Who will pay these medical bills? Will my health insurance cover this? What if my deductible is really high? How will I pay my bills if I can’t work?

In other words, wanting to know the average car accident settlement amount in North Carolina isn’t necessarily about hoping for a “big score” or a “windfall.” That can happen, but a lot of people just want some sort of reassurance that they’re going to have help paying for a mess they didn’t cause.

The number they’re asking for, however, is fraught with problems.

The Average Car Accident Settlement in N.C. (and a Whole Bunch of Disclaimers)

There are a lot of disclaimers, and I have to be careful with quoting a figure, because stating a number like this should not be considered promissory, as the number may be downright misleading.

The truth is, you could be entitled to much more, or much less, than that figure. You may be entitled to nothing at all. It all depends on the facts surrounding your case.

Still, it gives me a chance to address the question. I drew that $20,000 figure from the Insurance Information Institute’s own statistics, so it’s not made up. However, here are the disclaimers:

-

- This number is unhelpful. If you have a little neck pain and no other injuries, you are unlikely to get that much. Conversely, if you’re catastrophically injured, that number may be a drop in the bucket of what you actually need. Every injury case is different.

-

- This number could be misleading. While I was able to locate a research-based answer, that number draws on the entire United States. There isn’t any research I trusted that specifically provided North Carolina settlements. That’s important because…

-

- This number includes states with very different laws than North Carolina. For example, while the compiled statistics do exclude “no-fault” insurance states, North Carolina is one of very few contributory negligence That can affect outcomes. And…

-

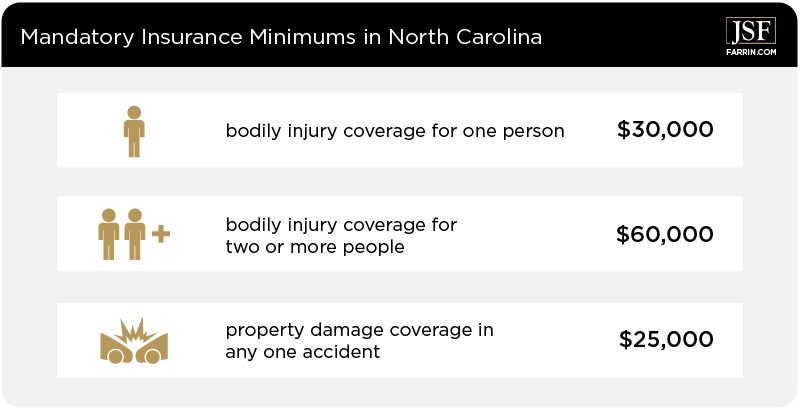

- This number doesn’t account for mandatory insurance minimums, which vary by state. In a state with high minimum insurance requirements, a crash injury victim may get more on average than a victim with the exact same injury in a state with lower minimums.

- This number doesn’t account for mandatory insurance minimums, which vary by state. In a state with high minimum insurance requirements, a crash injury victim may get more on average than a victim with the exact same injury in a state with lower minimums.

-

- This number is can’t be counted on as I said. Despite my best attempts to find a reliable average number, there simply isn’t one. And even if there were, some people might take that number as a promise for their particular case. I’m not going to promise an outcome – I can only promise to help my client seek as much as possible as quickly as possible in their unique case.

-

- That number is unclear because it does not specify if the injured person had an attorney, as far as I can tell. My experience tells me that many insurance companies love it when injured people settle without legal representation. That may be the only reason you need to consider hiring a lawyer.

What Factors Will Affect the Size of My Car Accident Settlement?

-

- Injury severity: How badly you’re hurt plays a role in how much you may get for your injury. It does not guarantee it, though.

-

- At-fault driver’s insurance: The insurance policy limits of the at-fault driver can affect any settlement. We research and investigate to try to discover more policies that may be applicable, and may seek compensation beyond the policy limits in some cases by filing a lawsuit directly against the driver.

-

- Crash circumstances: The circumstances of the crash may alter your outcome. Insurance companies may be more eager to settle, and for more money, if their insured driver was at fault and driving under the influence, for example.

-

- Evidence: Crash scene evidence. Your medical bills, including your ongoing treatment. Camera footage. The evidence surrounding your injury, and your attorney’s ability to gather it, can make a huge difference.

-

- Negotiation and litigation: Yes, the ability to effectively negotiate with an insurance company can affect your possible settlement. An attorney ready, willing, and able to litigate – go to court with – your case can make a big difference.

The Average Car Accident Settlement in North Carolina Is…

Irrelevant? Pick any number and there are some who would be overjoyed and some who would be disappointed. And the number would still be meaningless at the end of the day because your case really is unique. It should be treated that way.

If you’ve been hurt by another in a motor vehicle accident in North Carolina, visit us online or give us a call at 1-866-900-7078. Tell us the facts of your case, and we’ll see if we can help you fight for maximum compensation. The case evaluation is free, and there is no obligation to hire us afterwards.

You May Also Be Interested In

Driving High: What Marijuana Car Accident Statistics Teach Us

Can You Drive After Taking Benadryl and Other Allergy Medicines?