Overtime Pay & Unpaid Wages: How to Know

if an Employer Is Violating Your Rights

You work hard. And while you may enjoy your work, you’re not doing it for fun — you’re doing it so you can make a living and support your family. Both North Carolina and federal employment law provide protection for workers against exploitation or abuse by their employer. The bottom line is this: If you’re putting in extra work but not getting extra pay, it’s time to learn your employment law rights – or contact an employment lawyer.

What Are North Carolina Overtime Rules?

Sometimes, work means putting in overtime. That’s okay – but you should be paid for your extra work. When an hourly employee in North Carolina works more than 40 hours in a week for their employer, he or she is generally entitled to overtime pay for the excess hours.

It seems straightforward, but as always with the law, there are other nuances to consider.

What Do Salary Overtime Laws Say About Exempt Employees?

There are two main categories of workers when it comes to North Carolina overtime rules: exempt and non-exempt. Exempt means there’s an NC labor laws overtime exemption. Said another way, exempt workers are not entitled to overtime pay in NC. Non-exempt employees, on the other hand, are protected by precise overtime rules.

An employee’s status is based heavily on the type of job responsibilities they have. Exempt status often applies to so-called white-collar jobs, such as salaried business managers and teachers. In contrast, “blue-collar” jobs that require manual labor are typically non-exempt jobs, including construction workers, first responders, and others who can often find themselves working past the end of their shifts.

The amount you get paid also factors into your status. The NC overtime law change regarding weekly payment amounts went into effect in 2020. Under this law, even if you do “white-collar” work or get paid on a salary, you must make at least $684 a week before an employer can classify you as exempt from overtime protections.

Check your new hire paperwork to verify your status.

What if I’m Non-Exempt But My Employer Didn’t Pay Me for Overtime?

What do you do if your employer plays games so they don’t have to pay you overtime, like purposely misclassifying you as an exempt employee? Don’t let it slide without a fight because the money adds up and it’s your money. Plus, your employer may owe you double back pay for wage theft.

An attorney can help you try to recoup lost overtime wages. With us, you don’t even have to pay anything up-front. We only collect an attorney’s fee if we get compensation for you.2 If your employer hasn’t paid you the overtime you believe you’re due, get a free case evaluation so we can look into the strength of your claim.

Independent Contractor Status

The most common dispute over employee status is whether someone is an employee or an independent contractor. Sometimes employers categorize employees as independent contractors in order to avoid having to pay overtime. Even if your contract says you are an independent contractor, the law looks at the “economic reality” of your employment relationship.

Some things to consider in determining your status are:

- the degree of control the employer has over your activities

- whether you have invested in your own equipment or whether you use the employer’s equipment

- permanence of the employment relationship

- whether the employer employs other people in the same position but classifies them as employees.

How Do I Calculate Overtime in NC?

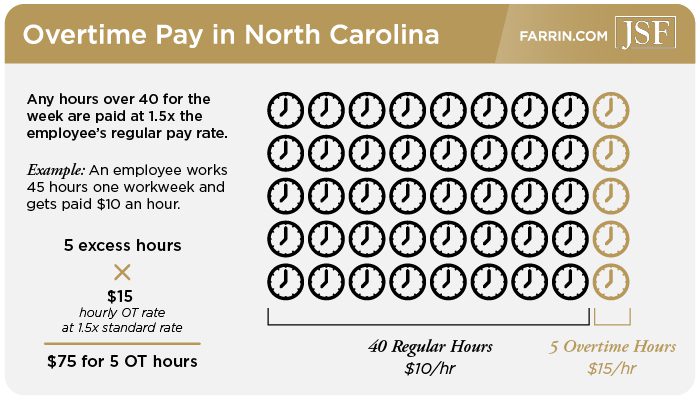

Calculating overtime pay is relatively straightforward. The overtime pay rate is 1.5 times the employee’s regular rate of pay. Said another way, it’s your hourly rate plus half your hourly rate for each overtime hour. But there is an important thing to note before you start crunching the numbers.

Overtime is measured by the week, not the day. Under the Fair Labor Standards Act (FLSA), overtime pay does not kick in until 40 hours has been reached for the week. If an employee works more than eight hours on a given day or works on weekends, those are still regular hours towards the 40-hour weekly count.

Employers must establish a permanent workweek and stick to it. They cannot regularly change the workweek in order to avoid paying overtime. They also cannot average two weeks together. If you work 30 hours one week and 50 hours the next, your employer cannot avoid paying you overtime for week two because they had “leftover” hours for week one. In this scenario, your employer would owe 10 hours of overtime for week two.

A few other important details about overtime in North Carolina to consider:

- You’re still protected by overtime rules even if you get paid a higher standard rate than minimum wage.

- There is no limit under the FLSA to the number of hours an employee can be required to work in a day or week, just a mandatory pay rate for overtime.

- Some seasonal businesses are only required to provide overtime pay for workweek hours in excess of 45.

- For tipped employees, the regular rate for purposes of overtime pay includes the cash wage and tips equal to (at least) the federal minimum wage.

A Note on Minimum Wage

The minimum wage in North Carolina is currently $7.25. That means employers doing business in the state as well as state government employers must pay their employees at least that much. This is also the minimum wage for federal employers under the FLSA.

Sadly, there are many ways employers may try to work around these requirements. For example, your employer may misclassify you as a “tipped” employee, which means your employer can pay you $2.13 an hour instead of $7.25. If the difference is not made up in tips, your employer is likely violating minimum wage laws.

What Does the Law Say About Meals and Breaks?

Meal breaks (30+ minutes) are not required for North Carolina employees who are 16 years old and up. Employers may provide an unpaid meal break — as long as it is actually a break. The employee has to be free to leave or do whatever they want during the meal break. Otherwise, even that meal break must be paid.

Rest breaks (~15 minutes) are also not required for North Carolina employees who are 16 years old and up. However, if an employer provides a rest break or breaks, they must be paid breaks. Your employer can’t generally deduct those small segments of time.

What About Vacation, Sick, Bereavement, or Holiday Leave?

Overtime and break rules come into play while you’re at work. What about those times you don’t want to or can’t be at work? North Carolina law is clear on an employer’s obligations regarding things like vacation and leave. Unfortunately, these obligations — or lack of obligations — heavily favor employers.

Vacation Leave

Employers in North Carolina are not required to provide vacation leave or other vacation benefits to employees. This is true of both paid and unpaid vacation. If an employer does offer vacation benefits, they must outline the terms and abide by them like any other contract. This includes provisions such as how vacation time accrues, if it rolls over from one year to the next, and things of that nature.

Note that accrued leave is not the same as money owed. An employer may deny you compensation for the vacation time you’ve already collected if you don’t use it before leaving the company. Your employer can also impose other restrictions like “use it or lose it,” as long as it is part of their established and previously communicated vacation policy.

Sick Leave

Certain unpaid sick leave is guaranteed for employees in North Carolina under federal protections such as the Family and Medical Leave Act (FMLA). Maternity leave, for example, is covered under the FMLA.

As for paid sick leave, employers are not required to provide it under North Carolina law. However, if they do choose to provide it, they must communicate the relevant rules and stick to them.

Bereavement Leave

Bereavement leave, which is leave taken by an employee upon the death of someone, typically a close relative, is not something employers have to provide their employees in North Carolina. Employers are not required to provide leave for an employee to grieve their loved one or even attend the funeral.

As with all leave policies in North Carolina, the employer must abide by whatever has been agreed to in the employee contract, including any bereavement leave incentives. Check your employee handbook or new hire paperwork to see if your employer has agreed to provide any bereavement leave.

Holiday Leave

In North Carolina, employers can require employees to work holidays, whether religious or federal. In theory, an employee who can’t or won’t meet that requirement is free to find work elsewhere. And, no, your employer is not required to pay you anything more than your standard compensation rate.

If I’m Terminated, What Does the Law Say About Severance Pay?

Sometimes, a job doesn’t work out and you get fired. Severance pay, unless otherwise contracted to, is not required from North Carolina employers upon employee separation. If an employer offers severance pay to you in return for signing a severance agreement, you can try to negotiate the terms of the agreement or even refuse to sign.

If you have any questions about your rights, what you may be entitled to, or what that confusing language in your agreement means, take advantage of our free case evaluation.

What if a Former Employer Blocks Me From Filing Unemployment?

A terminated employee may need to file for unemployment as they search for a new position. When you submit a claim, your former employer is able to review the information you submitted as part of your claim. If they believe that you’re not eligible for unemployment benefits, they may contest your claim.

For example, your employer may say that you were an independent contractor rather than a true employee, causing your claim for unemployment benefits to be denied.

If you are denied, you may appeal to the North Carolina Department of Employment Security (DES). Your denial notification will include instructions for how to appeal. According to the DES, the best and quickest way is to submit your application online. You should also email DES at the email provided so that you have a personal record of sending the appeal.

We urge you to contact an experienced employment law attorney before you file your appeal. Describing something inaccurately can lock you in to an unfavorable record.

After your appeal is processed, the DES will schedule a hearing for you. You want an attorney to represent you at the hearing, not only to argue evidence on your behalf but because your former employer may well be there, too — with their own lawyer. Following your appeal, the Appeals Section of the DES will send all parties a decision in writing.

How Do I File a Claim for Unpaid Wages in NC?

The best way to pursue your claim is often with the assistance of an attorney. An employee may file a wage complaint on their own with the North Carolina Department of Labor’s Wage and Hour Bureau. Bear in mind, however, that the Bureau receives a large number of complaints. Because of this heavy load, the Bureau will not even listen to complaints over wages that should have been paid a year ago or more. Fortunately, the deadline for bringing your own civil claim through an attorney is generally two years from when the wages were due.

These claims can be complicated, the Bureau has a lot on its plate, and your employer may fight back with a team of attorneys in their corner. If you file a complaint with the Wage and Hour Bureau and they are unable to resolve it, you may still be able to pursue legal action on your own. Request a free case evaluation to see if an attorney can help you balance the scales with your employer, wherever you are in the process.

When you hire one of our attorneys to fight for your overtime pay in NC, you pay nothing up front for high-quality legal assistance and you only pay an attorney’s fee if we recover money for you.2

That’s right: there are no up-front costs whatsoever. If your attorney recovers nothing for you, you don’t pay an attorney’s fee. If your attorney is successful, the attorney’s fee is a percentage of what we recover.2 As a result, you can be sure your attorney wants exactly what you want — to recover as much as possible as quickly as possible.

Get an Experienced Lawyer to Take on Employers

Have you been cheated of your overtime pay in NC? Your employer may expect you to just cut your losses and stay silent. Others before you have. But that’s your money. And you should fight for it – before times runs out.

We can fight for you if you’re owed unpaid wages in NC. Our employment law division help victims of abuse fight back. Our team can help you restore the balance of power with your employer.

Since 1997, our firm has helped more than 65,000 people seeking what they’re entitled to under the law. In total, we’ve recovered more than $1.8 billion in much-deserved compensation for our clients.1 Become a member of the James Scott Farrin family and tell them you mean business!

The clock is ticking on figuring out just how you might have been shorted, seeking evidence to support your claim, and bringing your claim before your window closes. For a free case evaluation, call 1-866-900-7078.