I get it. You were hurt at work but relieved when your employer told you, “Don’t worry, we’ve got workers’ compensation insurance and that’ll take care of you.” You may have been pretty surprised, then, to discover that your weekly lost wage benefits are a third less than what you normally make in a week. Is that really “taking care of you?”

Workers’ comp is a support system that provides cash (wage loss benefits) and medical care (medical benefits) for eligible sick or injured employees while they are recovering from their work-related injuries or occupational diseases. As a workers’ comp attorney, I work with clients all the time who need help navigating the workers’ comp system, the filing process, and the different types of benefits.

In this article, I will address some of the most common questions I hear. And yes, you guessed it, one of the top ones is, “Why does workers’ comp only pay 2/3?” Here’s the quick answer:

But that’s not the end of the discussion. The workers’ compensation system is complicated, and many injured employees can feel overwhelmed and unsure about whether they are receiving the full benefits they may be entitled to.

How Are Lost Wages Calculated?

This cash benefit portion of workers’ comp benefits is called lost wages, lost time benefits, wage replacement benefits, temporary disability (TD), or temporary total disability (TTD), and the basic formula for it is:

North Carolina and South Carolina each have specific formulas for calculating an employee’s average weekly wages (AWW) based on length, timing, and conditions of employment. A workers’ comp attorney can help you determine if the insurance company has chosen the correct formula for calculating your AWW.

North Carolina and South Carolina each set a maximum weekly compensation rate that the weekly wage replacement benefits of an injured worker cannot exceed, and this information will be listed on the state Workers’ Compensation Commission website.

Note: If you are able to return to work but are earning less than before your injury or illness, you may be eligible for another type of lost wages called temporary partial disability (TPD). These benefits equal two-thirds of the difference between your before-the-injury wages and your after-the-injury wages.

Now, let’s tackle the specific question of “why does workers’ comp only pay 2/3?”

Why Are My Lost Wages Only 2/3 of My Normal Pay?

I mentioned this earlier, but let’s expand on it a bit.

Workers’ comp benefits are not taxed, and 2/3 of your average weekly wage is approximately what you would have been taking home, after taxes, before you were injured.

If, instead, you were provided the same average weekly wage as before you were hurt, you’d actually be taking home more pay after your injury because no taxes are being deducted.

What if the Insurance Company Calculated My Wages Wrong?

Because the main component of the lost wages formula above is how much you earned in an average week before you got hurt (your average weekly wage), I urge you to consult with an experienced workers’ compensation attorney to ensure that the insurance company chose the appropriate method to calculate this amount.

It is not uncommon for an insurance company to miscalculate the amount of your weekly checks. For example, I had a client who was receiving more than $200 less per week than he should have been receiving. After the client hired us, we identified the error and convinced the insurance company to correct the amount of the weekly checks and issue a lump-sum payment for the back-due underpayment.1

Remember, most insurance companies are for-profit, which means they make more by paying you less.

Is 2/3 of my normal pay enough?

Hopefully, 2/3 of your average weekly wage is enough to get you through this time when you are not able to work – especially since workers’ comp disability also generally pays for the medical care prescribed by your workers’ comp doctor.

When Do I Become Eligible for Lost Wage Compensation?

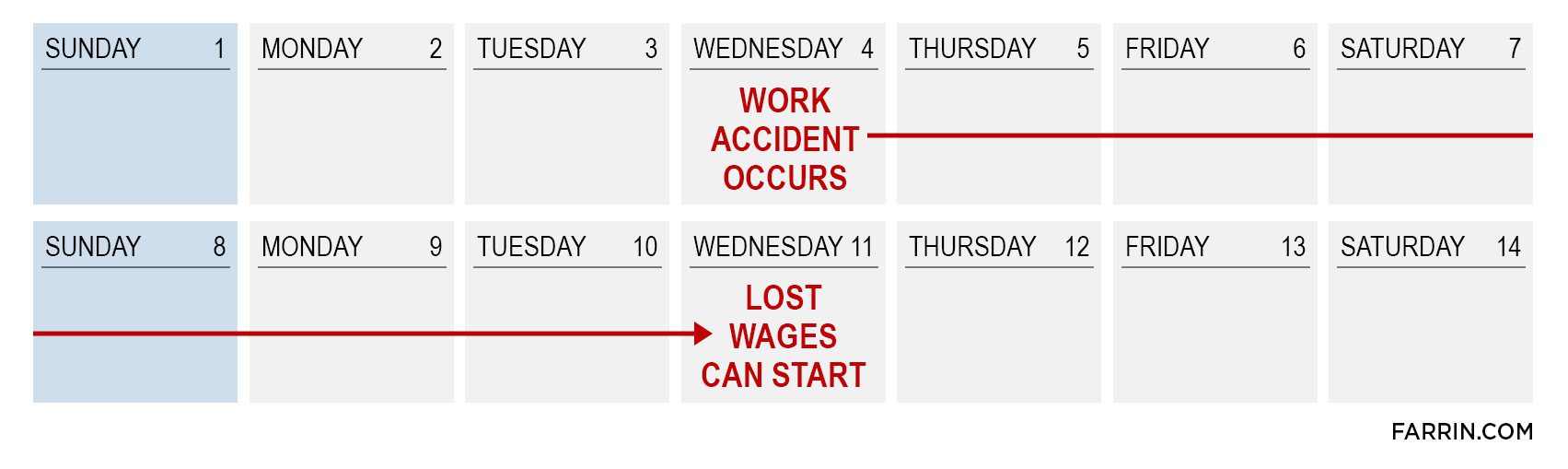

You become eligible for lost wages after having an illness or injury for seven days. These seven days don’t have to be consecutive, and if you miss any part of a day of work because of your disability, that generally counts towards the seven-day period.

If your eligible illness or disability exceeds 21 days in North Carolina or 14 days in South Carolina, payment for those first seven days will be made in a later check.

How Long Will I Receive Lost Wage Benefits?

Generally, you will receive lost wage benefits until you are able to return to work. However, some states set a cap on this time. For example, in North Carolina and South Carolina, there is a maximum limit of 500 weeks for most injured workers to receive TTD lost wage replacement.

I urge you to remember that having a right to workers’ comp benefits does not necessarily mean that you will get these benefits. You may need to fight to receive them – and keep them coming.

What Other Benefits Do I Get Besides Lost Wages?

Wage replacements benefits are just one of the types of workers’ comp benefits that you may receive after getting hurt or sick on the job. The workers’ compensation system is designed to also provide medical care to injured or ill workers.

If your workers’ compensation claim is approved, benefits will usually include full coverage of medical expenses, such as:

- medical devices

- prescriptions

- surgery

- pain management

- hospitalization

- physical therapy

- chiropractor visits

- prosthetic devices

Workers’ comp may even reimburse you for your mileage to and from medical treatment and vocational rehabilitation (training so you can do new types of work).

We Have the Experience and Skill to Help You Seek Maximum Workers’ Comp Benefits

At the Law Offices of James Scott Farrin, we have workers’ comp attorneys who have worked for insurance companies in the past and have chosen to now use this inside knowledge to represent injured workers and help them with their workers’ compensation claims.

We put our clients first every step of the way. And because we work on a contingency fee basis, you won’t have to pay any attorney’s fee unless we recover for you.2

If you think you’re not getting all the benefits to which you may be entitled, we can help. For a free case evaluation, contact us online or give us a call today at 1-866-900-7078.