People who have been injured will often come to us after they have tried to deal with the insurance companies themselves.

They may be frustrated with the lack of timely response from insurance adjusters. Some tell us the insurance company will not offer them enough to cover their medical expenses and other damages. Sometimes people are simply overwhelmed by the amount of phone calls, paperwork, follow-up, and bureaucracy just to try to get the insurance company to cover damages.

We know how they feel. We have many people here who play paper chase with the insurance companies every day.

There are some statements we often hear from people who call us for help. These are people who have never dealt with insurance adjusters and claims-filing entities. We work with these types every day. (Some of us used to work on the other side!) Here are five statements we hear and the accompanying things the “friendly” insurance adjuster and “good neighbor” insurance company may not want you to know.

1. The Insurance Adjuster Handling My Case Seems Very Nice and Is Even Willing to Settle as Soon as Possible. But the Settlement Amount Is So Low.

You should never rely on the adjuster or the insurance company as your friends. Most insurance companies are in business to make money. The less money the adjuster offers you to pay your damages, the more money insurance companies keep for themselves. Fact is, it is part of an insurance adjuster’s job description to offer you as little as possible. Adjusters may seem pleasant and sympathetic to your circumstances. Perhaps they are. But the bottom line is you are not signing their paychecks.

Adjusters go through intensive training programs to learn the art of negotiation. They can get very detailed, even covering the psychological aspects of negotiating in many instances.

Most insurance companies have auditing systems that show how much their adjusters paid out to claimants, based on the medical reports and what they can mitigate in their claimants’ files. Sometimes the adjuster’s pay can be tied to whether or not they meet the criteria the company has devised as “best practices” for payouts.

2. My Adjuster Said a Lawyer Won’t Do Anything More for Me Other Than Drag My Case on and on.

An insurance company may say that because they do not want you to hire a lawyer. If you hire a lawyer, they know they may potentially have to pay you more money. They know we know information that can help you. Insurance companies may sometimes call us ambulance chasers, sharks, greedy, and all kinds of names to try to prevent you from getting legal advice.

And they are unlikely to want to go to court to try your case in front of a jury. Insurance companies do not like uncertainty. And juries are by their very nature an uncertainty. We will go to court in a heartbeat if we think it will help you get the compensation you may deserve. Is that something the insurance companies want to hear?

3. My Pre-Existing Shoulder Condition Prohibits Them From Paying Me for the Full Extent of My Shoulder, Neck, and Back Injuries.

Ah! The pre-existing condition. That’s an oldie goldie. Some of our employees used to be insurance adjusters. Here’s what one of them had to say about this tactic:

The reality is a pre-existing condition may have no bearing on your new injury at all.

4. My Adjuster Told Me That After I Pay an Attorney’s Fee, I Would Probably Get Less Than Their Offer.

An insurance adjuster might try to get you to buy into all kinds of assumptions. They are highly trained professional negotiators. They might challenge you to take them to court. “You just wait and see,” they might say, acting like they welcome the chance. They might play the “take it or leave it” or “that’s my final offer” card. They might try to confuse you with all kinds of data and analyses and algorithms their statisticians have determined are “reasonable and fair” based on your medical bills and circumstances.

The list of deny and delay tactics is long. Yet it is effective in many instances! We don’t scare. (And we understand their algorithms.) If it’s in your best interest, we don’t back down.

5. The Insurance Company Said to Go Ahead and Take Them to Court. Facts Are Facts, and in My Case, the Facts Are Against Me.

Court is expensive. That is among the main reasons insurance companies typically want to settle your case quickly. Yet they may not let on that they would rather settle than go to court in most cases. Even so, they may still discount the amount they potentially owe you for damages. They may be assuming that you have no idea what you are potentially owed. They may try to make you believe they can only compensate you for medical expenses and not other damages, which may include the following:

- mileage to and from your medical appointments

- lost time from work

- prescriptions

- loss of the use of your vehicle

- and sometimes pain and suffering

You aren’t likely to hear those options voluntarily from the adjuster. But you will from us. And then some.

How Can You Scare a Car Insurance Adjuster Towards a Fair Settlement?

The most effective way is to hire an experienced personal injury lawyer. Consider a lawyer who works for a firm that:

- Has employees who have worked for insurance companies

- Has the resources, knowledge, and staff to deal with delay and deny tactics

- Has attorneys who are ready, willing, and able to fight for you in court

- Has a track record of successfully helping clients fight for their rights1

- Works on a contingency fee basis and doesn’t charge you upfront costs2

- Doesn’t get paid an attorney’s fee unless you get compensation2

- Won’t back down

In other words, give us a call.

We have been helping car accident victims fight for fair compensation for more than 25 years. In fact, we have helped 65,000+ people recover more than $1.8 billion in total compensation since we opened our doors in 1997.1

If you’re wondering “How can I scare an insurance adjuster into giving my case the time and attention it deserves?” here are just a few of the things we’ve learned over the years:

Turning the Tables by Taking Back Control

Insurance policies are complicated. Adjusters are trained in the intricate details of what makes up each policy, which can give them an advantage. While this is hopefully the only time you have to deal with this situation in your life, adjusters deal with cases every day.

With the scales tilted in their favor, some adjusters may propose settlements or agreements that might seem fair but are, in fact, heavily weighted in favor of their employer, the insurance company. Having an experienced car accident attorney at your side can help you take back control of your case.

Here are some of the ways we show the insurance company you mean business:

- Try to Use Timing to Our AdvantageMost adjusters want to resolve your case as quickly as possible. If they don’t agree to pay future medical costs and you don’t know to ask for them, they can potentially avoid responsibility for some of your medical bills and expenses.Settlements are generally binding whether they are made two days after your accident or two months. By waiting, you try to ensure that the entirety of your ordeal is taken into consideration.If you enter into an unfair agreement early on in your case, the adjuster can move on to their next claim while you might be left holding the bag.

- Not Giving InIf the initial offer is an unfair lowball offer, we will not accept it (unless you tell us to). Instead, we will let the insurance company know in writing that the offer is unacceptable, and we will outline why. It’s hard to argue with facts, and we can make a facts-and-evidence-based case that you may deserve significantly more compensation.We don’t quit when the going gets tough. Check out our page of client results and testimonial stories, including many accounts of our attorneys not backing down and fighting for our clients’ rights. We put you and your needs first every step of the way.

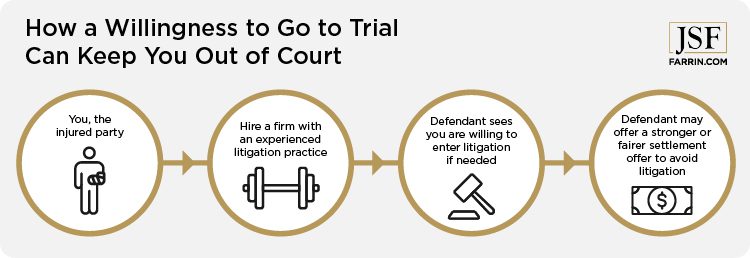

- Leveraging the Threat of Our Trial TeamWe let the insurance company know that we are willing to take your case to court, if needed. We have an experienced, award-winning trial team, and we are not afraid to litigate your case. And that can make claims adjusters very nervous!Hiring a firm that has an experienced litigation team means that your attorney may have multiple options at their disposal when working with you on a strategy for your case – we won’t settle if it’s not in your best interest.

Insurance Companies Keep Millions by Limiting Payouts

The bottom line is that many insurance companies are all about their bottom line. They hold millions, and in some cases billions, of dollars in reserves and earn interest and dividends on these assets. Many also have shareholders to answer to – large major shareholders like investment banks and mutual fund firms. Shareholders like to keep investing in profitable companies.

Sadly, it boils down to this. The insurance company is taking care of the shareholder and investor. The adjuster is taking care of the insurance company who gives them a consistent paycheck. Who is taking care of you?

You need to take care of you. We can help. Make sure you take care of your interests by consulting with an experienced personal injury attorney who knows how to deal with these issues.

Why Choose James Scott Farrin for Personal Injury, Workers’ Comp, or Social Security Disability Claims?

It starts with great people. We have over 60 accomplished attorneys, many of whom have won awards for their service and advocacy inside and outside the courtroom, including Best Lawyers “Best Lawyers in America,” 2021 list,4 “Lawyer of the Year” from Best Lawyers for 2017,4 “Super Lawyer” 20214 list by Super Lawyers, and Business North Carolina’s “Legal Elite” list for 2021.4

They’ve authored books, spoken at seminars for other attorneys, and some are sought by the media for their legal expertise. All are advocates dedicated to fighting tooth and nail for each and every client.

We’ve gone to great lengths to help make sure we know how the “other side” operates by hiring attorneys who’ve represented insurance companies and large major corporations.

We also have attorneys who are bilingual (as are many of our paralegals and staff).

Experienced Accident Attorneys Evaluate Your Case FREE

If you’re getting the run-around from your insurance adjuster or feel your best interests are not being considered, contact us or call 1-866-900-7078.

You May Also Be Interested In

5 Things You Should Not Say to a Car Insurance Adjuster

Car Insurance Myths and Facts (and Recommendations From a Former Claims Adjuster)

Confessions of a Former Insurance Adjuster: The Push for Lower Payouts?

Three Important Reasons Why to Hire a Personal Injury Attorney