When you’re involved in a crash with more than two vehicles, one of the first questions that likely comes to mind is, “Who pays in a multiple car accident in North Carolina?” The simple answer is that in North Carolina, the person who caused the accident — the at-fault driver — is generally responsible for paying for the damages through their insurance.

However, figuring out exactly who is at fault in a chaotic pile-up involving three, four, or even more cars is rarely simple. The aftermath can quickly become a tangled web of conflicting stories, multiple insurance companies, and complicated legal questions.

As a North Carolina car accident attorney, I’ve seen firsthand how a seemingly straightforward situation can become incredibly complex. The initial crash can set off a chain reaction, and what you think happened may not be the full story.

Key Takeaways for Who Pays in a Multiple Car Accident

- North Carolina is an at-fault state, meaning the insurance company for the driver who caused the crash is typically responsible for paying damages.

- Determining fault in a multi-car accident is challenging and often involves multiple drivers sharing some level of responsibility.

- Insurance companies may dispute liability to avoid paying claims, leading to potential delays and complications for injured people.

- Evidence such as police reports, witness statements, and vehicle damage is critical in piecing together how the collision occurred.

- Even a small degree of fault on the part of an injured driver can mean an insurer denying you compensation completely in North Carolina.

- An experienced car accident attorney can investigate the crash and significantly improve your odds of success.

Understanding Fault in North Carolina Crashes

North Carolina law operates on an at-fault system. This means that if another driver’s negligence — or carelessness — causes a crash that injures you, their insurance company is generally the one that should pay for your losses. These losses, called damages, can include things like medical bills, lost wages from being out of work, and the pain and hardship the injury has caused you.

The challenge with multi-car accidents is that there can be several negligent drivers. One person’s mistake can start a chain reaction that pulls other vehicles into the wreck. When this happens, each driver’s insurance company will launch its own investigation, and their primary goal is often to protect their own interests. They may try to shift blame to another driver — or even to you.

This is especially critical in North Carolina, where the rules about fault can be very unforgiving. A mistake in handling your claim could jeopardize your ability to get any compensation, which is a compelling reason to seek guidance from an experienced car wreck attorney.

Dissecting Complex Multi-Car Accident Scenarios

To understand how complicated these situations can get, let’s walk through a couple of common scenarios I see in my practice. While every crash is different, these examples show how fault isn’t always clear-cut.

Scenario 1: The Highway Chain Reaction

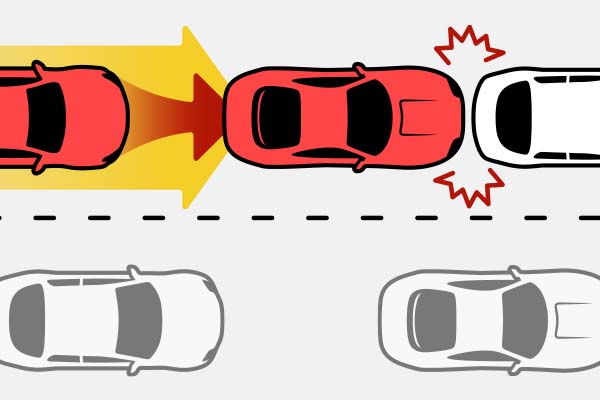

Imagine you are driving on a busy stretch of I-40. Traffic ahead begins to slow down.

- Driver B is in the left lane, going well over the speed limit. They come around a curve and don’t see the slowing traffic in time to stop, slamming into the back of Driver A’s car.

- Driver A was following Driver C too closely. The impact from Driver B shoves Driver A’s car forward, causing it to rear-end Driver C.

- Driver D, who was behind Driver B, was looking down at their phone. They look up too late and crash into the back of Driver B’s now-stopped vehicle.

In this pile-up, who pays for Driver C’s injuries and vehicle damage? Driver B’s speeding clearly initiated the crash. But Driver A’s tailgating contributed to the second impact, and Driver D’s distracted driving added another collision to the pile.

Multiple drivers acted negligently, and their insurance companies will likely spend a lot of time pointing fingers at each other to avoid being the one to pay. An attorney’s investigation would focus on gathering evidence like witness statements and vehicle data to try to prove who was responsible for each impact.

Scenario 2: The Intersection Pile-Up

Now, picture a busy four-lane road in a city like Greensboro or Raleigh.

The driver in Car A is texting while driving and isn’t paying full attention to the road. At the same time, the driver of Car B is trying to turn right out of a shopping center parking lot. Without making sure the way is clear, Car B pulls into the travel lanes. Car A, whose driver is distracted, hits Car B. The force of this collision pushes Car B into the adjacent lane, where it strikes Car C.

Who pays for the damages to Car C? The law generally places a duty on the driver entering a roadway to make sure it is safe to proceed. This might suggest the driver of Car B is at fault. However, was the driver of Car A so distracted that they could have avoided the crash if they had been paying attention?

It’s possible that both Driver A and Driver B share fault. The insurance companies for both will almost certainly argue with each other, which can leave the person in Car C waiting for answers and help.

These scenarios highlight why simply saying “the at-fault driver pays” is an oversimplification.

The Battle of the Insurance Companies

In a typical two-car accident, you are dealing with one other driver and their insurance company. In a multi-car accident, you may be dealing with three, four, or more insurance companies at once. For-profit insurers have teams of adjusters and lawyers who generally try to minimize the amount of money their company pays out, no matter how bad the victim’s injuries may be.

This can lead to several challenges for an injured person:

- Delayed Investigations: With so many parties involved, investigations can drag on for months. Insurers may wait to see what the others find before making a decision on a claim.

- Disputes Over Liability: One insurer might accept 50% of the fault but argue that another company is responsible for the other 50%. This can leave you stuck in the middle.

- Lowball Settlement Offers: Sometimes, an insurance company might offer a quick, small settlement to make the claim, and you, go away. These offers are often made before the full extent of your injuries is known and rarely cover all of your potential medical bills and lost income. Most insurance companies are for-profit businesses, and their actions often reflect that priority.

Dealing with insurance adjusters on your own can be frustrating, especially when you should be focused on recovering from your injuries.

What Evidence Determines Who Pays in a Multi-Car Wreck?

Because fault is so heavily contested, building a compelling case depends on gathering and analyzing strong evidence. The story of what happened is told through the details. As a car accident attorney, I fight to uncover all the facts, which often involves piecing together many types of evidence.

Some of the most critical pieces of evidence can include:

- The Official Police Report: The responding officer’s report contains important information, including a diagram of the scene, their initial assessment of fault, and any citations issued.

- Photos and Videos: Pictures of vehicle damage, skid marks, road conditions, and the final resting positions of the cars can be incredibly telling.

- Witness Statements: Independent witnesses who saw the crash can provide an unbiased account of what happened, which can be very persuasive.

- Dashcam and Surveillance Footage: Video from dashcams or nearby security cameras can provide indisputable proof of how the accident unfolded.

- Expert Analysis: In very complex cases, we may work with accident reconstruction experts as needed who can use physics and engineering principles to determine speeds, impact forces, and the sequence of events.

Gathering this evidence quickly is important, as memories fade and physical evidence can disappear. This is another area where having a legal team on your side from the beginning can make a significant difference.

What Happens When the At-Fault Driver’s Insurance Isn’t Enough?

A major concern in any serious accident is whether the at-fault driver has enough insurance to cover all the damages. North Carolina requires drivers to carry a minimum amount of liability insurance, as outlined in North Carolina General Statute § 20-279.21. However, in a multi-car accident with multiple injured people, these minimum policy limits can be exhausted very quickly.

For example, if an at-fault driver has the legal minimum in auto liability coverage (bodily injury coverage of $50,000 per person and $100,000 per accident and property damage coverage of $50,000 per accident) and causes a crash that seriously injures three people, that $100,000 will generally be divided among all three of them. It may not be nearly enough to cover everyone’s medical bills.

So, what can you do? There may be other avenues for seeking compensation.

- Multiple At-Fault Parties: As we discussed, if more than one driver was negligent, it may be possible to file claims against multiple insurance policies.

- Underinsured Motorist (UIM) Coverage: This can be a very important type of coverage on your own auto insurance policy. If the at-fault driver’s insurance is not enough to cover your damages, you can file a UIM claim with your own insurer for help covering the difference. I usually advise people to carry as much UIM coverage as they can afford, as it acts as a crucial safety net.

- Personal Assets: If all insurance options are exhausted, it may be possible to file a lawsuit directly against the at-fault drivers to pursue compensation from their personal assets, though this is often a last resort.

Exploring all potential sources of recovery is a detailed process that requires a thorough understanding of insurance policies and North Carolina law. And it’s what I do on a regular basis.

How an Attorney Can Level the Playing Field

When you’re injured and facing a mountain of medical bills, the last thing you likely want to do is fight with multiple insurance companies. My job as a car accident attorney is to take that burden off your shoulders. We handle the complexities of your case so you can focus on healing.

Here is how an experienced legal team can help you fight for maximum compensation:

- Conducting a Thorough Investigation: We dedicate the necessary assets to investigating your crash promptly. This includes gathering various forms of evidence, interviewing any witnesses, and, when appropriate, working with experts to build a compelling case on your behalf.

- Managing Communication: We handle the calls, emails, and correspondence from the many insurance adjusters who may be involved. We speak for you and know how to counter insurance adjuster tactics that could be used against you.

- Identifying Sources of Compensation: We carefully review applicable insurance policies — including your own UIM coverage — to try to identify every possible source of financial recovery.

- Calculating the Full Potential Value of Your Claim: We work to understand the full impact of the injuries you may have suffered, not just the immediate medical bills. This can include future medical needs, lost earning capacity, and the non-economic costs of pain and hardship.

- Fighting for a Fair Settlement: We negotiate aggressively on your behalf, countering any insurance company lowball tactics and pushing for a settlement that reflects what you may have endured. If they refuse to be fair, we are prepared to take your case to court if needed.

In a state with laws as strict as North Carolina’s, having a knowledgeable advocate on your side can significantly increase the odds of a positive outcome for you.

FAQs: Who Pays in a Multiple Car Accident in North Carolina?

Here are answers to some common questions I hear from clients involved in multi-vehicle collisions.