When you are injured at work, you have plenty to worry about: How am I going to pay the bills while I am out of work? Am I going to recover fully? When will I be able to return to work? Your focus should be on your health, but these questions can’t be left unanswered.

Nor can questions about the tax implications of workers’ comp. I have had many clients call me in a panic around tax time: Do I pay taxes on workers’ comp? Does workers’ comp count as income? Are taxes taken out of my workers’ compensation payments? In this article, I will tackle these and other questions about workers’ comp taxes, so you can focus your time and attention on recovering and getting your life back in order.

I am often asked the same general questions in slightly different ways by different clients. So, a few of the following questions may seem to be addressing the same issue, but there are nuances to each. My hope in including each question below is that one of them answers your specific question in a way that makes sense to you.

I encourage you to also check out the FAQs on our workers’ compensation page for important and helpful information for workers who have been hurt on the job and the workers’ compensation benefits to which they may be entitled.

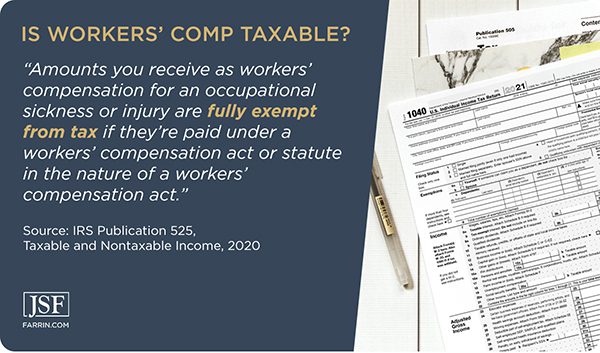

Do I Pay Taxes on Workers’ Comp?

No, you generally do not pay taxes on workers’ compensation benefits in North Carolina. These benefits and settlements are usually fully exempt from tax, and you do not need to include them on your tax return. Whew! Big relief, right? You’ll notice that I used the words “generally” and “usually” in my answer. That’s because there are exceptions to this rule.

If you also receive Social Security Disability Insurance (SSDI) benefits or Supplemental Security Income (SSI) benefits, a portion of your workers’ comp may be taxable. If your temporary total disability (TTD) benefit reduces your Social Security Disability Insurance benefits (SSDI), the amount of the reduction is still generally reported as a taxable benefit. For example, if you have a reduction of your monthly SSDI benefit by $200 because of your TTD benefits, the $200 is likely taxable under IRS guidelines.

If you settle your claim for workers’ compensation and your employer asks you to keep the matter confidential, you could face tax consequences. While settlements in workers’ compensation cases are not generally taxable, confidentiality provisions pushed by insurance companies and employers can place your settlement at risk of being taxed. The Internal Revenue Service (IRS) has ruled that when compensation is paid pursuant to a confidentiality clause, the settlement may be subject to taxation.

While confidentiality is a common provision in agreements, injured workers must be careful that the agreement specifically includes terms that prevent the risk of the IRS taxing the agreement. An experienced attorney knows which type of tax-free agreement is not subject to being taken by the IRS.

I encourage you to reach out to one of our North Carolina State Bar Board Certified Specialists in workers’ comp if you have received a settlement offer, are receiving workers’ comp benefits, and are thinking about applying, have applied, or are receiving SSDI benefits. At my firm, our workers’ comp attorneys and Disability attorneys often work closely together to guide and advise our clients. Give us a call at 1-866-900-7078 for a free case evaluation.

Does Workers’ Comp Count as Income?

No, in most cases. If you are not receiving Social Security Disability benefits, your workers’ comp will generally not be counted as taxable income.

Are Taxes Taken Out of Workers’ Compensation Payments?

No, taxes are usually not taken out of your workers’ comp payments.

One way of looking at workers’ comp benefits is that they are intended to help cover injured workers’ missed wages. Most workers take home about two-thirds of their pay, after taxes. In theory, workers’ comp pays injured workers two-thirds of their pay (average weekly wage), tax free, so workers are, more-or-less, receiving similar wages as before their work-related injuries or illnesses. If workers’ comp benefits were taxed, this would put workers in a disadvantaged financial position.

Do I Claim Workers’ Comp on My Taxes?

No, you usually do not need to claim workers’ comp on your taxes. But – here we go again – if you also receive Social Security Disability benefits, you may need to include a portion of your workers’ comp benefits on your taxes. Consult with an attorney before you file.

Is a Lump Sum Workers’ Comp Settlement Taxable?

Similarly, workers’ comp settlements are generally not taxable and do not need to be claimed on your tax return. But be careful because a confidentiality clause could make the settlement taxable. Consult with an experienced attorney before you sign a settlement agreement.

Is Workers’ Comp Tax Deductible?

No, workers’ comp is not tax deductible. The IRS does not allow you to deduct workers’ comp benefits on your tax return.

Will I Receive a 1099 or W-2 for Workers’ Compensation?

You should not receive a 1099 form (if you are an independent contractor or freelancer) or a W-2 form (if you are a regular employee) for workers’ compensation benefits received because these benefits are generally not taxable in North Carolina. If you do receive a 1099 or W-2 for workers’ compensation, contact an attorney or the North Carolina Industrial Commission to find out what you should do.

I hope this has provided information on some of your tax-related questions about workers’ compensation. I encourage you to consult with a workers’ comp attorney throughout your case so that you can focus on your health and leave the tax and legal questions to a person who deals with these on a regular basis. Contact our firm for a free case evaluation, and let us help you.

This blog is not intended to constitute written tax or legal advice. The author intends by this communication to share general information for discussion purposes only, and you should not interpret the statements otherwise.

You May Also Be Interested In

What Is My Workers’ Comp Case Worth?

Answers to 10 Commonly-Asked Workers’ Comp Questions

Workers’ Compensation Laws in (NC) North Carolina: What’s Covered