Hit-and-run drivers are everywhere. If you’ve had your car mysteriously dinged in a parking lot, you know how annoying it is. But there are much more sinister hit-and-run cases where drivers cause injury and flee the accident scene. According to data from 2021, a hit-and-run accident happens every 43 seconds.

What happens if you’re hurt by a hit-and-run driver? Who pays for your injury? How can you seek compensation? As an experienced car accident attorney, here’s what I can tell you.

Uninsured motorist coverage can be the answer, but getting the insurance company to pay can often be a difficult process.

What Insurance Can Cover You Against Hit-and-Run Drivers?

When a hit-and-run driver causes an accident, there can be two kinds of damage: property damage and bodily injury. The driver who can’t navigate a parking lot correctly, dings a car, and leaves the scene without saying anything thankfully only does property damage. If a driver strikes a car filled with passengers or a pedestrian and flees, this often involves bodily injury, sometimes catastrophic.

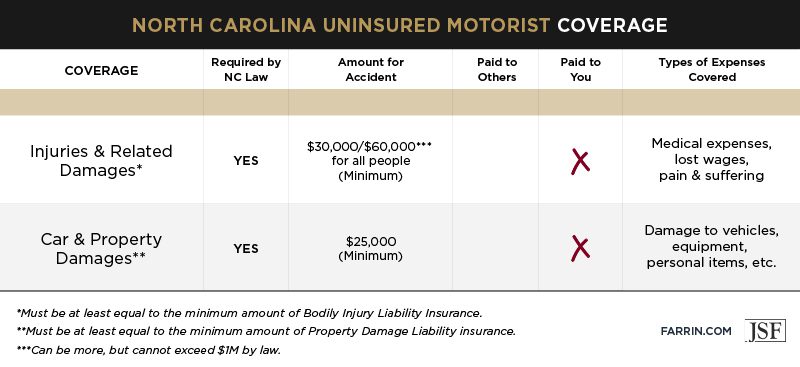

Uninsured motorist coverage is a required part of car insurance in most states, North and South Carolina included. It’s part of your policy, even if you have the minimum required insurance coverage.

FAST FACT: According to a AAA study, drivers who flee the scene of an accident are 9x more likely to be under the influence.

What Does Uninsured Motorist Coverage Pay For?

Uninsured motorist coverage can pay for:

- Bodily injury: Uninsured motorist coverage includes bodily injury coverage. The amount of coverage that may be available depends on your policy.

- Property damage: Uninsured motorist coverage includes coverage for damage to property such as your car and personal belongings. Your policy determines the amount of coverage that may be available.

You and your attorney can review your policy for the specifics regarding how much coverage you may have available. Don’t get frustrated if the insurance company denies your claim. Call an attorney instead. Remember, most insurance companies make more by paying out less for claims, even hit-and-run claims.

For a free professional opinion on your case, call 1-866-900-7078 now, or submit your online form.

What if I Am a Pedestrian Injured by a Hit-and-Run Driver?

Believe it or not, your automobile coverage may have your back here. Uninsured motorist coverage can also cover you as a pedestrian if an uninsured or hit-and-run driver hits you. Other coverage may also be available, and an experienced car accident attorney can help you seek out those policies and fight for maximum compensation.

FAST FACT: According to AAA, about 65% of fatalities from hit-and-run drivers are pedestrians and cyclists.

Are There Limits to Uninsured Motorist Coverage?

With an insurance policy, there are two limits. The hard limit is the policy limit – every policy has a maximum amount it will compensate. For example, if you hear that someone has “50/100” coverage, it likely refers to $50,000 per person and $100,000 per accident in bodily injury coverage.

There’s also a soft limit – how much the insurance company will offer or agree to pay. For example, just because the maximum insurance coverage is $100,000 does not mean the insurance company will happily cut a check for that amount. Most make more money by paying as little as possible. Even your own insurance company is protecting their interests, not yours.

Before you agree to anything, consult a personal injury attorney for a free case evaluation. Accepting a lowball offer or cashing a check you got in the mail may end your compensation claim when the bills are just beginning.

FAST FACT: Studies estimate that only about 10% of hit-and-run cases get solved. In 2017, one police department reported solving just 8% of these cases.

How Your Attorney Fights for You

You’re required to carry uninsured motorist coverage just in case a hit-and-run driver runs into you. That’s what it’s for, so don’t be afraid to use it. And don’t be surprised if the insurance company denies, delays, or offers too little.

We recommend that you hire a lawyer to help you accurately value your hit-and-run injury case and fight for all the compensation you may deserve. But that’s just the start of what your attorney can do for you:

Free Professional Opinion on Your Case

Since 1997, the Law Offices of James Scott Farrin has helped recover more than $2 billion in total compensation for 73,000+ people. And counting.1

We will take your case only if we think we can get you a better result than you would get without us. Our You-First Policy means we always act in your best interests. But don’t take our word for it:

Contact us online or call 1-866-900-7078 today for a free case evaluation!