This page refers to How to File for Workers’ Compensation in South Carolina.

Since laws differ between states, if you are located in North Carolina, please click here.

How to File for Workers’ Compensation in South Carolina

People sustain injuries and illnesses from their work often. And in South Carolina, employers with 4 or more employees are generally required by law to carry workers’ compensation insurance, which can cover hospital and medical expenses as well as Disability payments while injured employees are unable to work. Workers’ comp can be incredibly helpful in a tough time; however, there are steps you need to follow to file. If you fail to follow some of these steps, it could lead to your claim being denied.

Step #1 – Report All Injuries Immediately to Your Employer

When you get injured at work, it’s important to tell your employer as soon as possible. This should be done in writing if at all possible.

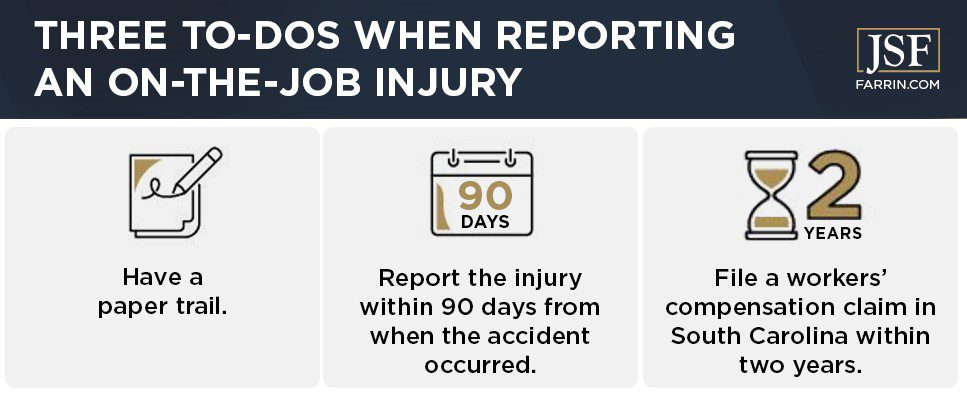

It’s always good practice to have a paper trail when it comes to workers’ compensation claims.

In South Carolina, you have 90 days from the day of the accident to report your injury to your employer; otherwise, you may lose your benefits. The earlier that you report your injuries the better, as delayed reporting may lead to the denial of your workers’ compensation benefits.

After you report your injury to your employer, you generally have up to two years to file a workers’ compensation claim in South Carolina. In the event that an employee dies from work-related injuries, the employee’s family, dependents, or parents may file the claim within two years of the death. These two-year deadlines are called statutes of limitations.

Step #2: Ask Your Employer to Cover Your Medical Treatment and File a Workers’ Comp Claim

It is your employer’s responsibility to file a claim with the South Carolina Workers’ Compensation Commission (SCWCC). If your employer’s insurance accepts your claim, then you could start receiving benefits right away. If your employer’s insurance denies your claim, ask them to put in writing why they denied it, and call a South Carolina workers’ compensation attorney to walk you through your options. Even if your claim is approved, it is still a good idea to talk with a South Carolina workers’ compensation lawyer to see if you are getting all the benefits you may be entitled to.

Step #3: Consider Filing a Claim or Requesting a Hearing with the South Carolina Workers’ Compensation Committee

This step may be necessary if your employer doesn’t report your accident with the Commission. Or the insurance company denies your claim. Or you think you did not receive your full benefits (this can happen surprisingly often). A qualified workers’ comp lawyer can guide you through this process. If you want to try to file a workers’ comp claim in South Carolina or request a hearing with the SCWCC by yourself:

- File a claim by filling out and submitting Form 50 (in case of work-related injuries) or Form 52 (in case of work-related death) to the Commission.

- Request a hearing by indicating this desire on the claim form (Line 13b on Form 50 or Line 12b on Form 52).

- At a hearing, a commissioner will determine the outcome of your case.

- If you are not satisfied with the commissioner’s decision, you may file an appeal to be reviewed by a panel of Commissioners.

When Do I Want a Workers’ Compensation Attorney?

Right away. Filing a workers’ comp claim in South Carolina can be a maze from the beginning. You may like your boss, but your boss’ insurance company has a different agenda than yours. How different?

Here are the names of a few recent cases from across the country that have something in common: Hines v. Geico. Hogan v. Provident Life. Leavey v. UNUM. Jeffers v. Farm Bureau. Demetrulias v. Wal-Mart. In each of these cases, courts have heard testimony about bad faith insurance practices. Specifically, that some insurance companies incentivize their adjusters to pay out less in claims in order to protect their bottom line. Don’t put your faith in a for-profit company; get an attorney to look after your best interests as soon as possible.

Our attorneys work on a contingency fee basis.2 That means we only collect an attorney’s fee if we get you money. The attorney’s fee is a percentage, so we are incentivized in the exact opposite way of an insurance company: we get more if you get more.

And that’s just one part of the James Scott Farrin Advantage. If you need a firm with:

- A track record of success;1

- A powerful roster of recognized professionals; and

- Inside knowledge from working for the insurance companies

Give us a call at 1-866-900-7078.

Did You Know? We created our own cutting-edge software to try to ensure no client detail ever falls through the cracks. That’s how committed we are to doing the best job we can on our clients’ cases.

Don’t Solve the Maze Alone: Contact Our Workers’ Compensation Attorneys

Call us any day, any time, submit our online form, or chat with an online representative for your free case evaluation by a knowledgeable attorney. If we take your case, our South Carolina workman’s comp legal team will help guide you through this entire process – from accurately filling out the right forms to trying to build your strongest possible case for compensation.

The first step in telling them you mean business is a no-obligation case evaluation. Call today!