How Personal Injury Liens Can Threaten a Payout - And How an Attorney Helps

When you’re injured by another, the situation can be overwhelming. In addition to the pain, you may be dealing with expenses such as medical bills, property damage, lost wages due to missed work, and more. A financial settlement at the end of your case can be a lifesaver – but a lienholder may come along and take any money for themselves.

We take pride in aggressively dealing with liens in order to try to put more money in your pocket. The system already feels stacked against you, so every penny matters. We’ve often been able to reach a beneficial resolution for our client by standing our ground and fighting for it.1

Let’s discuss what a lien is, what types of liens exist (and how they threaten your possible payout), and how an experienced personal injury attorney can help you when you are faced with the liens process.

What Is a Personal Injury Lien Exactly?

A lien is essentially a legal obligation to pay for something.

When you seek treatment and relief from your injuries, you engage a medical care provider. They, in turn, seek payment from your health insurer (if you have one). You may not pay much out of pocket at this point.

When you’re injured by a negligent person, your health insurance provider doesn’t want to be held responsible for your medical bills. From their perspective, that’s the responsibility of the at-fault person and their insurance. So, when any settlement for your injury comes in, your health insurance may claim it as reimbursement for what they’ve paid in your medical care.

Or what if you don’t have insurance? Sometimes, the only way to get care is to pay on a lien, meaning the medical provider cares for you now and can be reimbursed from any legal settlement you get.

Types of Personal Injury Liens

A health insurance lien is a way for health insurance companies to potentially reclaim the money they’ve paid medical care providers for your injuries if your injuries were caused by a negligent third party. Meaning, your insurance paid your doctor for your care, and now they want to be reimbursed from anything the negligent person may have paid you.

A medical lien is an IOU to a medical provider for your medical treatment. That IOU is paid from the proceeds of any settlement in a successful case. Medical liens are paid off after health insurance liens. In North Carolina, they are capped at 50% of any net settlement amount (but note – a medical provider does not have to accept any payment as satisfaction of the full bill if the bill is higher than the payment).

This can get very confusing, very fast, but an experienced liens attorney can help. Call 1-866-900-7078 before you agree to anything.

The Details of a Health Insurance Lien Depend on the Insurance Provider

There are various types of insurance providers, and each one has its own laws and rules for liens. Some insurance providers may claim a lien when what they really have is a “lesser right of subrogation.”

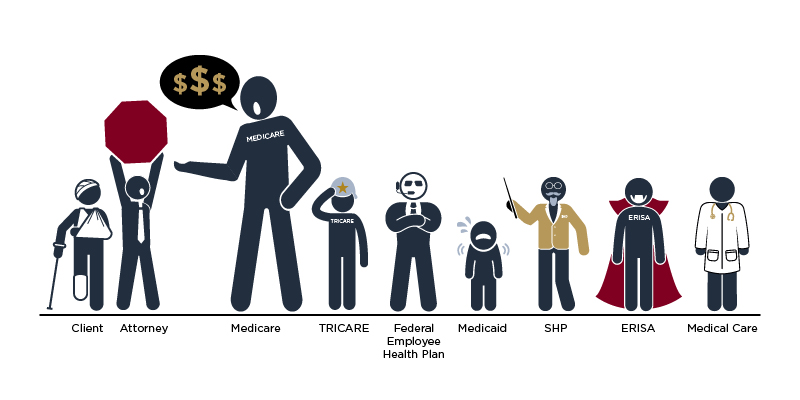

Here are common liens ordered by which generally must be paid out first (though the health insurance plans sometimes dispute their priority):

Medicare Liens

Medicare Liens

Medicare is health insurance provided by the federal government and takes priority over all other liens. Medicare is entitled to recover 100% of its disbursements and, unfortunately, could conceivably claim all of your potential settlement.

TRICARE Liens

TRICARE Liens

TRICARE is the government health insurance benefit to military service members and a few others, and it, too, is entitled to a lien. If a veteran receives care at a VA facility, there may be no medical bill. Yet, TRICARE can still place a lien on your possible personal injury settlement for reimbursement of expenses related to your care or the value of services provided at a VA facility.

The Federal Employee Health Plan

The Federal Employee Health Plan

Federal law requires that employees covered under the federal employee health plan must repay their health insurance when someone else is at fault for the injury.

Medicaid Liens

Medicaid Liens

Medicaid is entitled to liens where third-party negligence is involved, but it is behind Medicare in the lien pecking order. Medicaid liens are limited to 1/3 of your possible settlement.

State Health Plan (SEHP) Liens

State Health Plan (SEHP) Liens

SEHP mainly covers teachers and some state government employees. SEHP is entitled to the costs it incurs for care due to an injury caused by a negligent third party. SEHP’s portion of possible settlement compensation is limited to 50% of the total damages recovered after attorney’s fees.

Private Health Insurance Liens (Self-Funded ERISA)

Private Health Insurance Liens (Self-Funded ERISA)

Many Americans receive their health insurance through a privately funded employer health benefit plan. Private health plan liens do not have priority over Medicare or Medicaid liens, but there is no cap on the amount of potential settlement proceeds they can take if they qualify under federal ERISA law.

Even More Liens?!

Local governments may also have plans, known as Cost Plus Plans, that allow them to claim subrogation rights, which they may assert as a lien. However, this may not always apply in North Carolina. Do not pay out on a Cost Plus claim before speaking with an experienced liens attorney!

How Does My Attorney Help Me With Personal Injury Liens?

Liens have many rules and if a lienholder does not follow them, their lien may be invalidated or moved behind all other liens from a case.

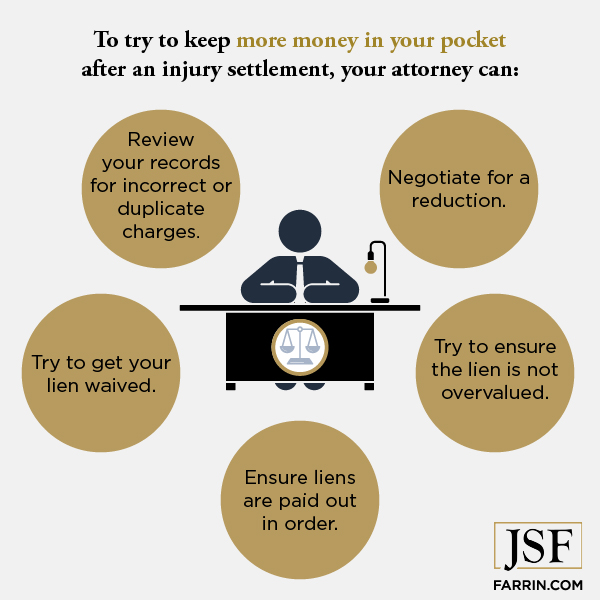

To try to keep more money in your pocket after an injury settlement, your attorney can:

-

- Review your medical records and bills for:

- duplicate charges

- charges for care that do not relate to your accident

- other charges that you’re not obligated to pay

- Negotiate for a reduction in the amount of the lien

- Try to get your lien waived in its entirety – for example, if your healthcare provider charged a fee for providing your records, the law says they are generally not entitled to a lien

- Review your medical records and bills for:

Liens Are Complicated, But an Attorney Is Your Advocate

The relief of receiving a settlement and moving on could be replaced with the horror of realizing that your potential settlement money may be owed to lienholders.

If you’ve been hurt in an accident through no fault of your own, seek skilled representation from a personal injury attorney experienced with liens. At the Law Offices of James Scott Farrin, we’ve been fighting for our clients since 1997 and have recovered over $1.8 billion in total compensation for more than 65,000 people. We have a reputation for getting great results.1

We will put you first by listening to your concerns, explaining your rights, determining what kind of case you may have, and working to help you try to keep more of your potential settlement money.

Call 1-866-900-7078 or contact us online today for a free case evaluation.

Medicare Liens

Medicare Liens TRICARE Liens

TRICARE Liens The Federal Employee Health Plan

The Federal Employee Health Plan Medicaid Liens

Medicaid Liens State Health Plan (SEHP) Liens

State Health Plan (SEHP) Liens Private Health Insurance Liens (Self-Funded ERISA)

Private Health Insurance Liens (Self-Funded ERISA)