Injured workers who face that growing pile of bills need benefits – as many benefits as possible. People in this situation often wonder, “Can you collect Social Security Disability and workers’ compensation at the same time?”

The answer is yes, but there are some things you should know first.

Workers’ Compensation and Social Security Disability Benefits Defined

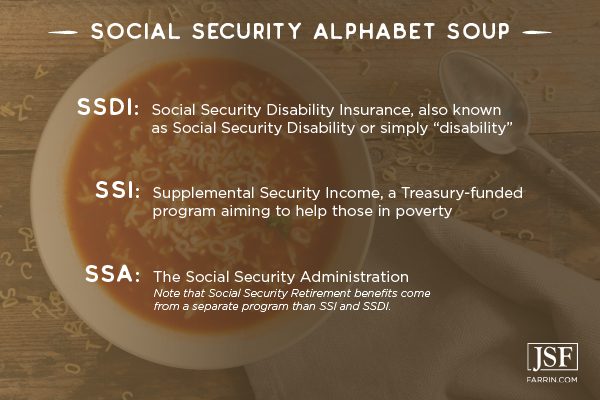

To try to collect workers’ compensation and Social Security Disability (SSD) at the same time, it’s important to understand where each type of benefit comes from and what they cover:

Workers’ Compensation Benefits: Most employees are entitled to benefits for their work injuries. Workers’ compensation benefits come from a private insurance policy paid for by your employer.

To seek benefits, you must make a claim with the insurance company. Major benefits include medical treatment and wage loss replacement.

Social Security Disability Benefits: Social Security Disability is a federal program, a government-backed insurance “policy” that you have been paying for if you’ve been working and paying into Social Security for long enough.

To seek benefits, you must make a claim with the Social Security Administration. The amount of possible financial assistance varies depending on how long you’ve worked and what other benefits you may be getting.

How to Qualify for Workers’ Compensation and Social Security Disability Benefits

You’ll need to make claims for both, and how you qualify for benefits is entirely different under each program.

Qualifying for Workers’ Compensation

If you are an eligible employee of a qualifying employer injured at work, you’re generally entitled to workers’ compensation benefits regardless of fault.

Let’s break down the “lawyer” words in there:

- Eligible employee: First of all, you generally have to be an employee, and not an independent contractor. Note that some government and union job employees have their own system separate from workers’ compensation.

- Qualifying employer: In North Carolina, if your employer has three or more employees, they are generally required by law to carry workers’ compensation insurance. In South Carolina, it’s four employees.

- Injured at work: The law here can be tricky and every detail matters, so you want to have your case evaluated for free by an experienced workers’ compensation attorney.

- Regardless of fault: Workers’ compensation is a no-fault system. Whether the accident was your fault, a coworker’s fault, or even your employer’s fault, the law doesn’t generally care.

Qualifying for Social Security Disability

Eligibility for Disability depends on how much you worked, what you made, and how long it’s been since you last worked. You also need a doctor to say you’ll be completely unable to work doing anything for at least one year.

Note: You’re more likely to be approved if you’re more than 50 years old.

It would be a good idea to consult a dedicated Social Security Disability attorney if you have questions about applying or qualifying for these benefits. An attorney may be able to help you avoid denials and obtain benefits faster.

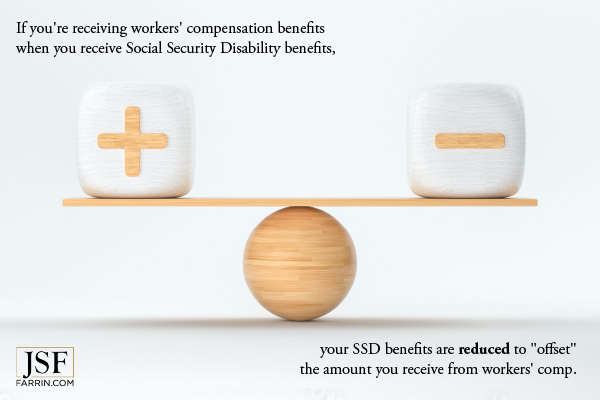

The Offset: The Catch to Receiving Both Workers’ Comp and SSD

Collecting workers’ compensation along with Social Security Disability insurance benefits has a catch: the offset. It’s also sometimes referred to as the “reverse offset.”

The rules governing Social Security Disability benefits, workers’ compensation laws, and the offset can be very complicated. The calculations can differ a lot from worker to worker. To explain the offset, here’s a simple example.

The Offset in Simple Math

Let’s say you earn an average of $1,000 each week when you’re working normally. After a disabling injury at work, you claim workers’ compensation and apply for Disability benefits as well. Both are granted.

The workers’ compensation wage replacement benefit is 66 2/3% of your average weekly wage of $1,000. That means workers’ compensation is paying you about $667 a week.

SSDI benefits pay you according to a set of formulas chosen by the federal government based on your average monthly wage, work credits, and so on. To estimate your potential SSDI, use the online Social Security detailed calculator.

For this example, let’s say your Disability benefits come to $300 a week. So it may seem as if you’re entitled to $967 a week in benefits between the two programs ($667 + $300).

No matter what your calculated benefit might be, the offset limits your total combined compensation from both programs to 80% of what you were earning. For our example, that means you could get an additional $133 per week from Disability to go with the $667 you’re getting from worker’ comp, for a total of $800 a week – or 80% of your average weekly wage.

Note: Your combined payments between the two programs will never be less than the amount of total Social Security Disability benefits you were awarded on its own.

Consult a Workers’ Compensation or Social Security Disability Attorney – or Both

Obtaining combined benefits from workers’ comp and SSD is possible, but the two programs are very different in what they offer and how they work. Disabled workers face a double dose of paperwork, phone calls, forms, and deadlines to try to get their claim approved (for workers’ comp) and clear the barriers to qualify (for SSD).

It is easy to damage your workers’ comp claim by making a simple mistake. Likewise, most initial SSD applications are denied. Fortunately, one of our experienced attorneys can guide you at every step and increase your odds of success.

For 2023, our law firm was named to the U.S. News – Best Lawyers “Best Law Firms” list for the 8th consecutive year. We were awarded the highest ranking (Tier 1) for Workers’ Compensation Law – Claimants.3

Our Social Security Disability department is led by Rick Fleming, President-elect for the National Organization of Social Security Claimants’ Representatives (NOSSCR) and a rare North Carolina State Bar Board Specialist in Social Security Disability law.

If you’ve suffered a disabling workplace injury, we can give you clarity on your situation with a free case evaluation. Call 1-866-900-7078 or contact us online now.