Some insurance companies may look for ways to stop sending you a weekly check while you’re recovering from your on-the-job injury. They’re in business to make money, not give it away.

When you receive workers’ compensation benefits, that is usually money coming out of the insurance company’s pocket and going into yours instead. That’s why some insurance companies may try to find ways to avoid paying you benefits. Sometimes, that means an insurance company may completely deny responsibility to pay for your injury. When this happens, they pay you no benefits at all, while you fight (sometimes for years) for what you potentially deserve.

Worker’s Comp Insurance Tactics to Pay You Less

Delay

We have seen some insurance companies try to wait out the injured worker while they’re hurt, out of work, and in financial distress. The longer they wait, the more urgent your need for money becomes, and the less compensation you may be likely to settle for. And that means less money they have to pay out.

Deny

Delaying compensation is not the only way some insurance companies may try to help themselves. Even when an insurance company accepts responsibility for your work injury, they can – at any time – try to reduce or even stop paying you benefits. We have seen them try to cut off injured workers’ weekly checks. Other times they may try to avoid paying for a recommended medical procedure.

No matter how some insurance companies may try to keep money for themselves, it is you, the injured worker, who is simply trying to get better and go back to work, that can end up paying the price.

Surveillance

Do insurance companies randomly decide one day that they are not going to pay you? Of course not. They must have proof that they don’t have to pay you. To help them in their efforts, they may try to piece together evidence to prove your benefits should be decreased or stopped altogether.

We have seen some insurance companies resort to hiring a private investigator to spy on injured workers to try to gain the evidence they need to reduce or stop workers’ comp payments.

They may hire investigators to follow you to the gas station, or the grocery store, or any errand you may be on. They may watch you pick up your kids at school. They may stake out your house and neighborhood at all hours of the day and night. These are just the obvious workers’ comp private investigator tactics.

The goal is to compile reports, photographs, and video to see if you are as badly injured as you claim. Then, if the insurance company can create a question in the mind of a doctor or judge, they may be able to cut you off or reduce your benefits – even if they have previously admitted responsibility for your injury.

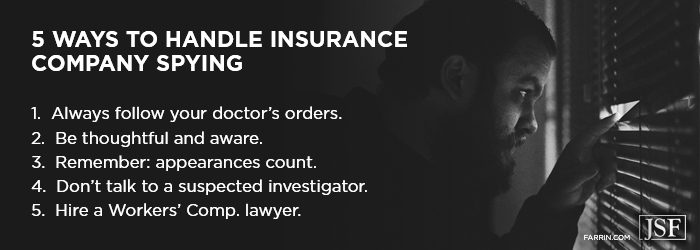

5 Ways to Handle Insurance Company Spying

You cannot stop the insurance company from hiring an investigator to watch you. But you can be smart about your behavior so that you aren’t making it easy for them to avoid paying you benefits. Here are five ways to help you avoid falling prey to workers’ comp surveillance.

1. Always Follow Your Doctor’s Orders.

Your doctor knows best what activities you should avoid while you heal. If the doctor tells you not to lift more than 10 pounds, don’t lift more than 10 pounds. The biggest risk of surveillance is that the workers’ comp private investigator will see you doing something outside the restrictions put on you by the doctor.

If that happens and the doctor is allowed to see the surveillance, the doctor may think you have been exaggerating your symptoms. In a worst-case scenario, the doctor may decide to no longer treat you.

2. Be Thoughtful.

If you aren’t following your doctor’s orders about activity restriction, it may not necessarily be because you are not injured. More likely it might be because you weren’t thinking about what you were doing, or you were in a hurry or distracted. Life happens, and you have to lift your 20-lb toddler out of her car seat. That happens to all of us.

But when you have a work injury, and an insurance company may be paying someone to watch you, the cost of being thoughtless can be significant. Violating your doctor’s restrictions just a handful of times could suggest to the insurance company and the doctor that you’re not as injured as you claim to be.

Also, mind what you post on social media. Even if there is not an investigator directly watching you, they could find photos or posts on Facebook, Twitter, Instagram, or some other social medium that do their work for them. If you’re not thoughtful, they may use your posts against you.

3. Remember That Appearances Count.

Sometimes, insurance company surveillance can be harmful even when you are not caught doing something against your doctor’s orders. Even simple appearances can be enough to cause problems. For example, let’s say your doctor told you not to push more than 10 pounds. And let’s say you’re mowing your lawn with a self-propelled lawnmower that doesn’t require pushing more than 10 pounds. And let’s further say there’s an investigator recording you.

All the doctor may see when he watches this video is someone who is well enough to do yard work, including pushing a potentially heavy lawnmower. You can explain to the doctor that the mower is self-propelled, but the damage may already be done. We are not suggesting you become paranoid, but it is important to be aware of how your activity may look to an outsider.

4. Don’t Talk to a Suspected Investigator.

Workers’ comp private investigators are likely to be very discreet, and you may never know you’re being watched – as long as that works in their favor. However, if they deem it necessary, they may approach family members or friends, and interact with them to try and get them talking.

If you think you’ve spotted an investigator who is watching you, don’t confront them or interact with them. This goes for you, your family, and your friends. The investigator will not be intimidated, and will only use the interaction to gather information from you that the insurance company may later try to use against you.

5. Hire a Workers’ Compensation Lawyer.

When you try to take on the insurance company yourself, it is not a fair fight. History tells us that many insurance companies may try to figure out ways to maximize their profits and minimize your compensation. Surveillance is just one tactic they sometimes rely on. They have adjusters and lawyers, many of whom spend their time trying to determine the best ways to reduce their payout.

Get Your Free Case Evaluation From Workers’ Comp Lawyers

To try to make sure the insurance companies do not use surveillance or any other tactic to deny you benefits, call the Law offices of James Scott Farrin. Our workers’ comp attorneys have the knowledge, experience, and dedication needed to try to see to it that the insurance company doesn’t get away with claiming your injuries are less disabling than they really are. Contact us today or call 1-866-900-7078. Your initial case evaluation is absolutely free.

You May Also Be Interested In

Can I Go to the Gym While on Workers’ Comp?

Is the Insurance Company Using a Workers’ Comp Nurse to Watch Over Me?