Getting injured at work can be painful and overwhelming. Shoulder injuries in particular can affect your productivity while also being very uncomfortable. If you’re entitled to a lump sum workers’ compensation settlement from your employer’s insurance company, you want to make sure it’s a fair one. So, what’s the average shoulder settlement in workers’ comp?

How much you can expect to receive from a possible shoulder injury settlement is more difficult to answer than it may seem. In this article, I’ll draw on my experience as a workers’ comp attorney to explain why. I’ll also lay out the factors that can contribute to determining your potential shoulder injury settlement amount.

The “Average” Workers’ Comp Settlement Amount Is Meaningless for Your Case

Your possible settlement amount is based on the workers’ compensation benefits you may receive for your shoulder injury claim. If approved, workers’ comp benefits generally consist of:

- Medical benefits: to cover all past and ongoing medical expenses arising from your injury.

- Wage loss benefits: to help make up for your lost income while you’re unable to work.

- Impairment rating, if applicable: Your treating physician may assign an impairment rating to your injured body part once you reach maximum medical improvement (MMI).

Each state determines workers’ compensation settlements in its own way. But even if we limit the discussion to just North Carolina and South Carolina, there’s no “average” settlement value for your shoulder injury because each detail can make a world of difference.

Said another way, several factors go into determining workers’ comp settlement amounts, and what you may be owed completely depends on the unique circumstances (and sometimes the smallest detail) of your case.

They include:

- Your average weekly wage (AWW) based on the 52 weeks prior to your injury

- The severity and location of your injury

- Your medical needs

- Any permanent disabilities that remain after you’ve reached MMI

There’s no judge or jury to decide how much you may receive according to any objective criteria – that’s yet another reason why it’s so difficult to calculate an average workers’ comp settlement amount. The number should be negotiated between you and your attorney and the workers’ compensation insurance company – both sides must agree or there’s no deal.

Did You See These Numbers Online?

We’ve seen some websites offer average workers’ comp settlement amounts based on uncertain criteria. One common amount that often appears online is around $20,000 per case, plus or minus a few thousand dollars. Another number we’ve encountered refers to data from the National Safety Council and is nearly $40,000 per case.

However, this information might give you the wrong idea about what your possible settlement amount could be for your individual case, so it’s best to approach these numbers with at least some skepticism. The amount you ultimately may receive could be in the $20,000 to $40,000 range – or significantly more or less.

How the Call Gets Made for How Much You May Get Paid

After you’ve suffered an eligible injury at work in North Carolina or South Carolina, your employer’s workers’ compensation insurance provider appoints the doctor who’ll provide treatment. The insurance company will then pay the cost of all authorized medical expenses that arise.

Since your treatment and how your body responds to it are unique to you, the settlement amount you may receive for ongoing and future medical care depends on the costs associated with the treatment the doctor recommends.

The next piece of the settlement puzzle is possible wage loss benefits to make up for the time you’re unable to work. These benefits are based on two-thirds of your Average Weekly Wage. For example, if you made $60,000 annually, your AWW would be approximately $1,153 (60,000/52 weeks) and so your wage loss benefit amount could be about $769 (.667 X $1,153).

Here’s the point where figuring out your possible settlement amount can get even trickier. How long you can receive wage loss benefits is based on how much the injury prevents you from working. Specifically, what your authorized doctor has to say about how the injury prevents you from working.

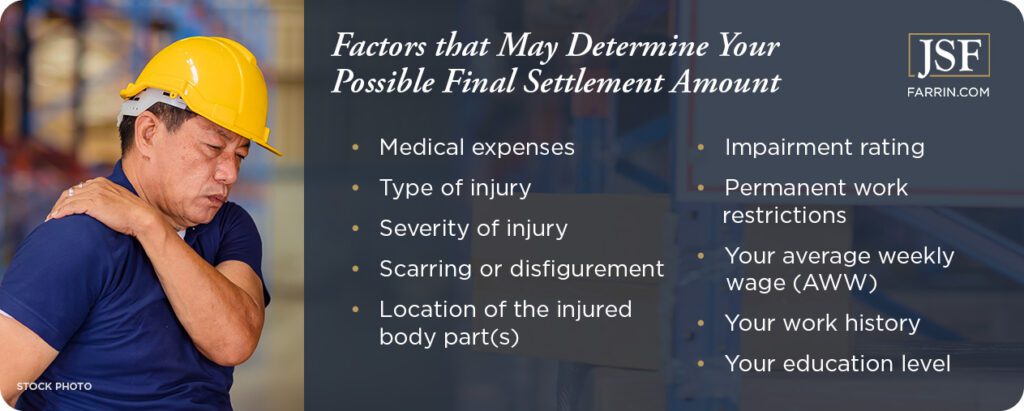

To summarize, if you have an eligible injury, these are some (but not all) of the factors that may go into determining your possible final settlement amount:

- Medical expenses

- Type of injury

- Severity of injury

- Scarring or disfigurement

- Location of the injured body part(s)

- Impairment rating

- Permanent work restrictions

- Your average weekly wage (AWW)

- Your work history

- Your education level

Heads up! Once a claim is settled and approved, it likely can’t be reopened. If the amount you settled for is inadequate, you may have no other options. That’s why it’s important to discuss your case with an experienced workers’ compensation lawyer before you agree to anything.

Get a free case evaluation of your shoulder injury workers’ compensation claim. Contact us online or call 1-866-900-7078 today.

The Doctor’s Role in Determining Your Possible Shoulder Injury Settlement Value

What type of treatment you get and are prescribed going forward, as well as your permanent work restrictions and impairments after reaching Maximum Medical Improvement, play an enormous rule in what you may be owed in a settlement. Each of these elements is determined by your doctor – who is chosen by your employer’s workers’ compensation insurance company.

Once you’ve completed your treatment for your shoulder injury, the doctor will indicate whether you have any permanent work restrictions (such as: cannot lift more than 50 pounds) and assign an impairment rating from 0-100 to indicate your shoulder’s level of permanent disability.

If you’re not happy with the insurance company’s doctor for any reason, you can seek a second opinion, and an experienced workers’ comp lawyer can help. Contact a workers’ comp attorney as soon as possible if you feel you’ve been given an inaccurate diagnosis, inadequate care, or have been cleared to go back to work too early.

In one case, I had a client whose first doctor cleared him to work before he felt he was ready. He got a second opinion from a doctor who said he was still injured and needed to continue treatment. In that case, the insurance company simply accepted the second opinion without objection. Knowing how and when to request a second opinion can be important leverage in your case.1

How a Workers’ Comp Shoulder Settlement Amount Might Be Determined: An Example1

To give you an idea of how a shoulder settlement might work in the real world, let’s consider the following hypothetical situation:

Jennifer, who makes $60,000 a year, hurts her shoulder one day while on the job in North Carolina. She successfully applies for workers’ compensation benefits and receives treatment. While she is out of work due to her injury, she is paid benefits of about $769 per week (2/3 of her average weekly wage of $1,153.85).

After following her doctor’s recommendations and finishing her treatment, she learns that she now has permanent work restrictions which prevent her from being able to do her old job. The doctor also assigns her shoulder an impairment rating of 40% and says she’ll need 12 sessions of physical therapy as well as ongoing steroid injections, hydrodilation, and shoulder manipulation at the hospital.

After discussing her situation with her workers’ compensation lawyer, Jennifer decides to settle her claim for a lump sum based on the following criteria:

- Value of the impairment rating – In North Carolina, a shoulder is worth up to a maximum of 240 weeks of pay at two-thirds of your Average Weekly Wage. Jennifer received a 40% impairment rating for her shoulder.

40% of 240 weeks = 96 weeks of benefits, at a rate of about $769, which equates to about $73,824. But before Jennifer agrees to a settlement at that amount, her attorney wants to investigate anticipated lost wages in the future.

- Future lost wages – This is an estimate of the length of time the insurance company might have to pay for Jennifer’s benefits before she finds a new job with the work restrictions from her injury.

Jennifer’s attorney estimates that it will take her two years to find another job that can accommodate her work restrictions. In Jennifer’s case, this equates to about $80,000. Because this amount is higher than the value of the impairment rating ($73,824), Jennifer should pursue a settlement based on the future lost wages number.

- Future medical treatment – based on Jennifer’s need for physical therapy and ongoing steroid shots, hydrodilation, and shoulder manipulation within a hospital setting, her attorney estimates future medical treatment costs of approximately $12,000.

Jennifer’s estimated total workers’ comp settlement value1: $92,000

Avoid These Pitfalls That Can Reduce Your Possible Shoulder Injury Settlement

When you injure your shoulder on the job, these pitfalls can result in the reduction or denial of workers’ comp benefits and your possible settlement:

- Being unprepared to deal with the insurance company: Your employer and their workers’ compensation insurance company are protecting their interests, not yours. An experienced workers’ compensation lawyer will deal with the insurance company for you and knows how to counter delay and deny tactics.

- Failing to seek or follow medical treatment: Following your doctor’s orders isn’t just important in helping you recover from your shoulder injury, it’s also crucial to your case for compensation for two reasons:

-

- It shows that your shoulder really is badly injured and that you’re doing everything you’re supposed to do to recover and get back to work.

-

- It creates a well-documented paper trail of medical expenses that you can use to try to demonstrate your need for maximum compensation.

- Not organizing your medical records: Along with completing medical treatment, it is also crucial to keep all your shoulder injury medical records together. Failing to do so could mean that you miss out on receiving all the compensation you may deserve for your medical treatment.

We’ve helped numerous clients avoid these pitfalls and maximize their workers’ compensation settlement amounts.1 Speak to an attorney when you’ve been injured at work. Even if you have a good relationship with your employer and you trust them to do the right thing, their insurance company generally makes more profit by paying out less.

If you’ve been offered a settlement from the insurance company and don’t have an attorney, please get a free case evaluation before you agree to anything. Even if you’ve experienced one of these pitfalls, we may still be able to help you. Call 1-866-900-7078 now.

How a Workers’ Compensation Lawyer Can Help with Your Shoulder Injury Claim

An attorney can significantly increase your odds of success by:

- Guiding you and being your advocate every step of the way

- Leveling the playing field with the insurance company, who do this every day

- Fighting for every dollar you may be owed

Find Out What Your Case Is Really Worth

The workers’ compensation team at James Scott Farrin includes attorneys with “other side” experience working for insurance defense firms. We understand what motivates insurance companies and how to negotiate with them.

My firm was named to the U.S. News 2023 list of “Best Law Firms,” with a Tier 1 ranking – the highest – for workers’ compensation.3

Contact the North and South Carolina workers’ compensation lawyers at James Scott Farrin today for a free evaluation of your shoulder injury case. You can reach us online or by calling 1-866-900-7078 right now.

Workers can often be blamed for their

Workers can often be blamed for their