Ready to settle your workers’ comp case?

Don’t settle for less. Here’s what you need to know and how an attorney can increase your odds of maximum compensation.

Workers’ Compensation Settlements and Closing Your Case in North Carolina: What You Need to Know

An on-the-job injury or illness can have serious long-term physical and financial consequences for you and your family.

Under North Carolina law, employers are generally responsible for compensating eligible injured workers for the medical treatment they need and the wages they lose due to a workplace injury or sickness. Hopefully, the injured worker fully recovers and returns to their previous job with no long-term consequences.

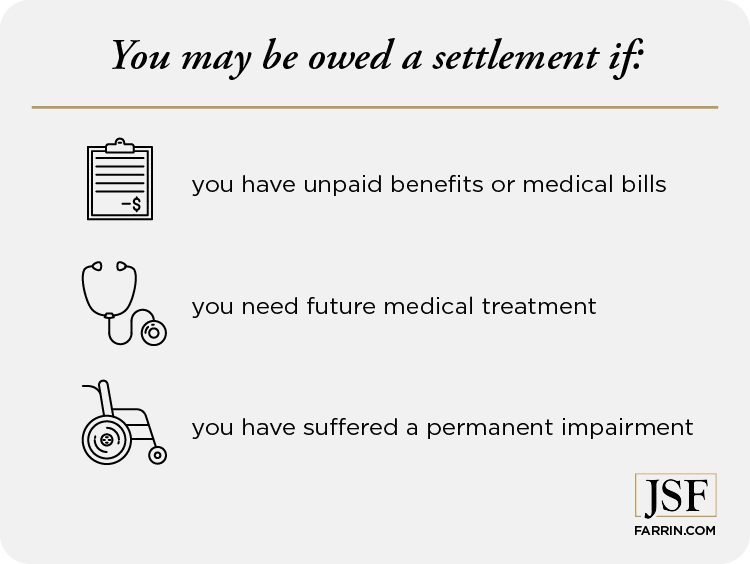

Sometimes, however, there may be permanent effects from your injury, and you may be owed a workers’ comp settlement.

Before you close your workers’ comp claim and accept a settlement from the insurance company, consult with an experienced workers’ compensation attorney who has your best interests and needs in mind. An early settlement offer may be the insurance company’s way of paying you less.

To see how much your settlement may really be worth, call 1-866-900-7078 today for a free case evaluation.

When Will Workers’ Comp Offer a Settlement?

Possible workers’ comp settlements are usually not negotiated until your medical treatment is completed and your doctor releases you from treatment. This is called reaching maximum medical improvement, or MMI for short.

At MMI, the doctor will decide whether you:

- have any permanent impairments

- have any permanent physical work restrictions

- may need additional medical treatment in the future

These are some of the important factors that go into determining how much your potential settlement may be worth.

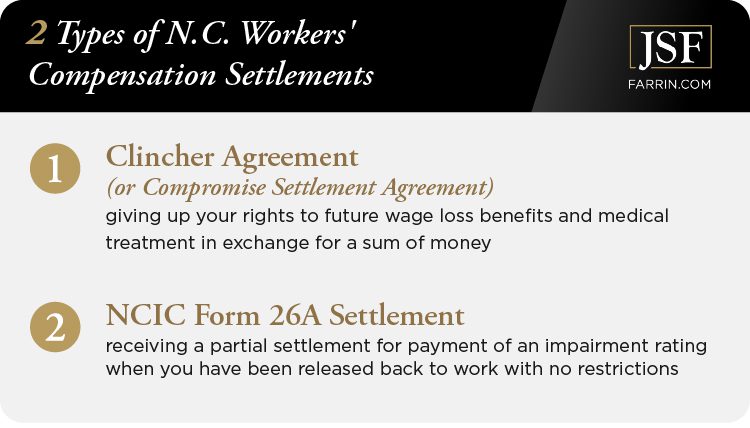

What Are the Different Type of Workers’ Comp Settlements in North Carolina?

In North Carolina, workers’ compensation settlements are generally structured as clincher agreements or as Form 26A settlements.

- A clincher agreement, or compromise settlement agreement, is a full and final settlement of your workers’ comp claim. When you sign a clincher agreement, you generally give up your rights to future wage loss benefits and medical treatment in exchange for a sum of money. Clincher agreements are generally paid in lump sum payments but can also be structured to be paid out in installments over time.

- An NCIC Form 26A settlement is a partial settlement for payment of any impairment rating when you have been released to full duty (i.e. have no physical restrictions) and have gone back to work. Typically, a 26A settlement does not cover future medical expenses. However, if you sign a Form 26A, you can still request additional medical treatment under workers’ compensation for a period of two years.

An experienced workers’ compensation attorney can advise you on whether accepting a clincher agreement or a Form 26A settlement makes sense for you and if so, can help you pursue the highest possible settlement amount. Contact us today at 1-866-900-7078 for a free case evaluation.

How Settlements Are Paid – Lump Sum or Structured

If you accept a settlement offer, you and your attorney can determine how you want it paid to you. Settlement payments may come in two forms:

- Lump sum: you receive the total settlement amount in a single payment. The majority of clincher agreements are paid as lump sum amounts.

- Structured: your possible settlement is paid to you in installments over an extended period. Your lawyer may advise you to consider a structured settlement if your work injury or illness left you totally disabled and in need of long-term care.

What Would Be a Good Settlement Offer?

A good settlement offer varies because each workers’ comp case is unique. A good potential lump sum settlement in your case should take into account, among other factors:

- Any unpaid past and future medical expenses

- Any lost wages

- Severity of your injury and any impairment rating

- Your education, ability to work, and future job prospects

Generally, it is advisable to wait until your doctor determines that you have reached Maximum Medical Improvement before accepting any settlement offer.

Note: Workers’ compensation benefits and settlements do not include compensation for pain and suffering.

What Can I Expect for My Workers’ Comp First Settlement Offer? The Process

In general, you should expect a complicated process when trying to settle your workers’ compensation claim. Your potential settlement should account for factors such as your impairment severity, your future medical needs, and your average pay before the injury. But the insurance company is protecting its own interests, and most insurers want to pay you as little as possible – negotiations may be difficult.

After you reach Maximum Medical Improvement in North Carolina, settlement negotiations may occur at a mediation, which is also known as a settlement conference. A large majority of workers’ compensation cases heading toward a settlement settle at mediation, so it is beneficial to have an experienced workers’ comp lawyer by your side to help you fight for a maximum settlement amount.

Does Workers’ Comp Always Offer a Settlement?

No. If you recover fully from your on-the-job accident and are able to return to your previous position with no long-term consequences, workers’ comp will generally not offer you a settlement.

However, if you have permanent effects from your injury, need continued medical care, or have unpaid workers’ comp benefits or medical bills, you may be owed a workers’ comp settlement.

In North Carolina, workers’ compensation settlements are voluntary. You do not have to settle your case, no matter what an insurance company or employer may tell you. If you are approved, you can keep receiving workers’ comp benefits for lost wages and medical care until you reach the maximum number of weeks allowed under law, which varies by injury.

And, if you are severely and permanently disabled and require continuing medical treatment, your workers’ comp attorney may advise you to let your employer or their insurance company pay lifetime wage replacement and medical benefits instead of settling.

Other times, it can be in your best interest to seek a fair settlement and not have to deal with the insurance company again. An experienced workers’ comp lawyer can help you weigh your options and decide on the best path forward for you.

To get clarity on your case at no cost and no obligation, call 1-866-900-7078 today.

When Can I Expect to Receive a Pay Out?

Since there are several parties and steps involved in negotiating and approving a settlement agreement, the waiting time for a potential payout will vary for each case. After the terms of your potential workers’ compensation settlement are negotiated between you and your employer or their insurance company, the settlement agreement must still be approved by the North Carolina Industrial Commission(NCIC).

You can receive a payout for your potential settlement after the North Carolina Industrial Commission (NCIC) approves the settlement agreement.

For clincher agreements, once the NCIC approves the settlement agreement, payment must be sent within 24 days of approval.

For Form 26A agreements, you can receive the value of any permanent disability rating in weekly installments that could start as of the day you reach Maximum Medical Improvement.

How Long Do Most Workers’ Comp Settlements Take?

There is no definite timeline. Typically, possible settlement discussions don’t start until after your medical treatment concludes. After that, it could take anywhere from 4-6 months to come to an agreement on a potential settlement, but every workers’ comp claim is different.

Accepting the insurance company’s first potential settlement offer, while quicker, is rarely advisable, and taking the time to negotiate for a fair settlement can pay off in terms of your possible compensation.

What Is the Process After My Claim Is Settled?

The process after your claim is settled depends on the type of potential settlement.

- If you agreed to a clincher agreement, your workers’ comp claim case is officially closed and you will receive the amount agreed upon. Clincher agreements also usually require that you resign from the company and agree not to reapply for a position with the company in the future. Therefore, if signing a clincher agreement, you are usually walking away from your job and the medical care that was provided by workers’ comp.

- If you agreed to a Form26A agreement, you will receive the value of your impairment rating, and you can request to receive medical benefits for two years after any impairment rating is paid.

James Scott Farrin Has a Formidable N.C. Workers’ Comp Team

Several of our workers’ comp attorneys are N.C. State Bar Board Certified Specialists in workers’ compensation law. This is the highest level of specialization available in N.C., and only a small percentage (less than 1%) of attorneys licensed to practice in the state have earned this recognition for workers’ compensation.*

On our team, we also have former Deputy Commissioners for the North Carolina Industrial Commission (the agency in charge of workers’ comp in N.C.). And eight of our attorneys were honored on the Best Lawyers 2024 “Best Lawyers” list for workers’ compensation.4

There’s no need to worry about the cost of having our experienced team in your corner. There are no hourly fees, no upfront costs – and you don’t pay an attorney’s fee at all if we don’t get compensation for you. Guaranteed.2

Whether you are at the beginning of your workers’ comp claim or hoping to settle it, we can help. We will always put your needs first, and we know how to fight for everything you may deserve.

It’s time to tell them you mean business. Call us today for a free case evaluation at 1-866-900-7078.

*Figures provided by NC State Bar as of 1/24.