Have you been deceived or treated unfairly as a consumer?

You may be eligible for compensation. Here’s what you need to know, and when to hire an attorney.

Unfair and Deceptive Trade Practices

As a consumer, you have the right to fair and honest treatment. If you buy a product or service that promises one thing and delivers something else, you may have been the victim of an unfair or deceptive trade practice. That is, however, the tip of an enormous legal iceberg.

There is a web of laws to protect consumers from predatory or unfair trade practices and punish those who use them. However, like any web, it can be a tangled and confusing mess if you don’t know what you’re looking at.

Unfair and deceptive trade practices can involve libel, fraud, breach of contract, defamation, and many other facets that can make these cases a real litigation challenge. Our experienced litigation attorneys may be able to help. Call us at 1-866-900-7078 or contact us online for a free case evaluation.

Frequently Asked Questions about Unfair and Deceptive Trade Practices

- What Are Unfair and Deceptive Trade Practices?

- What Are Some Examples of Unfair and Deceptive Trade Practices?

- Are Unfair and Deceptive Trade Practice Laws Different in Every State?

- What Is the Statute of Limitations for Filing a Claim Under the Unfair and Deceptive Trade Practices Act?

- What Must I Prove in an Unfair and Deceptive Trade Practices Case?

- What Kinds of Compensation Can I Seek in an Unfair and Deceptive Trade Practices Lawsuit?

- What Should I Do if I Believe I Am a Victim of Unfair or Deceptive Trade Practices?

- Attorney’s Fees in Unfair and Deceptive Trade Practices Cases

What Are Unfair and Deceptive Trade Practices?

Unfair and deceptive trade practices are essentially misleading or illegal acts that cause harm to consumers or competitors in the market. In order for something to be considered an unfair or deceptive trade practice, it must affect commerce and cause harm — typically financial harm — to consumers or competing business.

Section 5 of the Federal Trade Commission Act (FTCA, often mistakenly referred to as the Federal Unfair Trade Practices Act) governs unfair and deceptive acts and practices. Initially passed in 1914 and since amended many times, the FTCA created the Federal Trade Commission and empowered it to:

1) Prevent unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce;

2) Seek monetary redress and other relief for conduct injurious to consumers;

3) Prescribe trade regulation rules defining with specificity acts or practices that are unfair or deceptive, and establishing requirements designed to prevent such acts or practices;

4) Conduct investigations relating to the organization, business, practices, and management of entities engaged in commerce; and

5) Make reports and legislative recommendations to Congress.

The law aims to protect consumers and ensure fairness in the marketplace, thereby defending consumers from predation.

What Is an Unfair Trade Practice?

As defined by the statute, an unfair act or practice:

- Causes or is likely to cause substantial injury to consumers

- Cannot be reasonably avoided by consumers

- Is not outweighed by countervailing benefits to consumers or competition

Substantial Injury

An unfair act or practice is likely to cause substantial injury to consumers, most often when it involves monetary harm. A small amount of economic harm to a large number of consumers may be deemed significant enough to warrant enforcement under the law.

Also, note that actual injury is not always required. A significant risk of substantial harm can be sufficient, depending on the circumstances. And while emotional and other subjective harms or losses are not ordinarily considered substantial injuries, they can reach the level of “substantial injury” in some circumstances. Debt collection harassment is one possible example.

Cannot Be Reasonably Avoided

An unfair act or practice cannot be reasonably avoided by consumers if it interferes with their ability to make decisions or take action to avoid injury. An example here would be when a seller modifies the price of a product or withholds the price until after the consumer commits to the purchase. In this case, the consumer cannot reasonably avoid the injury.

It is also unfair if consumers are coerced into unwanted purchases (for example, timeshares) or if a transaction occurs without their knowledge or consent.

Countervailing Benefits

Countervailing benefits to consumers or competition do not outweigh an unfair act or practice. To be unfair, it must do more harm than good. If the practice produces more net positive effects, such as lower prices or a wider selection of products and services which give all consumers more choices, those factors are weighed against the harm that practice may cause.

What Is a Deceptive Trade Practice?

As defined by the statute, a deceptive act or practice:

- Misrepresents, omits, or misleads or is likely to mislead the consumer

- Would be reasonably misinterpreted by a consumer under the circumstances

- Is material

Misrepresents

A deceptive act or practice misrepresents, omits, or misleads or is likely to mislead a consumer. Note that a consumer does not have to suffer harm in this case — even the likelihood of being misled can be enough to satisfy this prong of “deception.” For this reason, an act or omission suspected of deception isn’t judged in a vacuum. The court must consider the entire context of the act.

In almost every ad, you’re likely to find fine print. Note that even disclosures such as these may not be sufficient to offset a deceptive claim or headline regardless of how many truthful disclosures follow it.

Examples include misleading cost or price claims, offering a product or service that is not available, using bait-and-switch techniques, omission of material limitations or conditions from an offer, or failing to provide a promised service.

Misinterpreted

Essentially, whether an act or practice is deceptive depends on how a reasonable target audience member would interpret the representation in question. It may still be considered deceptive if the majority of the target audience doesn’t share the plaintiff’s interpretation. The act or practice can still be regarded as deceptive if a significant minority of such consumers is misled.

Additionally, if a seller’s representation conveys more than one meaning (to reasonable consumers), and one of those meanings is false, the seller may be liable for the misleading interpretation. Exaggerated claims or “puffery” are not deceptive if a reasonable consumer would not take the claims seriously. Saying “This car flies like a jet,” for example, would not be misleading, as it is a fantastic or unrealistic claim.

Material

Whether or not an act or practice is “material” depends on whether or not it affects the consumer’s ability to make and understand a decision. If the information is important to consumers, it may be material. Under the law, some information is considered material. Additionally, even implied claims can be material in some cases.

Claims known to be false are presumed to be material, as are omissions that a seller should have known were important to the consumer. A good example would be the diesel cheating scandal involving car companies who advertised their products as “clean,” knowing full well the product was not nearly compliant with environmental laws.

[ Back to Top ]What Are Some Examples of Unfair and Deceptive Trade Practices?

Some examples of unfair or deceptive trade practices include:

- Claiming a product is something it is not or performs a task it does not, or substituting an inferior product for the product advertised

- Systematically overcharging for a product or service

- Failing in good faith to settle insurance claims

- Altering or otherwise falsifying measuring devices like vehicle odometers or the scales used to measure a product sold by weight

- Causing confusion or misunderstanding about the source, origin, or certification of a good or service, such as where it was made, or that it was approved by a certifying authority when it was not

- Libel or slander in business dealings

- Misrepresenting the benefits, characteristics, ingredients, or uses of a good or service

- Claiming or implying that a product is new when it is used, altered, or damaged, or otherwise not in claimed condition

- Representing that goods or services or of specific, quality, model, grade, standard, or style when they are not as represented

- Claiming the goods or services that belong to another entity or business are your own through misrepresentation or by use of misleading facts

- Advertising products or services with the intent to sell them in different quantities or at a different price

Note: This is not an all-inclusive list. If you believe you were a victim of unfair or deceptive trade practices, contact an attorney, who can evaluate your case.

[ Back to Top ]Are Unfair and Deceptive Trade Practice Laws Different in Every State?

In some cases, states have chosen to pass their own deceptive trade practices acts, often using the FTCA and its amendments as a foundation and then customizing the definitions of “unfair” and “deceptive” to apply specifically to what occurs in the state.

For that reason, what is an unfair and deceptive trade practice in one state may be slightly different than in a neighboring state.

For example, North Carolina’s Unfair and Deceptive Trade Practices Act (UDTPA) covers much more. North Carolina is among 30 states that chose not to adopt the federal version of the law, instead writing its own. For that reason, the North Carolina UDTPA differs from federal law, so if you believe you have a case, you should contact a North Carolina attorney for a free evaluation.

How Are States’ Deceptive Trade Practices Laws Different?

It depends greatly on the state, but the differences can be myriad. How does the state define unfair, deceptive, and commerce? Are there specific rules or case laws in the state that declare certain actions violations where federal law would not?

For example, both North and South Carolina passed their own laws, using the FTCA as a foundation but suiting the law to the individual state. The North Carolina UDTPA and South Carolina Unfair Trade Practices Act (SCUTPA) protect consumers — and in some cases businesses — from those who would deceive them in the act of commerce.

Regardless of which state you’re in, if you’re competing in commerce — buying or selling — then deceptive or unfair acts are against the law. Pieces of these laws originate with federal law, but they can differ slightly from the federal statute. The result is often a complex legal challenge with several twists.

That’s why you should hire a lawyer experienced in unfair and deceptive trade practices, both at the federal level and in your state.

[ Back to Top ]What Is the Statute of Limitations for Filing a Claim Under the Unfair and Deceptive Trade Practices Act?

The Federal Trade Commission Act offers a five-year statute of limitations in some cases. Beyond that, it may depend on the state or the alleged violation. For example, generally speaking, you have four years from the date of the violating act to file a civil claim in North Carolina. The law also accounts for mitigating circumstances. However, we don’t recommend waiting: if you believe you are a victim, you should act immediately to try to ensure the strongest possible case.

Regardless of which state you’re in, the statute of limitations doesn’t necessarily shield a violator who continues to defy the law. For example, say a company in North Carolina uses unfair and deceptive practices to cheat its competitors for eight years, stops the unfair practice, and is sued three years after stopping it. The case is still valid because the statute of limitations “resets” each week the violation occurs.

Likewise, if the unfair practices were not discovered until three years after the company stopped using them, the statute of limitations generally begins when the unfair practices are discovered.

[ Back to Top ]What Must I Prove in an Unfair and Deceptive Trade Practices Case?

Filing a lawsuit under the law is understandably complex and depends on how the law works in your state. You will almost definitely need to speak with an attorney. For the case to succeed, an unfair or deceptive trade practices case must prove three distinct elements:

- There was an unfair or deceptive trade practice: Someone advertised an expensive watch as having a unique movement when it did not, for example. You had no reason to disbelieve the claims.

- It affected commerce: You bought the watch instead of a competing product, but would have bought a different product if the truth were known.

- It was the proximate cause of actual injury to you or your business: As a consumer, you paid for something you did not get (a unique watch) and as a competing business, you lost customers and income due to the deception of your competitor.

Proving fraud is not required to satisfy the elements of a case under the law. If the act in question could deceive or create the likelihood of deception, it may qualify. Proof of an “actual injury” can include monetary losses, the loss of use of a specific and unique property, and losing the appreciated value of property, among others.

It is not hyperbole to say that every case is unique. We recommend that you consult with an experienced unfair trade practices lawyer. Call us at 1-866-900-7078 anytime for a free case evaluation.

[ Back to Top ]What Kinds of Compensation Can I Seek in an Unfair and Deceptive Trade Practices Lawsuit?

Here is where the federal law and state laws often diverge in perhaps the most critical way for victims of unfair or deceptive trade practices. Remedies available under the Federal Trade Commission Act include:

- Injunctions – An order to stop a behavior or practice

- Cease and desist orders – Similar to an injunction, depending on context

- Consent decrees – A settlement between parties in which no guilt or liability is admitted

- Disgorgement of profits – The forfeit of profits gained as a result of the unfair or deceptive practice

While at least a dozen state consumer protection acts limit plaintiffs to actual damages, restitution, or equitable relief, the majority of statutes provide additional possible remedies, including:

- Statutory damages – amounts specified by the law

- Treble damages – in effect, triple the amount of the harm done to the plaintiff

- Punitive damages – an additional award that seeks to punish the defendant for egregious or flagrant misdeeds

Nearly all states authorize the discretionary award of attorney’s fees.

Generally speaking, to recover damages under state laws, you have to make a case that will enable a jury to quantify or calculate the damage you suffered. In other words, they need to be able to put a price tag on the harm you suffered. Furthermore, the courts have held that the damages need to be “out-of-pocket.” The harm caused needs to have directly cost you something.

[ Back to Top ]What Should I Do if I Believe I Am a Victim of Unfair or Deceptive Trade Practices?

There are a few options for those who believe they’ve been treated unfairly or deceptively. First, you can file a complaint with the Attorney General’s office. If nothing else, it puts the issue on the state’s legal radar.

The second option is to contact the business directly and see if they’re willing to compensate you for any harm you suffered. In many cases, companies have an official program or department to handle these situations. Many will have policies for dealing with issues such as these, but they will not always offer satisfactory solutions.

Your best bet may be to contact an attorney with experience in unfair and deceptive trade practices. There is an incredible amount of detail and nuance to the law, not just the statutes. Over the years, court decisions (called case law) have also defined how the law is applied today.

As a result, these cases can be mindboggling in complexity. An attorney will be able to offer perspective, evaluate and investigate your claim, and advise you on how best to proceed.

[ Back to Top ]Attorney’s Fees in Unfair and Deceptive Trade Practices Cases

So if you did want to take legal action, what can you expect to pay an attorney? There are many ways in which attorneys may charge fees. When it comes to cases with a high probability of litigation — ending up in court — those fees are often hourly. In Unfair and Deceptive Trade Practices cases, which can be incredibly complex and time-consuming to litigate, the law allows the judge to award attorney’s fees in addition to damages.

In this way, the law encourages people wronged by unfair and deceptive trade practices to come forward and pursue justice without the specter of a mountain of legal costs — something a guilty defendant can be obligated to pay instead. In other words, it’s not necessarily about the cost, but about who you want to represent you.

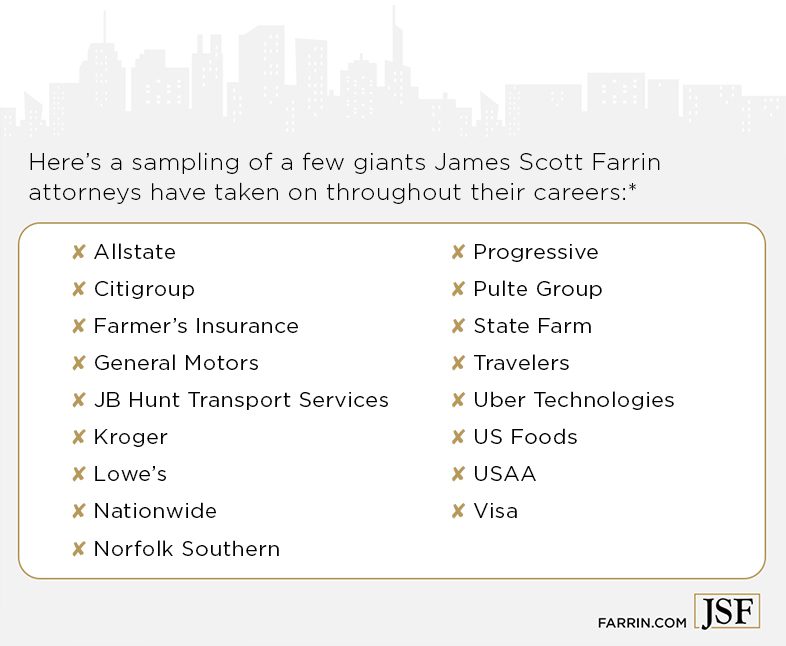

Our team of experienced litigators includes attorneys with extensive experience fighting some of the largest companies in the world – like Coleman Cowan. They’re backed by the resources of a powerful law firm, and they’re ready to fight for you.

We may be able to help you if you’ve been the victim of unfair or deceptive trade practices. Call any time at 1-866-900-7078 for a free case evaluation from a person, not a machine, or contact us online.

[ Back to Top ]Why You Should Consider the Law Offices of James Scott Farrin

We’re proud to serve the victims of unfair and deceptive businesses and are prepared to fight those violators to try to recover harms and losses for our clients. Our complex litigation team combines decades of courtroom experience and a deep understanding of unfair and deceptive trade practice law.

Furthermore, we understand how those laws interact with other statutes like those governing fraud, breach of contract, defamation, and more. Your case may include more than just the state’s consumer protection act or the federal law. We can help you find your available avenues to pursue justice.

If you’ve suffered losses due to unfair or deceptive trade practices, do not hesitate to call us anytime at 1-866-900-7078 or contact us online for a free case evaluation.