When you sustain an injury on the job, it’s crucial to report your injury to a manager or supervisor right away. You should also file a Form 18 with the North Carolina Industrial Commission, which can be submitted electronically.

After you file your workers’ comp claim, the insurance company must follow an investigative process to determine if your case will be accepted or denied. They will review medical records regarding the injury and talk to your employer.

The first contact you have with the workers’ comp insurance adjuster will likely be in the form of a recorded statement. The adjuster will call you and ask your permission to interview you over the phone while they record the conversation.

The recorded statement should be approached with great caution, and it is prudent to consult with an attorney prior to providing one. The primary purpose of the questions the adjuster asks during the recorded statement is to gather facts and information about your workplace accident. The recorded statement is a key phone call for them – and for you. What you say can lead to acceptance of your claim or denial.

Is My Insurance Company on My Side?

Many people believe that the insurance company is working in their best interests. However, I often have to remind them of a basic fact about insurance companies. The majority of insurance companies are for-profit businesses.

Adjusters are typically highly-trained at finding ways to undermine your claim. If they see an opportunity to reduce the insurance company’s payment and don’t take it, they’re not doing their jobs. If they offer you more money for something than the bare minimum you would accept, they’re not doing their jobs.

An insurance company’s greatest expense is what it pays out in claims. If it pays out less in claims, it keeps more in profits. As such, even though an insurance company can be very pleasant to work with at times in a workers’ compensation matter, they are deeply interested in doing what is best for their company.

That’s why you must be careful when you explain what happened to cause your injury. And be careful how you answer seemingly harmless questions. You want to tell the truth, of course, but we have seen instances where the insurance adjuster spun the truth out of context in their efforts to deny a claim.

“Anything Unusual Happen?”

Let’s say, for example, after you describe your work accident, the adjuster asks you if anything unusual happened. Were you doing a task that is part of your regular job and were you doing it the way you normally would? The purpose of this question is not to judge whether or not you are a conscientious and careful employee. The answer you give might be directly related to the compensability of your case.

Injury by Accident

Generally, in order for an injury to be considered compensable, there must be an “injury by accident,” which means that something out of the ordinary or unusual must have happened.

“Unusual” to the insurance company might mean that one particular shelf you were stocking had been moved higher than usual and you lost your balance and fell while reaching. To you, reaching for a high shelf is all in a hard day’s work. Unusual to you might mean the electricity went out and you were stocking shelves in the dark. So you might reply that nothing unusual happened.

If you tell them you were doing your job as usual at the time of injury and omit any unusual circumstances, such as the shelf having been moved a bit higher than normal, your case may potentially be denied.

To the insurance company, this critical piece of information could be a key factor in accepting or denying your claim. Adjusters know you are not aware of this. (But they know we are!)

Why Do Some Adjusters Tell You Not to Hire an Attorney?

The insurance adjuster has a job to do. Usually, that job is to award you as little money as possible.

I have had clients tell me that an insurance adjuster told them that hiring an attorney will only hurt their case, and the attorney will only be seeking to take money out of their pocket. Why? Because they know we are potentially able to point out deficiencies in the way they are assisting in the claim or any additional benefits the injured worker may be entitled to that the insurance company is not providing in the claim.

When an injured worker has an attorney who can try to make sure they receive what they may be entitled to, then that can affect an insurance company’s bottom line – and not for the better. Insurance companies are keenly aware of this. Despite what they might otherwise say to an injured worker, many insurance adjusters are ultimately interested in what is best for the insurance company — and only the insurance company.

Should I Use My Private Insurance After an Injury at Work?

At this point, you may be wondering: Is it easier and less stressful to just use your own insurance, even for an injury suffered while at work?

No.

Even if your employer asks you to do so and you don’t want to make waves, don’t do it. Don’t put yourself at risk so your employer can save on insurance premiums.

Your doctor likely won’t treat you under your insurance if you say you suffered a work-related injury. They know that workers’ compensation should be covering that and they might not get paid by your insurance. Will you lie to your doctor?

What if the injury is greater than expected and your insurance runs out? Any claim for workers’ compensation will likely be too late.

Can the Insurance Company Stop Sending Workers’ Comp Checks?

Congratulations! You recruited an experienced workers’ comp attorney and successfully avoided common insurance adjuster traps during your recorded statement. Your checks are coming regularly and for the proper amount. Can you relax, or can the insurance company suddenly stop sending you your check?

The concern about continuing to receive a weekly check is something we see often, and understandably so. When you are out of work due to a work injury, your only source of income is often that weekly benefits check, and it’s important to protect it while you’re recovering from your work injury.

Here’s the deal. If you go back to work, even for a day, the insurance company can stop your weekly workers’ compensation check immediately, without going before a judge. If you are, for any reason, unable to continue working after you’ve returned to work, it is very difficult to get that weekly check re-started.

If the insurance company is asking you to go back to work and you do not feel ready or able to perform the job they are asking of you, the only way the insurance company can stop your weekly check is to go before the Industrial Commission and obtain an order allowing them to stop it.

If the insurance company goes before the Industrial Commission, you or your attorney will have an opportunity to explain why you do not feel able to return to work. After that time, the Industrial Commission will make a ruling. Only if they side with the insurance company is the check stopped. This process can take several weeks.

Tip: In North Carolina, your doctor must review and approve a written job description before you go back to work.

Why You Want an Attorney to Deal with the Insurance Company for You

There are many nuances to workers’ compensation law, like the “injury by accident” rule. That is why we urge anyone who is faced with giving a statement to an insurance representative to consult with a workers’ compensation attorney first. An attorney can help you understand the types of questions you may be asked and possible pitfalls and nuances in language to heed. Your attorney can also be part of the conversation during your recorded statement. If inappropriate questions are asked, they can object.

Two Clients, Two Very Different Outcomes

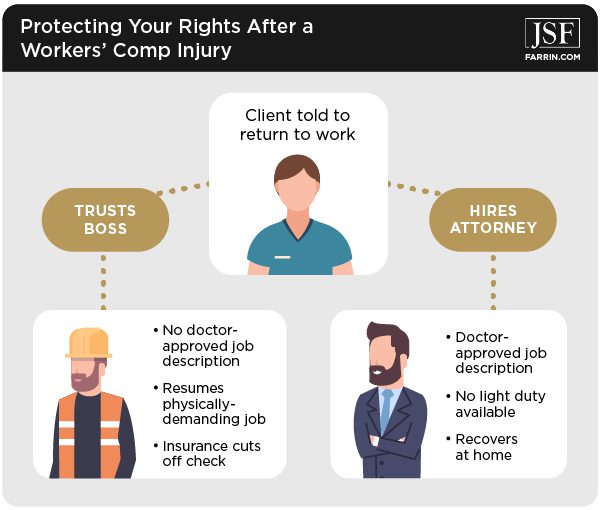

We had two clients recently who had to deal with the insurance company, and they had very different outcomes based on their actions.

One client was contacted by the insurance company and told to return to work. He had been assigned work restrictions and was unable to perform his pre-injury job due to the injury. He felt he had a good relationship with his boss, and thought his employer would work with him. He did not know that the insurance company was required to have a doctor-approved job description.

So he went back to work. His employer, however, made him do more than he was physically capable of doing, and he was unable to continue working. Yet, because he returned to work, the insurance company was able to cut off his check, and he eventually had to seek relief by going before a judge.

Another client was rightfully hesitant about returning to work when the insurance company asked him to. He contacted us and we told him to wait until he had a doctor-approved job description. As it turns out, his employer was never able to put together a job description because they didn’t really have “light duty” work available. He remained out of work and focused on healing from his injury.

Sadly, you simply cannot trust some insurance companies to act in your best interest. Too much money is at stake.

Need Advice? Get a Free Case Evaluation

We have several North Carolina State Bar Board Certified specialists in workers’ compensation law on our team. Several of our staff used to work for the insurance companies – and two even worked at the North Carolina Industrial Commission.

Before you talk to any insurance representative, especially on a recorded statement, contact us or call 1-866-900-7078. We’re available to take your call 24/7.

You May Also Be Interested In

When & How to Report a Work-Related Injury and Other Important Questions

Is the Insurance Company Using a Workers’ Comp Nurse to Watch Over Me?