. And we get a lot of clients who have misconceptions about the law.

Here are some of the myths I’ve had to deal with, and I’ll break them down by category to make it a bit easier.

Car Insurance Myths About How Insurance Works

Myth: You Don’t Need More than the Minimum Insurance Required in Your State.

Fact: No, you’re not *required* to have more than the minimum. Whether or not you *need* more will depend on the car accident, damage done, who’s at fault, and so on. Let’s say a driver injures you and only has the minimum coverage. Your injuries cost way more than the limit of that bare minimum policy. That at-fault driver is on the hook for the difference. It could be many thousands of dollars, depending on the severity of the injury.

Myth: You Have Comprehensive and Collision Coverage, so You Are Completely Protected.

Fact: Not necessarily. If someone else causes a crash that injures you, it’s not your coverage that matters most – it’s theirs. In case they have inadequate coverage, you would want underinsured/uninsured motorist coverage, which is not required in every state and is usually not part of comprehensive and collision coverage. And if you are the cause of the accident, you’re still only covered up to your policy limits. In other words, the completeness of your coverage depends on the limits of your policy.

Myth: You’re Required to Give the Insurance Company a Recorded Statement After an Accident.

Fact: No, you’re probably not. Yes, there are duties to cooperate with certain Uninsured and Underinsured auto policies. Generally, it’s probably better for your car accident injury case if you don’t agree to a recorded statement. At least consult with a car accident attorney before you do it.

Myth: It’s Okay to Fudge a Few Things or Lie When You’re Talking to an Insurance Company.

Fact: Not a good idea. Depending on what and how much you “fudge,” you may be guilty of fraud. Be truthful.

Bonus Fact: Your insurance company may try to fudge things when it talks to you.

Myth: The Insurance Company Can Drop You If You Have an Accident or Make a Claim.

Fact: Your insurance policy is a contract. As such, the conditions under which they can void the contract are specified in it. Generally speaking, no, the insurance company cannot simply drop you if you’re in an accident or make a claim as long as you’re paying premiums. They can, however, choose not to renew you when the policy expires.

Myth: The Insurance Company Is Working in Your Best Interests.

Fact: No. Think of an insurance policy as a bag of money you can access in an emergency – and you pay a premium for that access. When an accident happens, and you make a claim, you get to open that bag. But that bag belongs to the insurance company, and they don’t want you taking any more of their money than you need. In fact, they’ll probably do their best to make sure you take as little as possible. Is that in your best interests? Probably not.

Myth: My Insurance Will Cover Me If I Drive for Rideshare or Food Delivery Services.

Fact: Not unless you have the right policy. The vast majority of insurance policies only cover personal use. Once you start using your car for a business purpose, you’ve crossed the threshold into a different type of policy because you’re taking on a different kind of risk.

Myth: Lawyers Hate Insurance Companies (And Vice Versa).

Fact: No, but the relationship between plaintiffs’ attorneys and insurers is adversarial by nature. The underlying truth of the matter is that clients need those insurance companies, and so do we. Without coverage, our clients might never be able to receive the care and compensation they need. Plus, the insurance companies have lawyers, too. There’s little to be gained by being antagonistic toward each other. We pride ourselves on being respectful and professional. So do insurers (unless they don’t).

Car Accidents Myths About How Claims Work

Myth: If Someone Else Is Driving Your Car and Has an Accident, Their Insurance Pays.

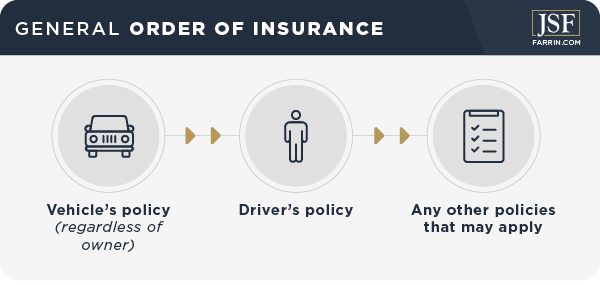

Fact: Not really. Generally, the insurance order starts with the vehicle, then to the driver, then to any other policies that may apply (which also have an order). As the vehicle and driver’s policies are usually the same, this is rarely an issue. But, if you loan your car to a friend and they have a crash and injure someone, your insurance company is probably first in line.

Myth: I Was Speeding at the Time of the Accident, so I Am Not Eligible for Compensation.

Fact: This is a complex myth and depends on many things, but I’ll divide it into three categories. First, your insurance policy covers you when you cause an accident. That’s what it’s primarily for. So, if you caused the accident and people got hurt, yes. You have coverage, though your insurer isn’t going to be happy, and you’d best hope your policy has enough coverage to provide for the care of the injured parties.

Second, the idea of fault may factor into how much compensation you can receive for your injuries, depending on your location. In a state with contributory negligence, like North Carolina, being even 1% at fault can bar you from any compensation. In a state with comparative negligence, like South Carolina, your amount of fault will reduce your amount of potential compensation proportionally. However, it’s important to note that you may be told you’re at fault when you’re not. Consult an attorney.

Third, every situation is unique. Were you going 30 over or going one over? Technically both are speeding, right? The point is the circumstances matter. You may have been speeding, but did your speed contribute to the cause of the crash? Again, consult an attorney.

Myth: I’m Not Eligible for Compensation Because I Was Already Hurt or Had a Condition That Predisposed Me to Injury.

Fact: There’s a legal doctrine that covers this very situation. It’s called many things: the “Glass Plaintiff” or “Eggshell Rule” or “Talem Qualem.” Essentially, the frailty or condition of the person injured can’t be used as a defense for causing them harm.

For example, let’s say you have hemophilia, a condition that prevents your blood from clotting properly. Someone injured you in a car crash, and your condition caused you to bleed excessively, leading to hypovolemic shock. As a result, you suffered permanent organ damage.

Your existing condition is irrelevant because if you hadn’t gotten injured in the car crash in the first place, it would not have been an issue. Sometimes, an insurance company denies or reduces a claim because someone had a pre-existing injury, like a bad shoulder or a bum knee. They may say the injury was there before the accident, so they are not liable to compensate for it. This is why having an experienced attorney is so important. We know how to fight this tactic. It makes you wonder how this myth got started, though.

Myth: I Was Driving Without a License or with an Expired License, and That Bars Me from Compensation.

Fact: Not really. If you didn’t cause the crash that injured you, your license status should not matter. You’ll likely be cited and fined for the violation, but that does not bar you from seeking compensation for your injuries. The other perspective is that if a driver has hurt you with a suspended license, the odds are that driver is also not insured. In either case, reach out to an auto accident attorney.

Myth: Hiring an Attorney Means You Will Receive Less Compensation.

Fact: I don’t know where this myth got started, but I can guess. An adjuster may try to convince you that they’re making a “good” offer and that hiring an attorney is a mistake. They’ll tell you you’ll be paying the attorney from the “good” amount they’ve already offered and so getting less for yourself. They may even insist that it’s all they’ll give you and you should take it or leave it. They might even tell you that if you refuse, they won’t pay you a dime.

Here’s an easy way to decide for yourself whether or not to hire a car accident attorney. Contact one. We offer complimentary case evaluations. If you give us the facts and circumstances of your case, we’ve got the experience to analyze your situation. Get your free evaluation before agreeing to the number the adjuster provided you.

Recommendations From a Former Claims Adjuster

We talked with a former insurance adjuster and asked him for his top recommendations to anyone who’s been injured in a car accident, here’s what he said:

-

- Don’t Rush – A Speedy Settlement Can be a Shoddy Settlement

Adjusters may want you to process your claim based on their timelines, which will usually be as quickly as possible. Don’t feel pressured to do this. This is a common strategy among adjusters because it can limit the amount of money they pay out for a claim. You are in control and shouldn’t feel the need to rush into something that may not be the best decision. A good rule of thumb is if you’re still getting any type of medical treatment, are on medications, or are still in pain, you probably shouldn’t talk about settling anything.

- Don’t Rush – A Speedy Settlement Can be a Shoddy Settlement

-

- Get a Professional to Review Your Paperwork – for Free

Signing a release or medical authorization can substantially limit your options for seeking compensation. If you’re not careful, you could give up benefits that you might have been entitled to otherwise. And often the damage from signing certain documents cannot be undone. It’s generally a good practice to consult with an attorney before signing any paperwork. Send your documents to an experienced attorney you trust (who focuses on your type of case) and ask them to review them. Many personal injury attorneys will do this for free.

- Get a Professional to Review Your Paperwork – for Free

-

- Keep in Mind – the Adjuster Is Not Looking Out for You

Although most adjusters present themselves as friendly and helpful, remember that their job is to resolve potential legal actions and claims as quickly and as cheaply as possible – that’s it. They are not there to look after your best interests. Even if your adjuster means well, they are just not trained to think of all the ways an injury can impact your life and what help you might need. What do insurance adjusters look for? Any potential problems with your claim and bring to light anything that could free their company of responsibility. Their goal is to keep more money in house than they pay out on claims (like yours).

- Keep in Mind – the Adjuster Is Not Looking Out for You

-

- Don’t Risk Your Future Needs – Get Concessions Upfront

Be careful resolving claims early on before you know the full extent of your injuries and medical care to come. You are bound by the agreement you enter into. If you settle too early and find that you still need ongoing treatment, you will likely have to pay for those treatments on your own. If you believe your injuries will result in permanent damage or may need ongoing care, make sure these concessions are calculated into your settlement upfront. An attorney may be able to help.

- Don’t Risk Your Future Needs – Get Concessions Upfront

Three Final Tips for Dealing With Your Car Accident Injury Claim

Tip #1: Attorney Attorney Attorney

Tip #1: Attorney Attorney Attorney

Talk to an attorney. Seriously. When you’re hurt in an accident, almost everything you do after the accident could have an impact on your case. Adjusters want to get in touch with you quickly, get as much information as they can, and potentially get you an offer. Generally, the quicker you get an offer, the less likely it is to cover your expenses.

They’ll probably ask you for a recorded statement. Don’t consent to that until you’ve spoken to an attorney. Contact one as soon as you can after your injury. The adjuster probably won’t be happy, but then, they’re not the injured party. You are.

Tip #2: Just the Facts

Tip #2: Just the Facts

When dealing with an insurance adjuster, you need to understand the difference between being friendly and factual. They’ll ask you what happened. Here are two ways someone might answer that question:

1. I was on my way home from a friend’s house at a red light. The light turned green, and I started to go, and then someone hit me. They must have been speeding. Totally destroyed the right side of my car, and now my bad knee hurts even worse.”

2. I was struck by another driver in an intersection when I had the right of way.

In the first response, there are several things that an insurance adjuster could and likely will infer. Where you were coming or going from does not matter, so why bring it up? The light turned green, but did you look both ways before proceeding? How did you know the other driver was speeding? Did you see them? If so, why didn’t you try to avoid them? How do you know your car is totally destroyed? Was your knee already hurt? How do I know that injury wasn’t there beforehand?

Tip #3: Doctor’s Orders Are Orders for a Reason

Tip #3: Doctor’s Orders Are Orders for a Reason

If you’re injured in an accident, seek treatment. Even if you don’t feel bad, make sure to get checked out. If a medical professional tells you to take a particular course of action, do it. Two reasons and they should be obvious by now.

First, you want to get better. If you’re injured, the way to recover from that injury is to follow the doctor’s orders. Do precisely what you’re told to do.

Second, not only does it help you, but it can also help your case. If you don’t do what a doctor tells you, an insurance adjuster could justify reducing or denying your claim: If you’re not accepting treatment, you must not be hurt.

Believing the Myths Could Cost You Dearly

Sometimes it’s hard to separate fact from fiction. All you need to do is ask. If another driver injures you, the stakes are very high. Get the facts and make a truly informed decision. If you’ve been hurt in an accident, and you don’t think it was your fault, contact us. You may have a case no matter what the myths might lead you to believe.

You May Also Be Interested In

Answers to the Most Frequent and Urgent Car Accident Injury Questions

How Do Various Types of Insurance Coverages Work Together After an Automobile Collision in NC?

What Happens When My Car Accident Damages Exceed Insurance Limits?

If You’re Just 1% at Fault for Injuries, Insurance May Give You Nothing. What You Can Do?