As a Social Security Disability attorney, I often receive questions about work credits. Clients usually understand that they have to prove that they meet the Social Security Administration’s (SSA) definition of being disabled in order to receive Disability benefits, but they are sometimes unprepared when they are informed that they must also meet a work credit requirement, as well.

In order to qualify to receive Social Security Disability Insurance (SSDI) benefits, you must meet the definition of disability and you must have worked long enough – and recently enough – under Social Security. The Social Security Administration determines if you meet both the duration work requirement and the recentness work requirement of the work credits system.

Think of it this way: SSDI is a type of insurance, and like most insurance policies, you must pay premiums in order to be covered. With SSDI, you pay these premiums through payroll taxes, and through those taxes you earn work credits (one per quarter). It’s important to note that if you stop paying those premiums (i.e. stop working), your coverage may lapse and you may no longer be insured. Remember, your work credits must meet the SSA requirements (worked long enough, recently enough) for you to be eligible to proceed on to a Disability evaluation for Disability benefits.

An Example of the Requirement for Working Long Enough and Recently Enough

John Doe works from 2000-2011 but had to stop working to take care of his sick mother. He returned to the workforce ten years later in 2021, and after only working 3 months, he was in a car accident. Mr. Doe files an application for Disability benefits alleging he became disabled as of that accident because his injuries were so severe that he could not return to work. Unfortunately, Mr. Doe does not meet the SSA requirements to qualify for Disability because he does not have the adequate number of credits during the correct timeframes.

What Are Social Security Work Credits?

Social Security work credits are used to determine if you have worked enough to earn Social Security Disability benefits (and Social Security retirement benefits). These credits are based on your total yearly wages or self-employment income, and to receive Disability benefits, there are time requirements associated with them.

What Requirements Do You Have to Meet to Get Work Credits?

The two requirements you must meet to earn work credits are:

1) You must work

2) You must pay Social Security taxes (often seen as OASDI or FICA on paystubs)

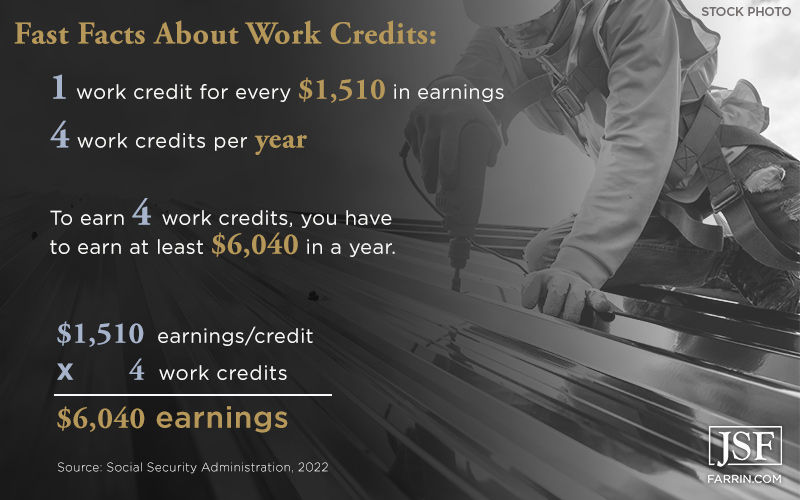

As of 2022, you can receive one credit for every $1,510 in wages or self-employment income, and you can earn up to four credits each year.

How Many Work Credits Do You Need to Get Social Security Disability Benefits?

Generally, you must earn 40 work credits, 20 of which were earned in the last 10 years ending with the year your disability began, to qualify to receive SSD benefits. Your insured status may lapse, or end, after you have not worked (and paid taxes) in the last five years. Younger workers may qualify with fewer credits.

Since you can earn a maximum of 4 work credits a year, it takes a minimum of 10 years to earn 40 credits.

How Do You Prove Your Eligibility for Work Credits?

You do not need to take an extra step to prove to the SSA that you are eligible for work credits because the SSA automatically tracks the work credits of all workers who pay Social Security taxes on their earnings.

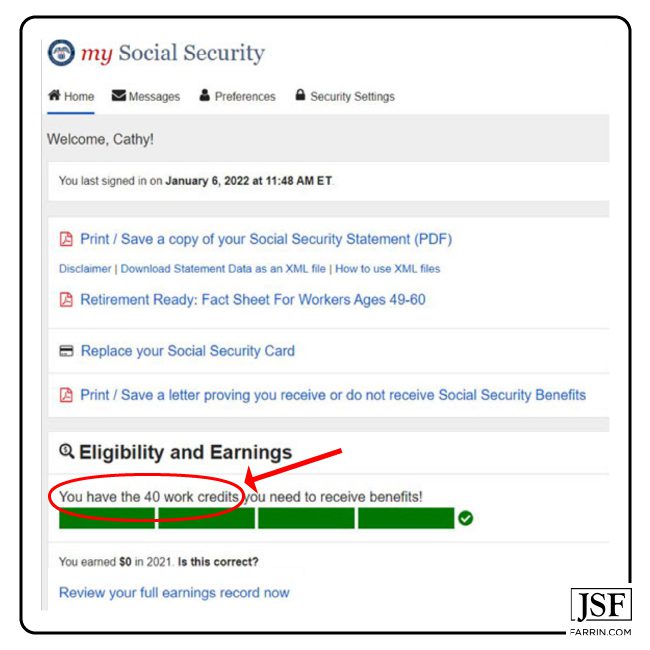

How Do You Find Out How Many Work Credits You Have?

The number of work credits you have earned is listed on your Social Security statement, which can be viewed online. Visit secure.ssa.gov and sign in or create an account by clicking on the “Create an Account” button. The number of credits you have earned is listed under the “Eligibility and Earnings” section of the webpage.

You can also request a written Social Security Statement from the Social Security Administration by filling out a Form SSA-7004 and mailing it to the address on the form. This statement will have information about your Social Security work credits.

What Are My Options if I’m Disabled But Don’t Have Enough Work Credits?

If you are disabled and don’t have enough work credits, you may still be eligible to receive Supplemental Security Income (SSI). SSI is a Disability benefit that provides low-income disabled people with monthly cash benefits to meet their basic needs. You may be eligible for SSI even if you have never worked.

I urge you to talk to a Social Security Disability attorney today to learn more about Social Security work credits and how they apply to your situation. Give us a call at 1-866-900-7078. We are here to help you.

Social Security Disability Work Credits FAQs

How do you calculate work credits for Disability benefits?

The SSA calculates and keeps track of your credits, but, generally, you earn one credit for every $1,510 you earn, and you can earn a maximum of four credits per year.

How does earning credits work for SSDI claims?

When determining your eligibility to claim Social Security Disability Insurance (SSDI) benefits, the SSA looks at how many credits you have earned. In general, you are required to have 40 credits to be considered eligible for SSDI, and half of those (20 credits) should be earned in the last 10 years ending with the year your disability began.

What’s the difference between SSI and SSDI benefits?

In terms of work credits, the difference between Supplemental Security Income and Social Security Disability Insurance benefits is that Supplemental Security Income provides Disability benefits to low-income disabled people who can’t work or haven’t worked long enough to qualify for 40 credits. Social Security Disability Insurance provides benefits to disabled people with enough work history to qualify for 40 credits.

What happens if I don’t get 40 credits for Social Security benefits?

In general, if you haven’t earned 40 credits, you will not be eligible for SSDI benefits but you may be eligible for SSI benefits.

I encourage you to talk to a Social Security Disability attorney to learn more about the differences between SSI and SSDI benefits.

You May Also Be Interested In

I’ve Worked All My Life. Why Aren’t I Eligible for Social Security Disability Benefits?

Does Social Security Disability Count as Income for Unemployment?

Social Security Disability Attorney Rick Fleming Answers Client Concerns