Back injuries are often very painful, disruptive, and even disabling – sometimes permanently. If you injured your back at work, you may be entitled to workers’ compensation benefits and a final lump sum settlement.

The problem is that your employer and their insurance carrier are not on your side. If you’re dealing with a debilitating back injury, especially a very serious one like a spinal cord injury, you shouldn’t also have to worry about trying to get everything you may be owed.

So what benefits are you entitled to? And how much compensation can you expect to receive from a workers’ compensation settlement for your back injury?

While benefits are fairly straightforward to describe (though not necessarily easy to get), answering what you can expect from a back injury settlement is harder than it may seem. I’ll draw on my years of experience as a workers’ compensation attorney to show you why and help you understand what might be factored into your potential back injury settlement amount.

The Three Types of Benefits That Affect a Workers’ Comp Settlement

Workers’ comp benefits come in the form of medical care, wage loss replacement, and impairment ratings. Once you reach maximum medical improvement (MMI), you and your attorney may turn your attention to reaching a final back injury settlement with your employer’s workers’ comp insurance provider.

Let’s discuss the three forms of workers’ compensation benefits first:

- Medical care benefits: these cover all the medical bills for your back injury. This includes authorized medical treatment such as:

- Surgery

- Hospitalization

- Physical therapy

- Medication

- Wage loss replacement benefits: these help to make up for your lost wages from not being able to work.

- Impairment rating: Once you reach MMI, your authorized treating physician may assign an impairment rating to the injured body part.

In North Carolina and South Carolina, an impairment rating to the back is worth a percentage of 300 weeks of benefits. So, a 5% rating would be worth 15 weeks of benefits, and a 15% rating would be worth 45 weeks of benefits.

How Much You Can Receive in Workers’ Comp Benefits

The amount of your medical care benefits depends on what treatments your doctor recommends to help you heal. Broadly speaking, the insurer’s medical provider recommends and provides treatment and the insurance company pays for it.

What about your wage loss benefits? The amount you can receive in wage loss benefits is two-thirds of your Average Weekly Wage (AWW) based on the period of 52 weeks prior to your injury. For example, if you made $60,000 annually, your AWW would be about $1,153 and your wage loss benefit amount would be about $769.

Seems pretty straightforward so far, but where it becomes less clear is the length of time you can receive wage loss replacement benefits. How long you can receive wage loss benefits depends on the work restrictions assigned by your doctor and whether work is available within those restrictions.

Once the full extent of your injury and how it will impact your productivity are clear, you and your attorney can consider all the factors that may impact your possible final settlement amount.

Why It’s So Hard to Know the Average Workers’ Comp Back Injury Settlement Amount

When you reach MMI, your doctor will assign you an impairment rating of 0-100 to reflect any permanent disability you may have from your back injury. Less disruptive permanent disabilities would result in lower impairment ratings, while more serious disabilities, such as those often resulting from spinal cord injuries, could result in higher ratings.

The fact is that you won’t know your rating and permanent work restrictions until after you’re done healing, and what you can’t do will factor into what you should seek in settlement negotiations.

How another person healed after a similar injury, or what settlement a coworker might have received after their back injury may or may not look anything like your situation. Your particular job, your particular healing process, and the particular harms and losses you suffered can all factor into what a fair final settlement should look like for you.

It’s also important to note that workers’ compensation settlements occur when all parties reach an agreement as to what the amount should be. There’s no judge or jury to objectively determine the amount – the parties must come to an agreement for a settlement to occur.

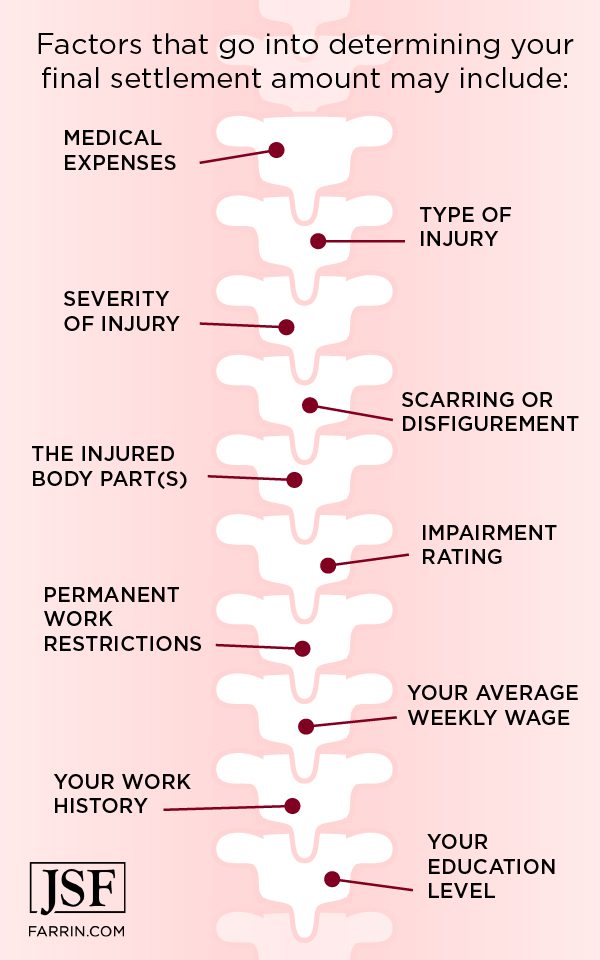

Factors that go into determining your final settlement amount may include:

- Medical expenses

- Type of injury

- Severity of injury

- Scarring or disfigurement

- The injured body part(s)

- Impairment rating

- Permanent work restrictions

- Your average weekly wage

- Your work history

- Your education level

Note: Unfortunately, workers’ compensation laws do not allow for pain and suffering damages to be covered by workers’ compensation settlements.

Workers’ Comp Settlements: An Example

To give this some real-world perspective, let’s imagine the following scenario1:

Gene is a construction worker who hurt his back one day while on site; he makes $60,000 per year. He applies for and receives workers’ compensation benefits while being treated for his symptoms. While he is out of work due to his injury, he is paid benefits of $769.62 (2/3 of his average weekly wage of $1,153.85).

After completing treatment, he learns he has permanent work restrictions that prevent him from going back to his job, and the doctor assigns his back an impairment rating of 20%. He’ll need 10 sessions of physical therapy as well as ongoing cortisone shots at the hospital for chronic pain.

After Gene discusses the situation with his attorney, they decide to settle his claim for a lump sum based on his injuries:

-

- Value of the impairment rating (20% of 300 weeks = 60 weeks of benefits, at a rate of $769.62, which equates to $46,177.20) – Note: if future lost wages are anticipated to be higher than that, Gene’s settlement would factor in that higher number, instead.

- Future Lost wages – an estimate of how long the insurance company may have to continue to pay Gene benefits before he finds a new job within his restrictions. This can vary based on factors other than work restrictions, including work history, education, geographic location, and age.

In this case, Gene’s attorney estimates two years of checks before Gene finds another job. This would equate to $80,040.48. As this is higher than the value of the impairment rating, it would cancel out the value of the impairment rating rather than add to it.

- Future Medical treatment – anticipating that Gene will require ongoing physical therapy and periodic cortisone injections, Gene’s attorney estimates future costs of $10,000.

Gene’s estimated total workers’ comp settlement value is $90,040.481

As you can see, the factors that go into determining each individual settlement amount can vary significantly. One example of an average settlement amount that I’ve seen thrown around a lot online is close to $20,000 per case, give or take a few thousand dollars. Another number I’ve seen is nearly $40,000, referring to data from the National Safety Council.

None of this information is necessarily wrong or inaccurate per se, but you should view it with at least some skepticism in terms of how it applies to your unique situation. Every back injury case is different and so is every back injury settlement.

Pitfalls That Can Prevent a Maximum Settlement

There are several pitfalls that may prevent you from achieving maximum compensation for your settlement.

Settlement pitfalls can include:

-

- Not completing your medical treatment

It’s crucial to complete your treatment and follow your doctor’s recommendations to recover from your injury as much as possible. This gives you the best chance to heal while also getting you to the point in your care (MMI) where you may receive an impairment rating and permanent work restrictions, if your injury is severe enough.

Failing to complete medical treatment could also be a reason the insurance company uses to reduce your claim.

- Not completing your medical treatment

-

- Not keeping track of your medical records

Establishing a paper trail to demonstrate your past, current, and ongoing medical needs from your work-related injury is important to helping you seek maximum compensation. Organize all your outstanding medical bills and records so you can show what medical benefits you need covered in your possible settlement.

- Not keeping track of your medical records

-

- Not being strategic about requesting a second opinion on your impairment rating

Doctors are only human – their opinions can vary greatly and sometimes they make mistakes. In addition, some doctors may be biased in favor of the insurance company that sends patients his or her way. The insurance company’s doctor may clear you to return to work too soon or give you an impairment rating you disagree with.

In this case, you may be able to request a second opinion from another doctor. This is a complicated decision, so consult with a workers’ compensation attorney before acting. If you do seek a second opinion, one key strategic consideration is which doctor to see. Your attorney may be able to help you identify a doctor who’ll provide an expert second opinion.

- Not being strategic about requesting a second opinion on your impairment rating

-

- Talking to the insurance company unprepared

By now, you’ve probably given a statement to the insurance adjuster about the work-related incident in which you were injured, or you’ve hired an attorney to deal with them for you.

- Talking to the insurance company unprepared

In either case, at this point, you still run the risk of having any settlement reduced if you communicate with the insurance company and they use what you say against you. Even if you answer a simple question from an adjuster like “How are you doing?” by saying “Fine,” they could use it against you!

Remember: the insurance company is likely looking for any opportunity to reduce your settlement amount. Fight back! A workers’ compensation attorney can communicate with your employers’ insurance company on your behalf and try to ensure that you don’t say anything they’ll use to reduce your settlement.

- Rushing to accept a settlement offer

It can be tempting to accept the insurance company’s initial offer to settle your claim, but you can and should push back if their offer doesn’t give you the full amount to which you may be entitled. Again, most insurance companies are trying to minimize their payout, and if they can get you to quickly accept a lowball offer, they will.

Beware! Once your claim is settled and approved, it almost certainly cannot be reopened even if your settlement amount turns out to be inadequate. For example, there may be medical expenses you didn’t anticipate. An experienced workers’ compensation attorney fights for everything you may deserve, now and in the future.

Our Workers’ Compensation Team Can Help With Your Back Injury Settlement

The workers’ compensation team at James Scott Farrin features several attorneys with prior experience working for insurance companies. We draw on this knowledge and experience to fight for all the benefits and settlement compensation you may deserve.

We know we can help you with your case, but don’t take our word for it. See what our clients have to say:

“If you are looking for attorneys that will make you a high priority, ones who fight for you, beginning to end, then you need the Law Offices of James Scott Farrin! They represented my husband in his worker’s comp case and we cannot say enough about how awesome they were!! They maintained regular communication, pushed for the best possible outcome, and far exceeded what we’d hoped to achieve.” – Tina G., happy client1

Average of all Google reviews from all office locations as of 2/7/23.1

Contact the workers’ comp attorneys at James Scott Farrin for a free evaluation of your back injury case. Reach us online or call 1-866-900-7078 today.