This page refers to Underinsured/Uninsured Motorist Coverage law in South Carolina.

Since laws differ between states, if you are located in North Carolina, please click here.

Understanding Uninsured Motorist Coverage and

Underinsured Motorists Coverage in South Carolina

Car accidents are bad enough, but what happens if you are injured in a hit-and-run accident or if the driver who hit you doesn’t have enough insurance to cover your medical bills or expenses? Did your luck just go from bad to worse?

Not necessarily. In South Carolina, there is auto insurance coverage that can potentially provide protection to drivers injured in these types of circumstances – uninsured motorist (UM) coverage and underinsured motorist (UIM) coverage.

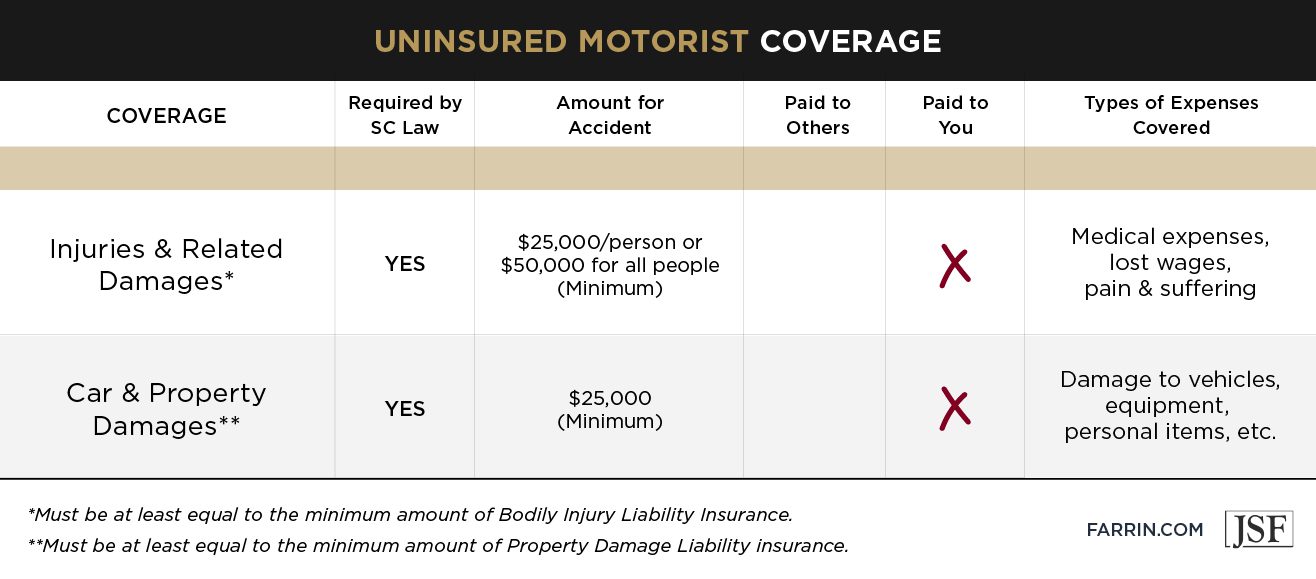

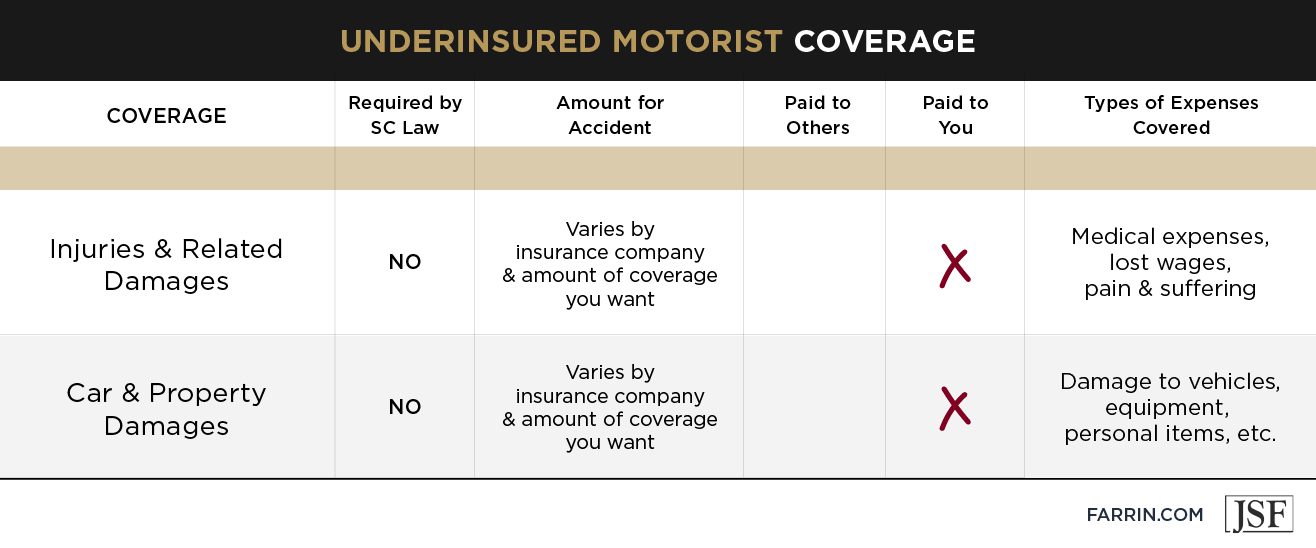

Car insurance provides protection to drivers by covering certain risks and paying for financial losses caused by these risks. Review these South Carolina auto insurance charts for an overview of the different types of auto insurance offered and required in the state.

What Is Uninsured Motorist Coverage in South Carolina?

Uninsured motorist coverage is insurance that potentially pays you if you are injured and/or your property is damaged by a hit-and-run driver or an uninsured driver.

- In South Carolina, all drivers are required by law to carry uninsured motorist coverage for personal injuries and related damages of $25,000 per person, or $50,000 for all people, per accident – this is the minimum level required.

- In addition, all drivers must also carry uninsured motorist coverage for car and property damage of $25,000, minimum.

The National Highway Traffic Safety Administration reports that there were 2,872 fatalities in crashes involving hit-and run drivers in 2021, an 11% increase over the prior year. Of the 7,388 pedestrian fatalities, 1,802 (24%) were involved in hit-and-run crashes in 2021. And of the 966 pedalcyclist fatalities, 220 (22%) were involved in hit-and-run crashes in 2021.

Source: NHTSA Overview of Motor Vehicle Crashes in 2021

According to a 2017 study by the Insurance Research Council,

an estimated 9.4% of drivers on South Carolina roads are uninsured. While that may not seem like a high percentage, keep in mind that means that nearly one out of every eleven cars on South Carolina roads likely has no car insurance.Can I Stack Uninsured Motorist Insurance Policies in South Carolina?

Under certain circumstances, South Carolina allows car accident victims to stack, or combine, UM coverage limits within a single car insurance policy as well as across multiple insurance policies. Stacking means that you can use more than one policy to cover bodily damages after an accident.

Stacking on one car insurance policy

If you and your spouse both have vehicles on the same insurance policy with UM coverage for bodily injury of $25,000 for one person per vehicle, you may be able to stack that coverage to equal $50,000 per accident.

Stacking across multiple car insurance policies

If your name is listed on two car insurance policies within your household, you may be able to stack across both policies to increase your UM coverage.

Dealing with insurance policies and regulations can be confusing, and some insurance companies may delay and deny claims in order to protect their bottom lines. We can help you assess your case and fight for the maximum coverage you may deserve.

What Is Underinsured Motorist Coverage in South Carolina?

Underinsured motorists coverage is similar to uninsured motorist coverage, but it potentially pays for your injuries or property damage if the at-fault driver does not have enough insurance to cover your damages or medical bills. Auto insurers are generally required to offer you UIM coverage in South Carolina, but you are not required to purchase it.

UIM insurance can help make up the difference when the at-fault driver has insurance, but the policy limits are too low to cover all of your damages or injuries. Since many drivers only purchase the minimum limits of car insurance coverage, UIM coverage allows you to turn to your own insurance company for potential compensation for harms and losses you sustain in excess of the at-fault driver’s liability coverage.

Can I Stack UIM Coverage in South Carolina?

Yes, South Carolina law allows the stacking of multiple UIM coverages in certain circumstances. If the at-fault driver’s liability insurance is not enough to cover your medical expenses, you may be able to combine UIM coverage for multiple cars from a single auto insurance policy or coverage from multiple policies – as long as certain conditions are met.

To stack UIM coverage in South Carolina, you must be a Class 1 Insured (a named insured or resident relative of a named insured), and the insured vehicle must have been involved in the accident. An experienced attorney can help you determine if you are eligible to stack UIM coverage in your case.

How Do I Contact the Law Offices of James Scott Farrin?

Contact us for a free case evaluation. We will only take your case if we think we can help you. We work on a contingency fee basis so you don’t have to pay an hourly attorney fee.2

Serious injuries demand serious attention. Call us at 1-866-900-7078.