You’re not alone – most people are denied multiple times.

Let us help you fight for your rights.

Our Experienced North Carolina Social Security Disability Attorneys

The government has programs designed to help people who are disabled, but the laws governing these programs are complex. If you have a disability, it’s important to put experience on your side as you apply, or appeal, a Social Security Disability claim. Learn more about our North Carolina Social Security Disability team.

- Our lead Social Security Disability lawyer, Rick Fleming, is a North Carolina State Bar Board Certified Specialist in Social Security Disability Law and was formerly on the NC State Bar’s Social Security Disability Law Specialty Committee. Fleming is also a member of the Board of Directors of the National Organization of Social Security Claimants’ Representatives and has formerly held various positions with North Carolina Advocates for Justice.

- Several of the paralegals in our Social Security Disability practice have at least six years of experience as Disability Determination Services examiners for the Social Security Administration, and some were certified as “Level II” examiners involved in reconsiderations and conducting continuing disability reviews.

- Several members of our North Carolina Social Security Disability team have worked inside the Social Security Administration.

What You Need to Know About Social Security Disability Law in North Carolina

- What Is Supplemental Security Income (SSI)?

- What Is Social Security Disability Insurance (SSDI)?

- What Is the Difference Between SSI and SSDI?

- What Does the Social Security Administration (SSA) Do?

- How Soon Can I Apply for Disability Benefits?

- When Can I Get My Disability Check in North Carolina?

- How Do I Contact the Law Offices of James Scott Farrin?

What Is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal income supplement program created to provide low-income disabled people and people over 65 years of age with monthly cash benefits to meet their basic needs, such as food, clothing, and housing.

In North Carolina, there are many people who need help to meet these fundamental needs. Some are disabled, some are older, but they all have needs that they can’t meet fully on their own. If you are one of these people, SSI may be able to help.

Successfully accessing this program is not always easy, but an experienced North Carolina Social Security Disability attorney may be able to help you. If you are applying for SSI for the first time or appealing a denied claim, call our social security disability lawyers at 1-866-900-9078. There is no obligation, and the call is free – we are on your side.

Do I Qualify for SSI?

It’s confusing, but let’s break it down. You may be eligible for SSI if you are a U.S. citizen with limited income and meet one of the following requirements:

- You are disabled with a medical condition that keeps you from working or is expected to last at least one year or result in death.

- You are totally or partially blind.

- You are 65 years or older.

Tip: Children under the age of 18 who are disabled are eligible to apply for SSI benefits.

The Social Security Administration (SSA) has a long list of what types of earnings, payments, and noncash assistance that it considers countable income when determining if your income is limited enough for you to qualify for SSI. It also describes SSI eligibility requirements in great detail on its website. For assistance in understanding these requirements and determining if you qualify for SSI, contact our social security disability appeal attorneys. Several of the members on this team have prior experience working inside the Social Security Administration.

How Are My SSI Benefits Calculated?

The monthly payment a person receives under SSI varies up to the maximum federal benefit rate. The maximum amount may be decreased due to a person’s countable income and resources.

- The maximum federal benefits rate was raised to $783 a month for individuals and $1,175 for an individual with a spouse in January 2020.

Tip: All SSI recipients are automatically qualified for Medicaid health benefits which are not included as countable income and resources.

[ Back to Top ]

What Is Social Security Disability Insurance (SSDI)?

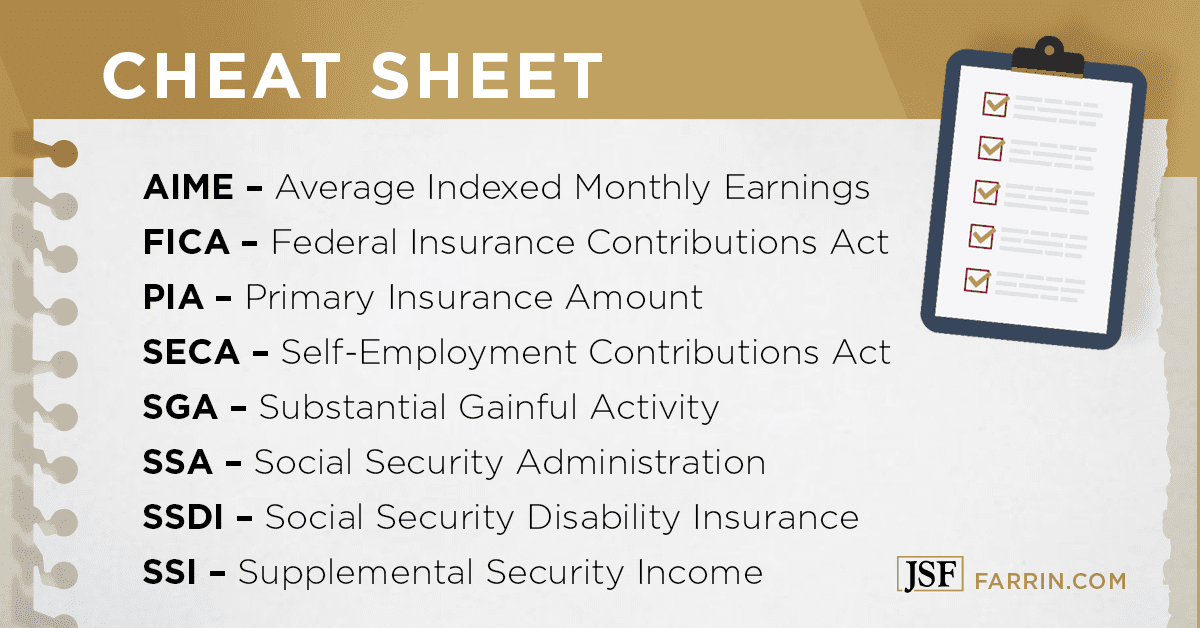

Social Security Disability Insurance (SSDI) is a federal insurance program that provides monetary benefits to people with a substantial work history who have developed a disability likely to last at least 12 months or to result in death. If you have ever wondered where the FICA taxes (or SECA taxes if you are self-employed) that are taken out of your paycheck go, now you know – part of these Social Security taxes go towards funding SSDI and paying SSDI benefits.

In addition to the SSDI benefits paid to a disabled worker, there are also:

- Disabled Widow’s and Widower’s Benefits— which are paid to people who are aged 50 or over who have become disabled within a certain amount of time after the death of their spouse and meet other requirements.

- Disabled Adult Child Benefits— which are paid to the disabled children of persons who are deceased or who are drawing Social Security disability or retirement benefits, if the child became disabled before age 22 and meets other eligibility requirements.

“Disability” is the inability to engage in any Substantial Gainful Activity (SGA) due to a physical or mental impairment. In 2020, the SGA limit was increased to $1,260 per month for non-blind SSDI or SSI applicants, and $2,110 per month for blind SSDI applicants. (Note: The SGA limit does not apply to blind SSI applicants.) If you are able to earn more than the SGA limit, your disability claim will be denied.

You have been paying Social Security taxes all your working life, but when a disability prevents you from working and you apply for assistance, the government turns you down. How can they do this after all those years of paying all those taxes? We understand your frustration, and we may be able to help you. Call 1-866-900-7078 to see if our North Carolina Social Security Disability attorneys can help.

Do I Qualify for SSDI?

To be eligible for SSDI, what matters is that:

- You have worked long enough to be considered “insured” for Social Security purposes (usually five out of the last 10 years for people over the age of 31).

- Your jobs have paid into the Social Security program, meaning your paycheck had money withheld for Social Security taxes (FICA or SECA).

- You have been disabled, or will be disabled, for at least 12 months.

- Your medical condition prevents you from engaging in SGA, or work that earns more than a minimal level of income.

What doesn’t matter is any amount of savings or debt you may have – wealth and poverty don’t factor into your eligibility for SSDI benefits.

Tip: Many SSDI recipients also commonly receive Medicare health benefits as well.

How Are My SSDI Benefits Calculated?

The monthly SSDI benefit you are allowed is based solely on the amount of time you have worked and your average income during those years, known as your Average Indexed Monthly Earnings (AIME). A formula is applied to your AIME to calculate your Primary Insurance Amount (PIA) which is then used to establish your actual SSDI benefit amount.

To get an estimate of your SSDI, you can use the online Social Security detailed calculator.

[ Back to Top ]What Is the Difference Between SSI and SSDI?

While both SSI and SSDI are federal income replacement programs designed to help people who are disabled and cannot work, they differ in who they help and how they are funded.

THE MAJOR DIFFERENCES BETWEEN SSI AND SSDI

WHO:

- SSDI is designed to assist people with a substantial work history who have developed a disability likely to last at least 12 months or is likely to result in their death.

- SSI is designed to provide a basic income for low-income disabled people who have never been able to work, or who have not worked long enough or recently enough to qualify for SSDI.

HOW:

- SSDI is funded by US federal payroll taxes (FICA and SECA).

- SSI is funded by general tax revenues.

What Does the Social Security Administration (SSA) Do?

The SSA is the U.S. government agency that oversees the Social Security program and administers SSI and SSDI benefits and retirement income. By providing retirement, disability, and survivors’ benefits, it strives to help Americans maintain their basic well-being. Unfortunately, as with many large bureaucracies, it has complicated guidelines, eligibility requirements, and benefit calculations that often frustrate those who need its benefits most. In addition, the SSA has a history of backlog issues.

One way to make the application process for SSI and SSDI benefits go more smoothly is to ensure that you are eligible when you first apply. Contact our North Carolina Social Security Disability lawyers for a free case evaluation today to see if we can help.

What Factors Does SSA Use to Determine if I Am Disabled?

The SSA considers your medical records, age, education, and work experience to determine if you are able to continue in your present employment. If you are not, it will use these same factors to determine if you are capable of other types of employment or retraining for future employment.

Tip: There is no such thing as partial disability under SSDI or SSI. You are either disabled or not disabled.

[ Back to Top ]How Soon Can I Apply for Disability Benefits?

You should apply for SSDI as soon as you become disabled. The SSA can take 3 to 5 months to process an application, and there is a mandatory waiting period of 5 months between the onset of your condition and when you can receive disability benefits. So, you can see that there is a need for speed in applying for disability benefits.

As with SSDI, it takes 3 to 5 months to get a decision on your SSI application, so apply immediately.

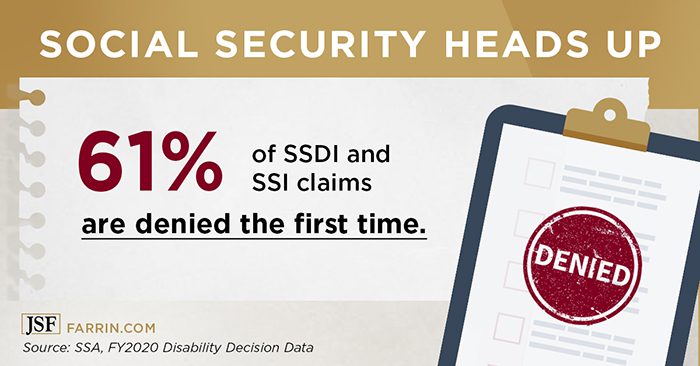

It is also important that your application is accurate and complete because 61% of Social Security disability applications are initially denied. Our team of social security disability appeal lawyers can help you through the application process, or if your claim was denied, we can help you through the appeals process. We know from firsthand inside experience how the system works, what they look for to accept a claim, the importance of filing the correct forms and meeting strict deadlines, and what medical records to present. Call us today at 1-866-900-7078 for a free case evaluation.

When Can I Get My Disability Check in North Carolina?

SSDI payments cannot begin until five months after the date of the disability and can extend back no more than one year before the date of the application. SSI payments cannot be made prior to the month after the date of the application.

What Are Compassionate Allowances and Presumptive Disabilities?

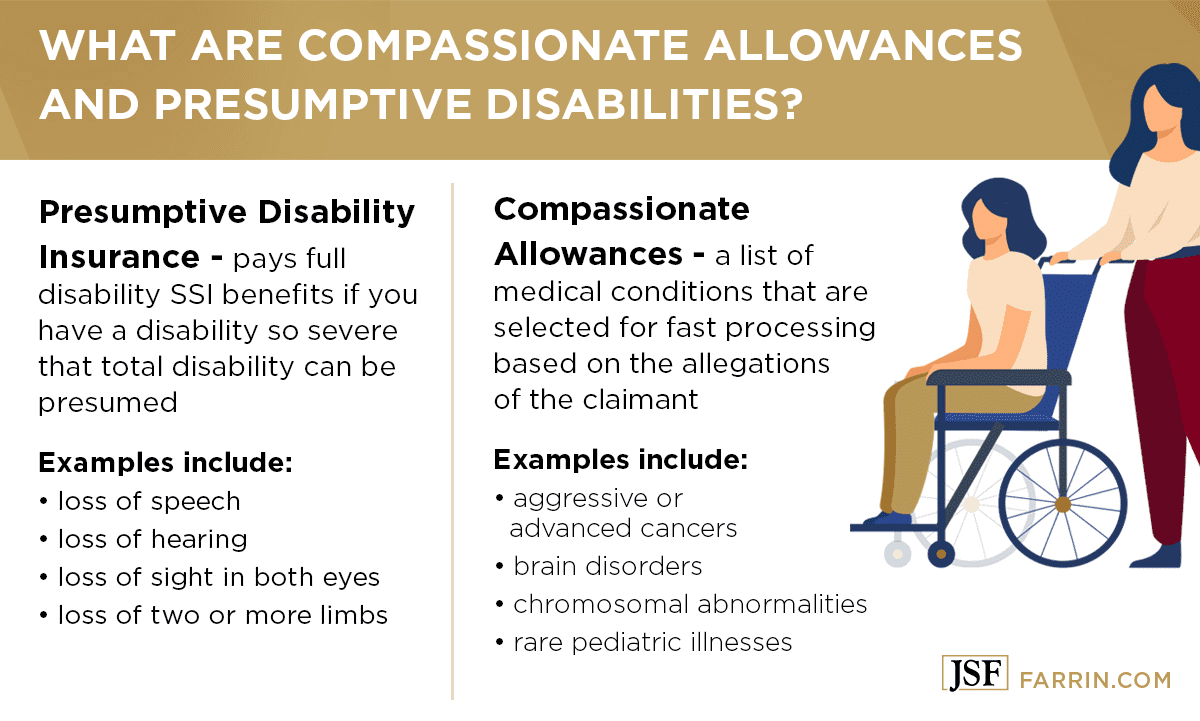

While rare, some people will automatically qualify for SSI due to a Presumptive Disability or they will have their cases qualify for expedited reviews under the Compassionate Allowance initiative. These initiatives allow people with the most severe disabilities (about 4 percent of all disability cases) to be approved, at least temporarily, in about 10 days instead of the typical three to five month waiting period.

- Presumptive Disability Insurance pays full disability SSI benefits if you have a disability so severe that total disability can be presumed.

- Compassionate Allowances are medical conditions that are selected for fast processing based on the allegations of the claimant.

Tip: Compassionate allowances can be applied to both SSI and SSDI.

How Do I Contact the Law Offices of James Scott Farrin?

Call us today at 1-866-900-7078 for a free case review and conversation about your potential claim. We understand how confusing it can be to submit a claim and also how frustrating it is to receive a denial notice from the government when you believe you have a legitimate claim for assistance. Let us put our knowledge and experience to work for you.

Text UsAnd if you are worried about the cost of hiring an attorney, our Social Security Disability lawyers work on a contingency fee2 basis, which means our attorney’s fees are based on a percentage of the back-due benefits subject to a maximum fee as determined by the commissioner of the SSA. While your case may have fees and costs associated with it, there are no hourly or flat fees charged by our firm. Simply put, if you do not recover back-due benefits from your claim, there is no attorney’s fee. This allows us to bear the burden of investigating and pursuing your claim and allows you to focus on your well-being.

“I felt like, hey I matter! They let me know what was going on, and the correspondence also, that was helpful. They’re going to take care of you, man. They’re going to do a really good job.”

–Tony S., who received back-due disability benefits and became immediately eligible for Medicare with the help of the James Scott Farrin Social Security Disability team1

We have experienced North Carolina Social Security Disability lawyers who can help you with your case. The Law Offices of James Scott Farrin has locations conveniently located throughout the state.

[ Back to Top ]Law Offices of James Scott Farrin Help Is Always Nearby

- Asheville Social Security Disability Lawyers

- Charlotte Social Security Disability Lawyers

- Durham Social Security Disability Lawyers

- Fayetteville Social Security Disability Lawyers

- Goldsboro Social Security Disability Lawyers

- Greensboro Social Security Disability Lawyers

- Greenville, NC Social Security Disability Lawyers

- Henderson Social Security Disability Lawyers

- New Bern Social Security Disability Lawyers

- Roanoke Rapids Social Security Disability Lawyers

- Rocky Mount Social Security Disability Lawyers

- Raleigh Social Security Disability Lawyers

- Sanford Social Security Disability Lawyers

- Wilson Social Security Disability Lawyers

- Winston-Salem Social Security Disability Lawyers