Injured in a North Carolina Car Accident? You Can Seek Compensation for Your Injuries!

Our experienced attorneys understand the challenges you face after a serious crash.

This page refers to North Carolina Car Accident Lawyer in North Carolina.

Since laws differ between states, if you are located in South Carolina, please click here.

North Carolina Car Accident Lawyer

You weren’t expecting the crash, but the at-fault driver’s insurance company was ready for it when it happened. While you’re dealing with injuries and medical bills, some may already be working to minimize what they’ll pay. Whether it happened on I-85, a Charlotte intersection, or a quiet Asheville street, you need someone who knows how to fight back.

After a serious car wreck, the physical pain, emotional distress, and mounting financial burdens of medical bills and lost wages can quickly become unbearable. At the Law Offices of James Scott Farrin, we recognize the immense challenges you may face. We will navigate the complex legal and insurance processes on your behalf and fight to recover maximum compensation for you.

Don’t face this challenge alone. Contact us today for a free and confidential case evaluation.

Key Takeaways – North Carolina Car Accident Lawyer

- North Carolina car accident claims require proving the other driver was negligent and their actions directly caused your injuries and damages.

- The state follows a three-year statute of limitations for filing personal injury lawsuits from the date of the accident.

- Common car accident causes include distracted driving, speeding, impaired driving, and aggressive driving behaviors.

- Damages may include medical expenses, lost wages, and pain and suffering.

- Multiple parties might be held liable, including drivers, vehicle owners, or government entities, depending on circumstances.

Why Choose the Law Offices of James Scott Farrin for Your Car Accident Case

After a car accident, a law firm that understands the intricacies of North Carolina law and has the strength and extensive assets to stand up to large insurance companies can be a tremendous asset. The Law Offices of James Scott Farrin has a long-standing history of fighting for the injured, marked by significant results and a client-first approach.1

We have recovered over $2 billion total for over 78,000 clients since 1997. And counting. We recovered over $230 million total for over 4,500 people in 2025.¹ These numbers don’t include the $1.25 billion we led a team of firms to recover for 15,700 claimants in a historic class action case against the U.S. government for discrimination.*

Many of our attorneys are North Carolina State Bar Board Certified Specialists in their fields. We accept personal injury cases on a contingency fee basis, meaning that you pay nothing unless we obtain a financial recovery for you. Guaranteed.²

Our You-First Policy is more than just a motto. We focus on clear communication, efficient case management, and a steadfast commitment to your well-being throughout the legal process.

What Is a Car Accident Claim in North Carolina?

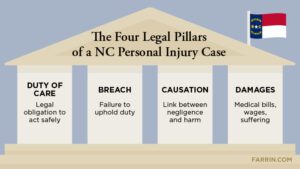

This process typically involves proving that the other driver owed a duty of care, breached that duty through their negligent actions, and that this breach directly caused the injuries and your subsequent damages.

Common Types of Car Accidents in North Carolina

Car accidents have unique dynamics and potential for injury. Understanding these different types can help identify potential liability and build stronger cases.

Some of the most common types of auto accidents our North Carolina car accident lawyers handle include:

- Rear-End Collisions: Often caused by distracted driving, tailgating, or sudden stops, these might lead to severe whiplash and other soft tissue injuries.

- Head-On Collisions: Among the most dangerous, and often fatal, head-on collisions occur when the front ends of two vehicles collide, usually due to impaired driving, distracted driving, or swerving into oncoming traffic.

- T-Bone or Side-Impact Collisions: These types of wrecks typically occur at intersections when one vehicle strikes another on its side, often due to running red lights, disobeying stop signs, or failing to yield the right of way.

- Sideswipe Accidents: These happen when two vehicles traveling in the same direction make contact along their sides, frequently due to unsafe lane changes, distracted driving, or driver fatigue.

- Rollover Accidents: While less common, these often result in severe injuries or fatalities and might be caused by high speed, sharp turns, striking an object, or certain vehicle defects.

Additional accident types include drunk or impaired driving accidents, distracted driving accidents, hit-and-run accidents, and accidents involving uninsured or underinsured motorists. Each type presents unique challenges in establishing potential liability and pursuing compensation.

Common Causes of Car Accidents in North Carolina

While accidents might result from a myriad of factors, most car crashes in North Carolina might be traced back to driver error or negligence. Understanding these causes helps build effective cases that try to prove liability.

Leading causes of accidents in NC include:

- Distracted Driving: This involves any activity that takes a driver’s eyes, hands, or mind away from the task of driving.

- Speeding: Exceeding posted speed limits or driving too fast for road conditions significantly reduces reaction time.

- Impaired Driving: Operating a vehicle under the influence of alcohol or drugs severely compromises judgment and coordination. According to NHTSA, one person was killed in a drunk-driving crash every 42 minutes in 2023.

- Aggressive Driving: Tailgating, weaving through traffic, road rage, or making abrupt lane changes increase collision likelihood.

- Driver Fatigue: Drowsy driving might be as dangerous as impaired driving, leading to impaired judgment and slower reaction times.

Other contributing factors include failure to yield right-of-way, disobeying traffic laws, poor road conditions, and vehicle defects. Our legal team strives to investigate every aspect to identify all possible negligent parties.

Who May Be Held Liable in an NC Car Crash Claim?

While in many single-vehicle accidents, the at-fault driver is the primary liable party, other entities might also share responsibility, depending on the circumstances. Identifying any and all liable parties is essential for maximizing your potential recovery.

Common parties who may be held liable include the at-fault driver, the vehicle owner if different from the driver, the driver’s employer if operating a company vehicle or performing work duties, and, in rare cases, government entities responsible for road maintenance or traffic control.

Bars or restaurants might potentially be held liable under North Carolina’s dram shop laws if they served alcohol to an already intoxicated person who then caused an accident. Our legal team conducts a meticulous investigation into your car accident, working to uncover all potential sources of negligence.

What Damages Are Available in a North Carolina Car Collision Lawsuit?

Economic Damages

Potential economic damages represent tangible, quantifiable financial losses. These concrete costs form the foundation of most personal injury claims and include several key categories, such as:

- Medical expenses for all past and projected future medical expenses, especially if injuries require ongoing treatment

- Lost wages for income lost due to injuries preventing work

- Loss of earning capacity, as when permanent disabilities reduce future income potential

These damages require careful documentation to help protect your right to seek full compensation for any and all financial losses stemming from the accident.

Non-Economic Damages

Non-economic damages potentially compensate for the non-financial impacts of injuries. While harder to quantify, they represent very real suffering and diminished quality of life that accident victims endure.

- Pain and suffering compensation addresses physical pain and discomfort.

- Emotional distress damages can cover psychological trauma like anxiety, depression, and PTSD.

- Loss of enjoyment of life damages are for the inability to participate in previously enjoyed activities.

- Disfigurement damages address permanent scarring or physical alterations.

- Loss of consortium can compensate spouses for lost companionship in severe injury cases.

Our attorneys work with medical professionals and experts as needed to help document these damages comprehensively.

Punitive Damages

Punitive damages in North Carolina car accident cases punish exceptionally reckless or malicious conduct and are designed to deter similar future behavior.

What Is the Deadline for Filing a Car Accident Lawsuit in North Carolina?

This deadline is strict. Failing to file within this three-year window might result in permanently losing your right to seek compensation, regardless of case strength. Early action allows our legal team the opportunity to preserve critical evidence right away, interview witnesses while memories remain fresh, and start building your case immediately.

How Much Does It Cost to Hire a Car Accident Attorney in North Carolina?

This means our fee is contingent upon securing a financial recovery for you. You pay nothing upfront, no hourly fees, and you owe us no fee at all if we don’t obtain compensation on your behalf. Guaranteed.²

How a Lawyer at the Law Offices of James Scott Farrin Can Help You

A dedicated North Carolina car accident lawyer from the Law Offices of James Scott Farrin can be an invaluable ally. Our comprehensive approach to case management includes several critical services as we fight to maximize your recovery.

We launch thorough accident investigations, gathering available evidence such as police reports, traffic camera footage, witness statements, and damage documentation. Our attorneys meticulously identify possible negligent parties and build compelling cases that try to prove the other driver’s negligence directly caused your injuries. If needed, we work with medical professionals and financial experts to assess the full extent of damages, including all past and future losses.

Dealing with insurance companies might be daunting, so we handle all communications and negotiations. Our extensive experience helps us counter aggressive tactics, possibly misleading questions, and lowball settlement offers. We negotiate for the highest possible settlements, and if needed, our skilled litigators are fully prepared to take cases to court. We manage all paperwork and deadlines throughout the process, helping prevent procedural errors that might jeopardize claims.

FAQ – North Carolina Car Accident Lawyer

What should I bring to my first consultation with a car accident attorney?

You don’t have to bring anything. If you have it, bring any documentation related to your accident, including the police report, insurance information, medical records and bills, photographs of injuries and vehicle damage, and witness contact information. Also, any correspondence from insurance companies. Remember, while having these materials can help our team evaluate your case during the initial consultation, you don’t need to have any of them on hand to get started.

How long does a typical car accident case take to resolve in North Carolina?

Case timelines vary significantly based on injury severity, liability disputes, and insurance company cooperation. Simple cases with clear liability might resolve in several months. Complex cases involving serious injuries or multiple parties may take a year or longer. Your attorney can provide more specific estimates after reviewing your case details.

Can I still pursue a claim if the accident was partially my fault?

Maybe. North Carolina follows specific fault rules that make consulting an attorney essential. Even minor mistakes might impact your ability to recover compensation. An experienced attorney can evaluate the circumstances and advise whether you have a viable claim despite potential fault issues. We have helped many clients who thought they were at fault recover compensation instead.1

What if the at-fault driver doesn't have insurance or enough coverage?

Uninsured and underinsured motorist coverage on your own policy might provide compensation when the at-fault driver lacks adequate insurance. Your attorney can also review all available insurance policies and identify potential sources of recovery beyond the at-fault driver’s coverage.

Should I accept the insurance company's first settlement offer?

Initial settlement offers from insurance companies are typically low and may not cover all your injuries. Having an attorney review any offer before accepting it helps protect your rights. Attorneys can evaluate whether offers fairly compensate for any and all current and future losses related to your injuries. Call our team for your free case evaluation.

Get the Legal Help You Need Today

A car accident might disrupt your life in profound ways, leaving you with serious injuries, financial strain, and emotional distress. The Law Offices of James Scott Farrin fights for injured accident victims throughout North Carolina.

We possess the knowledge, extensive resources, and unwavering determination to challenge insurance companies. Our goal is to help you secure the financial recovery necessary to rebuild your life.

If you have been injured in a car accident due to someone else’s negligence, reach out for legal guidance. For a free case evaluation, contact our dedicated team today. Call us 24/7 at 1-866-900-7078 or contact us online to learn how we can help you. Tell them you mean business.

*In re Black Farmers Discrimination Litigation, the Law Offices of James Scott Farrin led a team of firms to recover $1.25 billion from the U.S. government for discrimination against African-American farmers.1

Car Accidents Help Is Always Nearby

- Asheville Car Accident Lawyers

- Charlotte Car Accident Lawyers

- Durham Car Accident Lawyers

- Fayetteville Car Accident Lawyers

- Goldsboro Car Accident Lawyers

- Greensboro Car Accident Lawyers

- Greenville, NC Car Accident Lawyers

- Greenville, SC Car Accident Lawyers

- Henderson Car Accident Lawyers

- New Bern Car Accident Lawyers

- Raleigh Car Accident Lawyers

- Roanoke Rapids Car Accident Lawyers

- Rocky Mount Car Accident Lawyers

- Sanford Car Accident Lawyers

- Wilson Car Accident Lawyers

- Wilmington Car Accident Lawyers

- Winston-Salem Car Accident Lawyers

READ MORE

- Our Team of Car Accident Attorneys

- Why Hire a Car Accident Lawyer

- Types of Car Accidents

- Car Accident Injuries

- What to Do After a Car Accident

- Personal Injury Car Accident Claims

- Insurance Companies

- Uninsured/Underinsured Motorist

- MedPay

- Diminished Value Claims

- DWI

- North Carolina Car Accident Statistics

- North Carolina Car Crash Fact Report

AWARDS