Insurance adjusters may not tell outright lies, but in my experience as a North Carolina personal injury attorney, some may use confusing or misleading tactics to protect their company’s financial interests. Although insurance companies are prohibited from deliberately misrepresenting facts or policy terms, many use aggressive negotiation strategies. Remember: an objective for most for-profit insurance companies is to resolve your claim for the least amount of money possible, no matter how injured you may be.

This potential conflict of interest is something fundamental many injured people may not realize until it’s too late, and it’s why understanding insurance strategies is so important to help protect your rights after an accident.

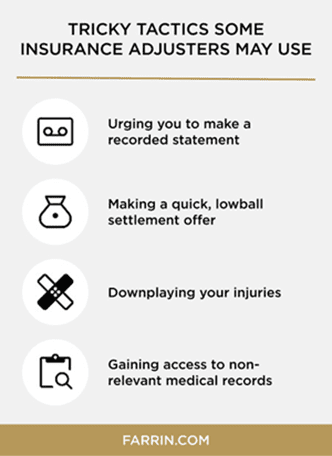

Key Takeaways – Insurance Adjuster Tactics

- A for-profit insurance adjuster’s primary loyalty is to the insurance company that employs them, not to the injured individual.

- Some adjusters may use potentially misleading tactics to try to reduce the value of your claim.

- Providing a recorded statement or signing broad medical authorizations without legal guidance can be detrimental to your case.

- Early, low settlement offers often fail to account for the full extent of your potential long-term medical needs and financial losses.

- An experienced attorney can manage all communications with the insurance company and help protect an injured person’s rights.

For-Profit Adjuster’s Job: Protecting the Insurance Company’s Bottom Line

After you’ve been in an accident, it’s not uncommon to get a call from an insurance adjuster who sounds friendly and helpful. They might say things like, “I’m just here to help you get this taken care of,” or “Let’s work together to get you back on your feet.” While both of these statements sound supportive, it’s critical to remember who most adjusters work for.

Most insurance companies are for-profit businesses. Their goal is to maximize profits for their stakeholders, and the less their adjusters pay out in claims, the more the company makes in profit. The adjuster is the frontline employee tasked with protecting the company’s bottom line.

For-profit insurance adjusters’ main objectives may include:

- Trying to pay as little as possible to settle your claim

- Attempting to close your case file as quickly as possible, often before you know the full extent of your injuries

- Looking for any information that could be used to argue you were partially at fault or that your injuries aren’t as severe as you claim

Understanding this dynamic is the first step to help protect yourself in your personal injury case.

Common Tactics Some Insurance Adjusters May Use That Can Feel Like

The Friendly Recorded Statement Request

Very soon after an accident, an adjuster for the at-fault party will likely call and ask you to provide a recorded statement about what happened. They might frame it as a simple formality needed to “get your side of the story.” This sounds reasonable, but it can be a trap.

Some adjusters may ask questions in a specific way that could lead you to unintentionally say something that harms your case. For example, they may ask you how you are feeling. If you say, “I’m feeling okay,” even if you are in significant pain and are just trying to be polite, adjusters will likely take note of it and some may use it later against you.

In North Carolina, a recorded statement can be especially dangerous. Our state has a law that can be very unforgiving to accident victims. A small misstatement from you about the sequence of events or your speed at the time of the accident can potentially be used to suggest you were slightly at fault for the accident – and this could potentially prevent you from recovering any compensation at all!

This is a complex legal issue, and it is one of the most critical reasons to be cautious when speaking with an adjuster. You are not typically required to give a recorded statement to the other driver’s insurance company, and it is often wise to decline until after you have spoken with an attorney.

The Quick, Lowball Settlement Offer

Imagine this: It’s been a week since your car wreck in Charlotte. You’re out of work, your car is totaled, and the medical bills are starting to arrive. Then, the adjuster calls with an offer to send you a check for a few thousand dollars, right now. It can be incredibly tempting to say yes just to get some financial relief.

This can be a calculated tactic. Insurance companies know that you are in a vulnerable position. Some may hope to get you to accept a quick, low settlement before you:

- Understand the full extent of your injuries. Some injuries, like traumatic brain injuries or spinal damage, may not show their full effects for weeks or even months.

- Know the total cost of your medical treatment. You may need future surgeries, physical therapy, or long-term care that this initial offer won’t even begin to cover.

- Realize the full potential value of your claim. This could include lost wages, future lost earning capacity, pain, and other damages.

Once you accept a settlement and sign a release, you generally cannot ask for more money later, even if your medical condition worsens. That quick check could end up costing you tens or even hundreds of thousands of dollars in the long run.

Downplaying Your Injuries

Another common strategy some adjusters may use is to question the severity of your injuries or the necessity of your medical treatment. Though they generally have no medical expertise, they might still make statements, such as:

- “In my experience, a fender-bender like that doesn’t cause a serious back injury.”

- “Your car only had minor damage, so you couldn’t have been hurt that badly.”

- “We generally only cover six weeks of physical therapy for this type of injury.”

These statements can be designed to make you doubt yourself and your doctors. The adjuster is not in a position to give a medical opinion. The connection between vehicle damage and bodily injury is not always direct – serious injuries can and do happen in low-impact collisions. For some adjusters, their goal may be to create an excuse to offer you less money than what you may really be owed.

The Broad Medical Authorization Form

The adjuster may send you a stack of paperwork to sign, including a medical authorization form. They may tell you they need it to verify your injuries and review your medical bills from the accident. However, these forms are often written to be extremely broad.

Signing a standard authorization form can give the insurance company permission to access your entire medical history, going back years before the accident. Some may not just be looking at your records from the emergency room visit after the crash. They may be digging for anything they can find – such as an old sports injury, a previous complaint of back pain, or any pre-existing condition – that they can use to argue that your current injuries were not caused by the accident.

For example, if you mentioned to your doctor five years ago that your neck was sore after a long drive on the Blue Ridge Parkway, they might try to argue that your current neck injury from a truck accident is just an aggravation of an old problem. A North Carolina car accident attorney can help you provide the insurance company with only the relevant medical records they need, protecting the rest of your private health information.

Are These Insurance Adjuster Tactics Deceptive?

This brings us back to the original question: Do insurance adjusters lie? While it is illegal for an insurance company to knowingly misrepresent facts or policy provisions, many of the tactics described above may exist in a legally gray area. They are aggressive negotiation strategies.

The adjuster may not be telling a direct lie when they say an offer is fair, because “fair” is a subjective term. From their perspective (which is often focused on saving their company money), the offer might seem fair.

How an Attorney Levels the Playing Field

Hiring a personal injury attorney can quickly shift the dynamic.

As your advocate, I would step in and offer to handle all communication with the insurance company and counter their tactics. This helps protect you from saying something that could be used against you and frees you to focus on what matters most — your health and your family. I will also fight to make sure your voice is heard and your rights are protected.

At my firm, we can help you by:

- Managing the details.We complete the complicated paperwork, make sure all procedures are followed correctly, and meet the strict deadlines that apply to your case.

- Advising and communicating.We listen to your questions, tell you the truth about your case, and provide a measure of peace of mind during a difficult time.

- Handling the insurance company.We take over communication and negotiation on your behalf. We know how to counter any lowball tactics and push back against any unfair delays.

- Building your case.We gather and examine crucial evidence, such as police reports, witness statements, and medical records. If needed, we can work with investigators to reconstruct the accident scene to try to prove what happened.

- Fighting for maximum compensation.We try to identify all possible sources of compensation and work to calculate the full potential value of your harms and losses, including any medical bills, lost wages, and future needs.

Having a legal professional on your side signals to the insurance company that you are serious about seeking a fair outcome. It levels the playing field and can significantly increase the odds of a better result.

FAQs: Do Insurance Adjusters Lie?

Here are answers to some other common questions people have about dealing with insurance adjusters.

What should I do if an insurance adjuster calls me?

Be polite but brief. You can provide your basic contact information, but you should politely decline to give a recorded statement or discuss the details of the accident or your injuries until you have had the chance to seek legal advice. Simply tell the insurance adjuster that your attorney will be in touch.

Do I have to accept the first settlement offer from the insurance company?

No, you absolutely do not have to accept any initial settlement offer. The first offer is almost always a low starting point for negotiations. It is rarely the best offer the insurance company is willing to make and may not adequately cover your total losses.

Don’t Face the Insurance Company Alone – Call the Law Offices of James Scott Farrin

If you have been injured and are dealing with an insurance company, you don’t have to face them alone. An experienced attorney can be your guide and your advocate, fighting to protect your rights every step of the way.

If you’ve been hurt, contact the Law Offices of James Scott Farrin today for a free case evaluation. Call us at 1-866-900-7078 or contact us through our online form. Tell them you mean business.