Workers’ Compensation claims in North Carolina are a matter of process. The process for Charles, our fictional injured worker, has just begun. As we proceed, we’ll show how the process differs with and without an experienced Workers’ Compensation attorney, and in this installment, how medical treatment works under NC Workers’ Compensation law.

In part one, Charles filed for Workers’ Compensation and received a Form 61 – the insurance company has denied his claim. Now what?

Requesting a Hearing After a Workers’ Compensation Claim Is Denied

Charles’ claim being denied should not come as a surprise. Insurance companies make money by limiting their payouts – that’s simply the nature of the business. Denying claims may make workers who are mildly injured simply give up. Charles, however, has serious upper and lower back pain and left shoulder pain as well. He’s not going to give up.

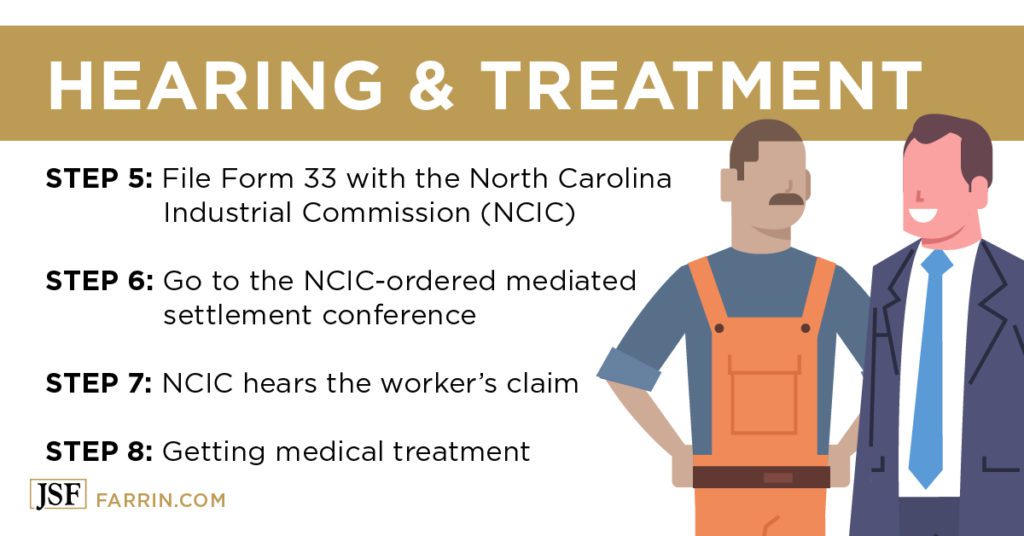

Knowing that the bills for his treatments are going to pile up, Charles decides to press forward on his claim. To do that, Charles must file a Form 33 Request for Hearing with the North Carolina Industrial Commission. This is Step 5 of the claim process. For information on Steps 1-4, please refer to part one of this series.

Preparing for a Hearing

To read the NCIC’s own information on preparing for a hearing, you can read this document. It can seem overwhelming to anyone who isn’t an attorney, and even to attorneys who do not focus their practice in Workers’ Compensation. A general practice or family law attorney may miss some of the nuances of the Workers’ Comp processes, which is why it is preferable to enlist the services of an attorney with experience, There are a lot of great Workers’ Comp attorneys. Hopefully, you’ll consider ours. You can call 866-900-7078 for a free case evaluation or contact us online.

STEP 5: File Form 33 with the North Carolina Industrial Commission (NCIC).

IF FILING WITHOUT AN ATTORNEY, Charles must file Form 33 with the NCIC. At a glance, it seems like a restatement of a lot of the information from Form 18. Some is, but there are other important aspects that Charles may not know how to handle, including the length of the hearing and the written reason he and the insurance company disagree.

IF FILING WITH AN ATTORNEY, Charles would simply review this document, as the attorney would be the one completing it and submitting it. An experienced attorney will know how to complete this form effectively and word it properly for the desired result. The attorney will also know what compensation and benefits to ask for and how to push for the maximum compensation.

It’s important to know that filing for a hearing isn’t “suing the employer.” This is not a civil lawsuit, but a request to the NCIC to hear the claim and decide whether or not the employer and insurance company should be responsible for providing Workers’ Compensation benefits.

Required Mediation, the NCIC Hearing, and Beyond

Before a worker like Charles ever gets to plead his claim before the North Carolina Industrial Commission, the Commission will probably order the insurance company and the worker to sit down and try to work out their differences through mediation.

STEP 6: Go to the NCIC-ordered mediated settlement conference.

WITHOUT AN ATTORNEY, when an injured worker is not represented by an attorney, the case usually bypasses mediation. This is unfortunate because mediations are the best opportunity that an injured worker may have to resolve their issues quickly without having to go through the lengthy and frustrating hearing process. If Charles had an attorney, he would have a chance to negotiate a reasonable settlement and would have more control over the outcome of his case than he would have by just letting a hearing officer decide what he deserves.

WITH AN ATTORNEY, Charles has a seasoned, knowledgeable, and experienced advocate to help him prepare for mediation. His attorney will correspond with the insurance company in advance, setting out the strengths of Charles’ case and making an appropriate settlement demand. At the mediation, Charles will have his attorney with him the entire time. The longer the attorney has had his case, the more firepower he or she can probably bring to bear on his behalf. An experienced attorney will know the strengths of Charles’ case, be able to argue effectively for the best outcome possible, and explain the details and consequences of any settlement he’s offered. Charles will understand his options and his attorney will help him make the decision that is best for Charles.

Cases are often settled at mediation, but not always. It’s simply something the NCIC requires before they take their time to hear the claim. For our example, we’ll say that Charles and the insurance company can’t agree, and the claim pushes forward to the hearing.

STEP 7: The NCIC hears the worker’s claim.

WITHOUT AN ATTORNEY, Charles will be answering the Commission’s questions without any idea what to expect. He’s gotten this far on his own, and it hasn’t been easy. By now, he might wonder if he will ever get relief. If the NCIC rules against him, he will have very few options left.

WITH AN ATTORNEY coaching him and setting his expectations, Charles will likely be more comfortable in front of the Commission. The questions will likely be the same, but he will at least know what to expect and have time to consider his answers before the hearing. It’s still stressful, but not as much.

If the hearing officer, who is a Deputy Commissioner, denies Charles’ claim, he can appeal to a panel of three Commissioners. If the worker is denied coverage at this level, the only avenue remaining is to appeal the decision to the North Carolina Court of Appeals, and then the North Carolina Supreme Court – at which juncture a lawyer is highly advised and perhaps too late! Fortunately for Charles, the NCIC rules in his favor, and the insurance company does not appeal.

Medical Treatment and Workers’ Compensation

Workers’ Compensation laws are focused on getting workers healthy enough to return to work. The law provides that the insurance company should pay for treatment that will enable a worker to get better and get back to work, including:

- Medical Treatment: The services of a doctor or specialists to diagnose and treat the injuries

- Hospital Care: Whether it’s day-of-injury or part of recovery for a surgery or medical treatment

- Surgical Procedures: Getting the procedures necessary to treat the worker’s injuries

- Nursing Care: If the worker requires the support of a nurse, or simply receives such care at a facility

- Medicines: Anything the worker needs to take, including prescription medications, while recovering

- Sick Travel: Reimbursement for any travel to authorized medical providers or pharmacies more than 10 miles away

- Rehabilitative services, such as:

- Attendant care services for at-home care or physical therapy

- Vocational rehabilitation to find another job; the insurance company may pay for retraining or for a specialist to help a worker retrain

- Other treatment: A catch-all category

KEEP IN MIND: If the insurance company is paying for treatment, the insurance company gets to select the doctors. It will be up to the doctors chosen by the insurance company, and not Charles, or his personal doctors, to decide what treatment Charles needs.

The Insurance Company Chooses the Care Provider

In North Carolina, the workers’ compensation insurer chooses the care provider for the injured worker. They’re paying for the care, and they choose who provides it.

Remember that insurance companies are in business to make money. It stands to reason that, given the choice between care providers who claim to be able to accomplish the same treatments or results, they’re going to choose the least expensive option. They’ll also look at which option claims it can get the worker back to work the quickest, which saves them money in the long run.

Even if Charles’ doctor recommends a course of care, specific treatment, or recovery period for his injuries, the insurance company is not obligated to authorize it. The truth is, even when workers like Charles win benefits, the fight is only beginning. They often find themselves fighting for treatments and second opinions as well.

STEP 7: Getting optimal medical treatment.

WITHOUT AN ATTORNEY, Charles is not happy with the treatment he is getting from the doctor that the insurance company sends him to see. The doctor says he just needs some physical therapy and some muscle relaxants and he should be able to return to work in a month or so. Charles does the physical therapy and the doctor releases him to return to full duty work. Charles is frustrated because he is still in the same amount of pain that he had in the beginning. He knows something is wrong, but he doesn’t know what to do.

It’s important to note that even if the doctor recommended by the insurance company recommends more helpful treatment, the insurance company may still refuse to pay for it.

WITH AN ATTORNEY handling the claim for him, Charles will have more options.

If the insurance company refuses to pay for treatments recommended by the doctor they authorized, the attorney will know how to fight for the treatment. And when the authorized doctor releases Charles from treatment before Charles feels he is ready, his attorney will know how to go about trying to get a second opinion for him with another doctor, who hopefully will be more helpful in recommending necessary and appropriate treatment.

It’s also important to note that the insurance company may deny suggested treatments even if those suggestions are from a doctor of their choosing!

In the Next Installment…

Charles finally gets the medical treatment he needs. We’ve covered the medical portion above, and even that’s not entirely complete. We just want to give you a feel for how the process can work – and how much work is involved.

In the next installment, we’ll take a look at the payments that Charles receives when he is unable to work because of his injury, how they’re calculated, what insurance companies may do to limit their payout, as well as Charles’ return to work and life after the injury.

If You Were Injured on the Job and Would Like to Know Your Options, Contact Us

Why go it alone? Being hurt on the job is a life-changing event and can be a source of immense stress. How will the bills get paid? What will you do if you can’t work? How can you get treatment? Call our experienced North Carolina Workers’ Compensation attorneys at 1-866-900-7078, or contact us online for a free case evaluation.

You May Also Be Interested In

The Case of Charles Part 1: Hurt at Work and the Journey of a NC Workers’ Comp Claim

Charles’ Story Pt. 3: Benefits, Return to Work, and Life After the Injury

When & How to Report a Work-Related Injury and Other Important Questions